The cryptocurrency market is currently experiencing a bullish sentiment driven by Bitcoin (BTC), aiming to retest the $50,000 mark. Notably, Bitcoin has surged by almost 10% in the past week, reaching $47,298 at press time.

Amid this positive market sentiment, several cryptocurrencies display signs of a short squeeze phenomenon in the near term. Notably, a short squeeze occurs when short-sellers face liquidation due to a price increase.

These liquidations compel traders to repurchase the cryptocurrency, causing a price surge, triggering further liquidations, and potentially leading to a significant upward movement.

In line with this, Finbold has identified the following two cryptocurrencies with the potential to rally, showing a higher volume of opened short positions in the last 24 hours than long positions open interest.

Chainlink (LINK)

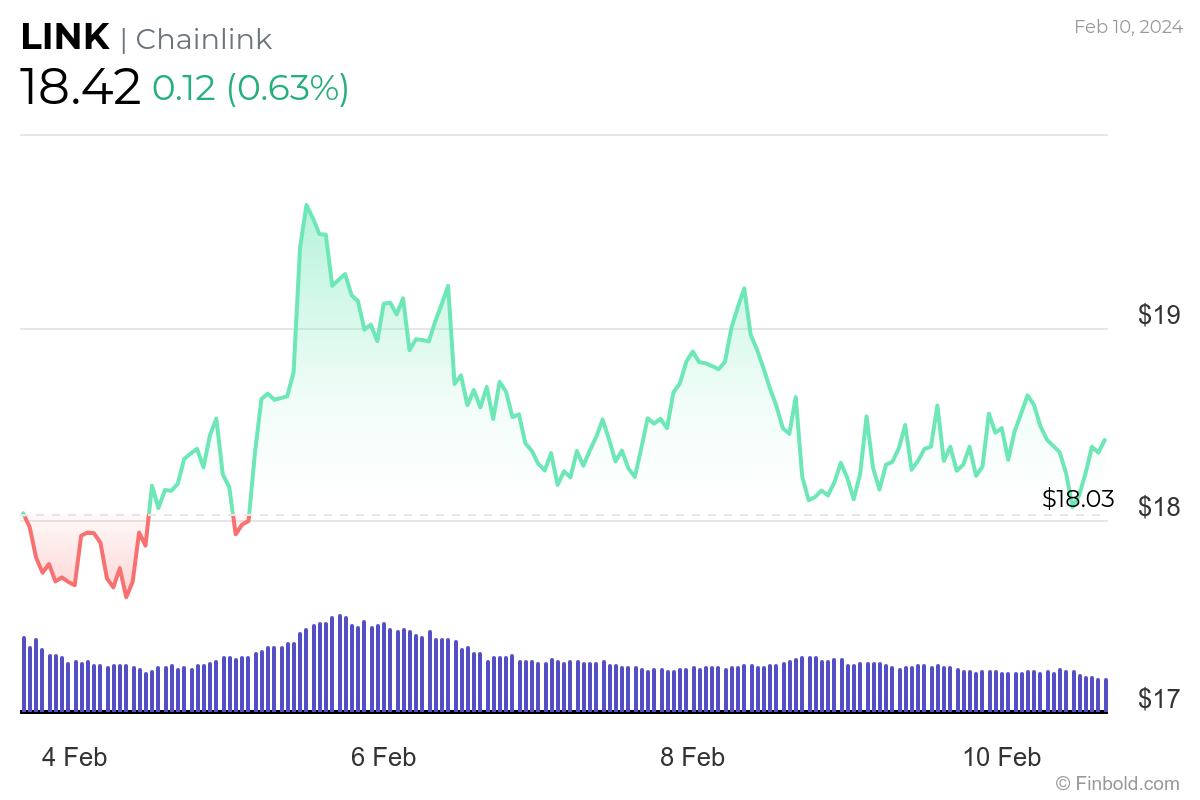

Chainlink (LINK) has emerged as one of the top-performing cryptocurrencies in recent weeks, striving to surpass the $20 valuation. Notably, the token experienced a remarkable surge of nearly 40% within a week, reaching a 24-month high at $19.75.

These gains coincide with heightened whale activity surrounding LINK. According to data from Lookonchain, an unidentified and potentially institutional whale has been accumulating Chainlink. This mysterious entity withdrew 2.7 million LINK tokens from the Binance cryptocurrency exchange, utilizing 49 new wallets.

The price surge aligns with a period during which Chainlink observed a notable activation of previously dormant wallets, leading to the highest recorded spike in the “Age Consumed” metric. The sudden reintroduction of old LINK tokens into circulation has significantly increased the observed price jump.

Regarding a potential short squeeze, data obtained by Finbold from Coinglass indicates that by press time, there were $445.88 million (52.70%) in short positions opened in the last 24 hours, in contrast to $400.17 million in long positions within the same timeframe.

By the time of writing, LINK was trading at $18.42, reflecting a weekly gain of almost 3%.

Cardano (ADA)

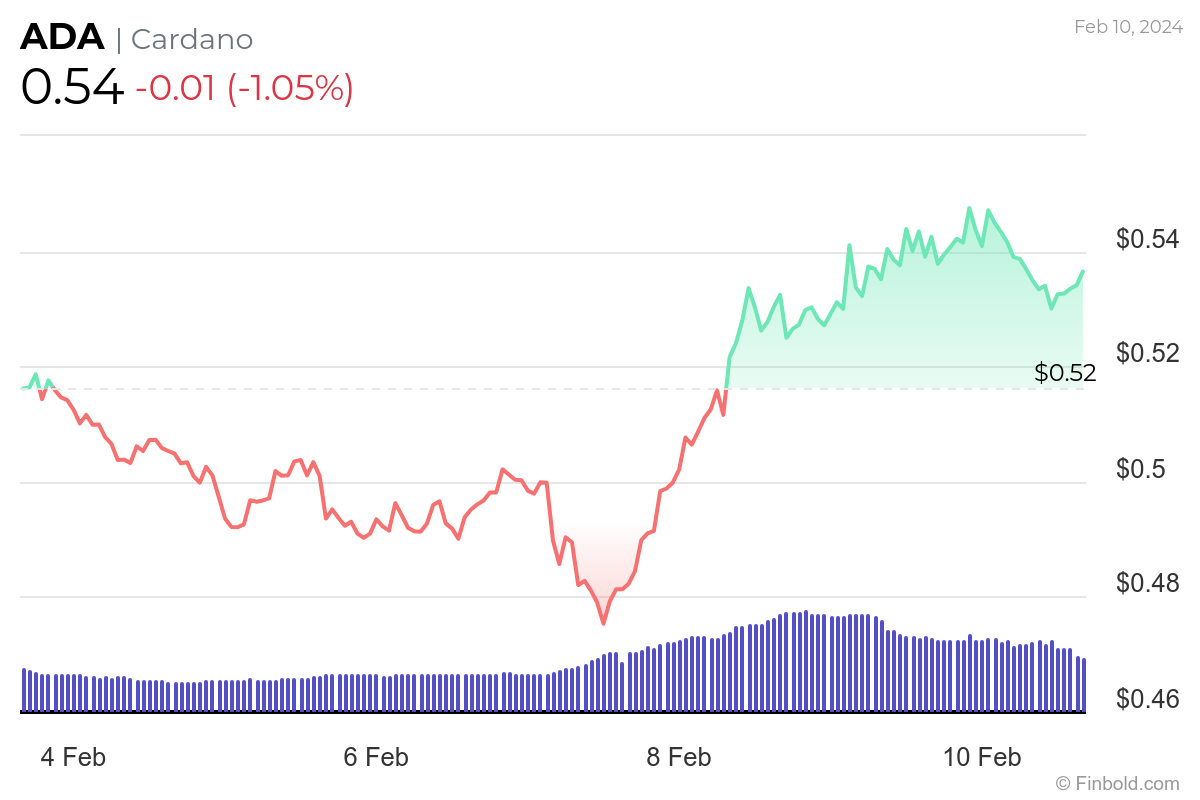

The decentralized finance (DeFi) platform Cardano (ADA) is among cryptocurrencies experiencing increased network activity, aiming to fulfill its role as a potential ‘Ethereum (ETH) killer.’ Recent days have seen heightened investor enthusiasm, particularly as the token reclaimed the $0.50 support zone.

These gains are noteworthy, considering ADA endured a period of price stagnation despite previous recovery attempts following a bounce off the support at around $0.45 in late January.

ADA’s future outlook is closely tied to network activity, especially as it advances into the Voltaire Era, marked by strides in implementing an on-chain governance model. This phase allows ADA holders to influence the network’s direction actively, capturing investor attention.

Projects like the user-friendly Cardano Light Wallet Lace enhance ADA’s appeal, offering solutions for storage and transactions. The Cardano developer community consistently introduces upgrades, ensuring a positive user experience and sustaining investor interest amid increasing smart contract adoption.

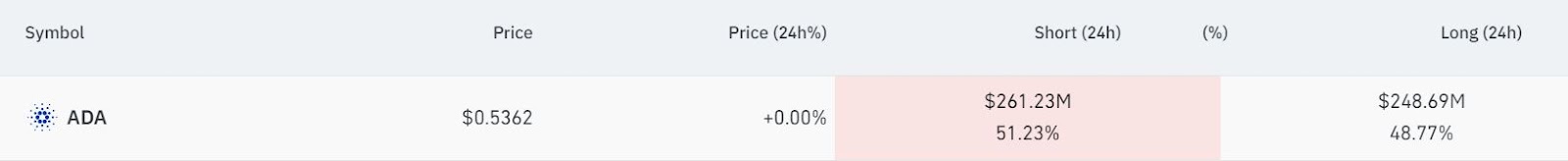

Regarding short squeeze potential, data from Coinglass indicates $261.23 million (51.23%) in short positions opened in the last 24 hours, compared to 48.77% in long positions within the same timeframe.

ADA has rallied almost 4% in the past seven days, currently trading at $0.54.

While these highlighted cryptocurrencies show short-squeeze potential, their susceptibility to the overall market trajectory is worth noting.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here