The recent parabolic increase in the Solana (SOL) coin’s price reached a local peak at a 19-month high of $68.2. Following this, altcoin has undergone a minor correction in the face of the current uncertainties in the crypto market, resulting in a 15.6% decline to its current trading price of $57.00. However, is this correction a temporary phase, or if it will extend further

Also Read: Solana (SOL) “FOMO Has Picked Up in a Big Way”

Will SOL Recovery Regain $70

- The formation of a rounding bottom pattern hints at early signs of trend reversal

- The $48.3 breakout has set the SOL price for a rally to $78.

- The 24-hour trading volume on the Solana coin is $1.93 Billion, indicating a 4% gain.

Source-Tradingview

The current correction in the Solana price is testing support around the 23.6% Fibonacci retracement level at approximately $36.1. The daily candlestick, showing low price rejection at this level, suggests active buyer accumulation.

Corrections of this nature are often seen as normal and healthy within a bull market, as they provide opportunities for the market to consolidate and build bullish momentum. Notably, throughout its recovery phase, the SOL price has not fallen below the 50% Fibonacci level.

In the event of an extended correction, the 38.2% and 50% Fibonacci levels, at $48.3 and $42.2 respectively, will serve as crucial support zones. Should buyers maintain the price above these levels, SOL will likely resume its bullish trajectory, potentially following a rounding bottom pattern.

This pattern could lead to an extended recovery with potential targets at $78.22, $100, $121, and $143

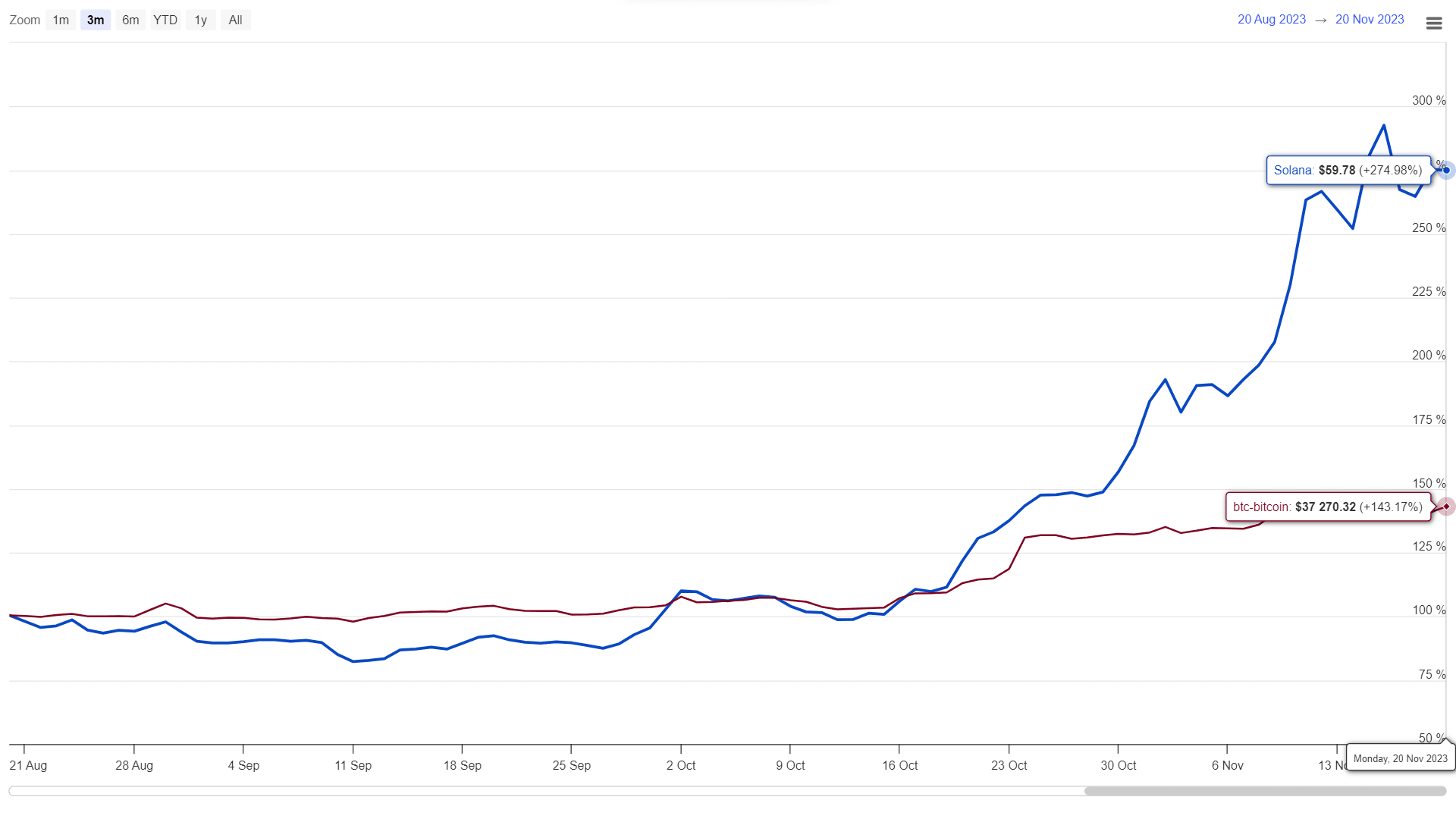

SOL vs BTC Performance

Source: Coingape| Solana Vs Bitcoin Price

Source: Coingape| Solana Vs Bitcoin Price

In comparison to Bitcoin, SOL has exhibited a stronger performance in the October-November rally. The aggressive rally characterized by short pullbacks suggests a strong buyer conviction for sustainable growth. Even the current correction seems to be a healthy retracement, which is likely to support the continuation of the recovery rate.

- Moving Average Convergence Divergence (MACD): A potential bearish crossover between the MACD line and the signal line could indicate an increase in bearish momentum in the market.

- Exponential Moving Average (EMA): The 20-day EMA, currently around the $52 mark, may provide early support during the ongoing correction.

Read the full article here