Shiba Inu (SHIB) bullish price momentum has intensified this as the bulls look to break down the $0.000009 resistance. On-chain analysis beams a spotlight on critical data points that could decide SHIB price action in the days ahead.

Shiba Inu’s price has entered a break-out phase this week as the trading activity intensified. Will the second-largest meme coin by market capitalization extend its gains or retrace as it approaches the vital $0.000009 resistance?

Crypto Traders Holding SHIB Increase Trading Activity

Shiba Inu holders have significantly increased their transactional activity over the past week. As depicted below, SHIB Tokens Transferred crossed 15.9 trillion on Nov. 6, marking the highest level of economic activity since August.

But in contrast, the highest figure registered last month was 11.5 trillion token transfers recorded on Oct. 20. Hence, this week’s high represents a 38% increase from last month’s peak transaction activity on the Shiba Inu network.

Shiba Inu (SHIB) Tokens Transferred. Source: CryptoQuant

The Tokens Transferred metric provides a daily aggregate of the number of tokens transacted on any given day. Typically, a sharp increase decline in transactional activity, as observed above, is often taken as a bullish signal.

Read More: 11 Best Sites To Instantly Swap Crypto for the Lowest Fees

It indicates a growing interest among investors and increased market liquidity. It is no surprise that the 38% increase from last month’s peak network activity has been followed by a double-digit price rally.

SHIB Sell Orders Surpass Current Market Demand

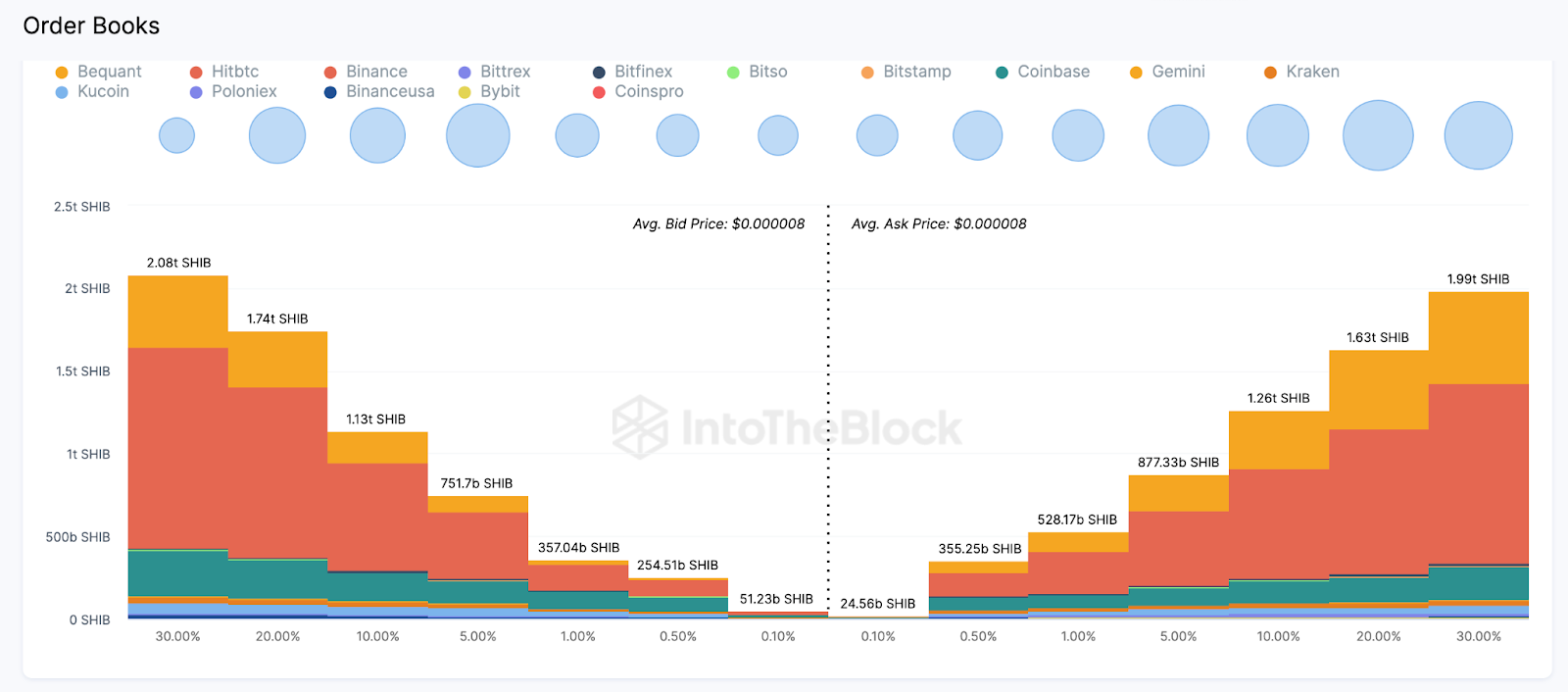

The aggregate order books is another vital on-chain chart currently pointing towards an increase in demand for SHIB. As depicted below, SHIB traders have placed active buy-orders for 6.8 trillion tokens. Notably, this is considerably higher than the 6.5 trillion SHIB sell-orders currently listed across crypto exchanges.

Shiba Inu (SHIB) Aggregate Exchange Order Books. Source: IntoTheBlock

The Aggregate Order Books of Exchanges presents a real-time snapshot of the total active market orders for an asset. Logically, when demand is higher, many buyers may have to compete by increasing their prices.

Hence, the increase in trading activity and the growing market demand could combine to trigger an upward SHIB price movement in the days ahead.

Learn more: 12 Best AI Crypto Trading Bots To Maximize Your Profits

SHIB Price Prediction: Potential Downswing toward $0.000005?

Based on the current on-chain data trends, Shiba Inu will likely experience a further price upswing toward $0.00001 in the coming days.

The Global In/Out of the Money (GIOM) chart, which depicts the entry price distribution of current SHIB holders, also supports this bullish narrative. It, however, depicts that Shiba Inu could experience significant resistance at $0.00009 could trigger a retracement.

As illustrated below, 373,360 addresses purchased 251.51 trillion SHIB at a maximum price of $0.00008. Considering this is the largest support cluster above the current prices, they will likely pose strong resistance.

But if the network activity keeps growing, Shiba Inu’s price could rise further to reclaim $0.00001.

Shiba Inu (SHIB) Price Prediction | Global In/Out of the Money (GIOM) data | Source: IntoTheBlock

Alternatively, the bears could negate that bearish prediction if Shiba Inu’s price dips to $0.00006. But that currently seems far fetch, as 227,480 addresses are holding 83.2 trillion SHIB bought at the average price of $0.000006. If they hold their positions, SHIB’s price will likely rebound.

But if that support level caves, Shiba Inu’s price could retrace toward the $0.00005 range.

Read More: 6 Best Copy Trading Platforms in 2023

Read the full article here