XRP price has experienced a significant recovery in the past few months, showcasing a robust bullish trend that propelled its value above the critical support level of $0.5500. This surge indicated strong market confidence in XRP, often linked to its association with Ripple and its utility in facilitating fast and cost-effective cross-border transactions.

However, the past week has reversed this upward trajectory, with bearish pressures emerging in the XRP market. This change in market sentiment has led to a decline of over 10% in its value. The price, which had reached a resistance level near $0.63, experienced a pullback, descending to the current level around $0.55. Despite this recent downturn, XRP remains a promising token in the eyes of many investors and market analysts.

Ripple Price Current Trends and Market Analysis

XRP price has been navigating a challenging market phase as it struggles to maintain its footing against bearish trends. The XRP has dipped below the $0.60 mark, currently standing at $0.554, reflecting a 2.75 % decrease over the last 24 hours. Despite these hurdles, XRP still holds a significant position in the cryptocurrency world, ranked as the 5th largest market cap, presently at $30 billion. The 24-hour trading volume has surged by 122% to $1.71 billion, suggesting increased trading activity.

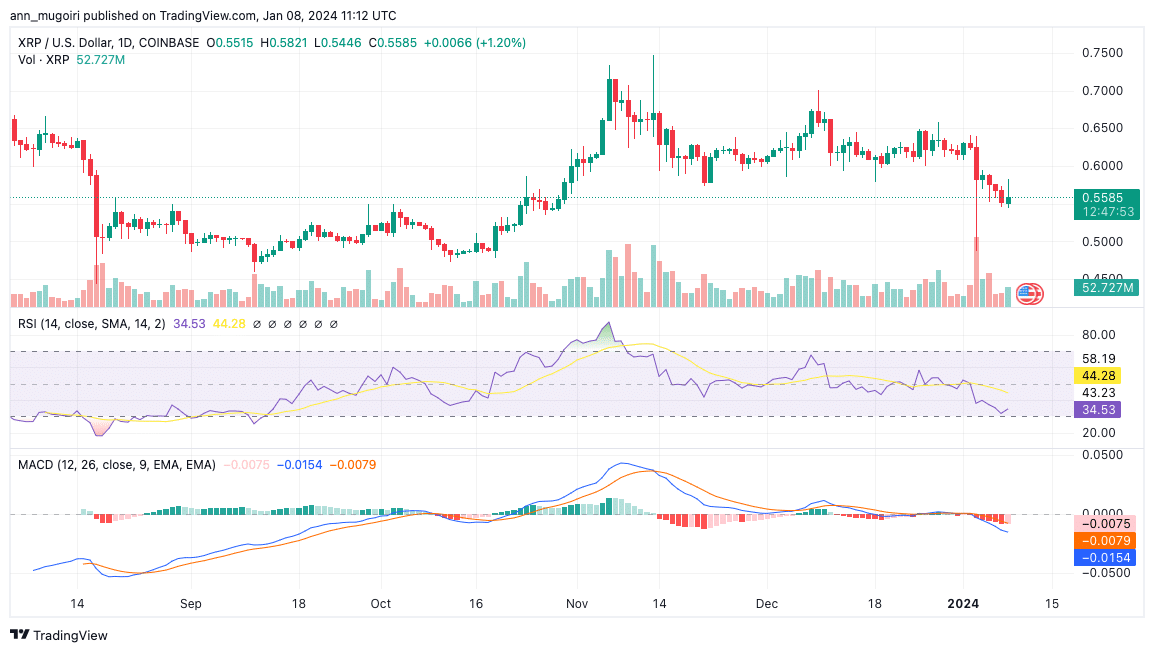

Source: Tradingview

Impact of Upcoming XRP ETF and Market Sentiment

April 2024 is shaping up to be a pivotal month for XRP, as major US asset management firms, including Blackrock, are reportedly preparing to file applications for XRP Exchange-Traded Funds with the SEC. This significant development, highlighted in a video by Crypto Influencer Ben “BitBoy” Armstrong, has stirred the market, especially since Grayscale reintegrated XRP into its GDLC Fund, fueling further excitement about the potential ETF launch.

The anticipation surrounding the proposed XRP ETFs is creating a buzz in the crypto community, with speculations suggesting a bullish future for Ripple price. Analysts are closely watching the market dynamics, noting that a consistent buying pressure could propel XRP’s value above the $1 mark, breaching key resistance levels. This scenario would affirm a reversal pattern and potentially set the stage for a new upward trend in XRP’s market trajectory. The coming months are a turning point for XRP as these developments unfold.

Technical Indicators and Future Outlook for XRP

A recent analysis of XRP’s technical indicators highlights a bearish trend in the market. The MACD is currently positioned below zero, aligning with bearish signals as evidenced by its signal line moving under the MACD line. This shift is further accentuated by a negative turn in the histogram, underscoring the bearish momentum. Additionally, the RSI, standing at 34.53, indicates a potential further decline if current bearish pressures continue.

XRP/USD 24-hour price chart, Source: Tradingview

Regarding moving averages, there’s a clear bearish inclination as the 50-Exponential Moving Average trails below the 20-EMA, typically a signal for selling in the market. This setup indicates prevailing bearish sentiment in the near term. However, amidst these trends, XRP still holds potential promise, maintaining interest and speculation within the investment community.

Related Articles

- XRP Price Prediction: Key Levels to Watch As $XRP Sees 30% Breakout Rally

- XRP Price Prediction As Bulls, Bears Tug-of-War Intensifies – $1 Next or Back To Square One?

- XRP Price Prediction for 2023, 2025, 2027, 2030: Will XRP Price Break Past $10?

Read the full article here