Solana price prediction: SOL’s trading momentum has been mostly positive in recent weeks, showcasing an optimistic trend. However, Over the last day, the Solana price has experienced a notable decline of 5%, dropping to $104. This downturn comes after SOL briefly fell beneath the crucial $109 support level the day prior. Despite this, bullish trends have swiftly regained momentum, indicating a potential for recovery.

The currency successfully overcame a significant hurdle, surpassing the $104.92 resistance zone, which has historically acted as a dense area of sell-off. Solana’s attempts to breach this barrier were met with resistance multiple times, but its latest effort suggests a rally might be on the horizon. In recent sessions, Solana has been trading within a narrow band, maintaining its position above the $104 support mark, signaling a continued bullish outlook.

Solana price prediction

Although the ascent has been gradual, SOL’s market capitalization stands strong at $45 billion, making it the fifth-largest digital currency by market cap as per Coinmarketcap. The 24-hour trading volume has seen a rise of over 5%, reaching $1.54 million. This increase indicates a growing interest from investors, laying the groundwork for potential price movements in the near future.

SOL market outlook for February 2024 is painting a bullish picture, as the digital asset has been on an upward trajectory. Over the last week, the cryptocurrency has rallied impressively, marking a gain of over 10%. The price of Solana has oscillated between $109 and $104, touching the upper resistance at $109 before slipping back to the $104 support level.

Solana Price Prediction: Can It Break Through the $140 Barrier?

Noted cryptocurrency analyst Crypto Tonny has shared a bullish prediction for Solana, hinting at a significant uptrend. Currently, Solana is trading around the pivotal $104 mark, indicating a strong and potentially bullish long-term stance.

$SOL / $USD – Update

Long and strong above $104.00 legends pic.twitter.com/kSnGkUFz3V

— Crypto Tony (@CryptoTony__) February 11, 2024

Solana has recaptured the key $104 level on the technical front, setting the stage for further advancements. If the bullish momentum continues to hold above this level, a move towards the $120 mark could soon materialize, with the potential to surge to $140 if the upward pressure persists. On the flip side, failure to maintain this momentum could lead to a decline toward the $95 support level, a crucial buffer against further losses.

Solana’s Technical Outlook Remains Strong

The technical indicators for SOL display signs of optimism despite the short-term dip. The Moving Average Convergence Divergence (MACD) indicator is currently bullish, as evidenced by its line crossing above the signal line. This is further supported by a positive green histogram, suggesting an increase in buying activity.

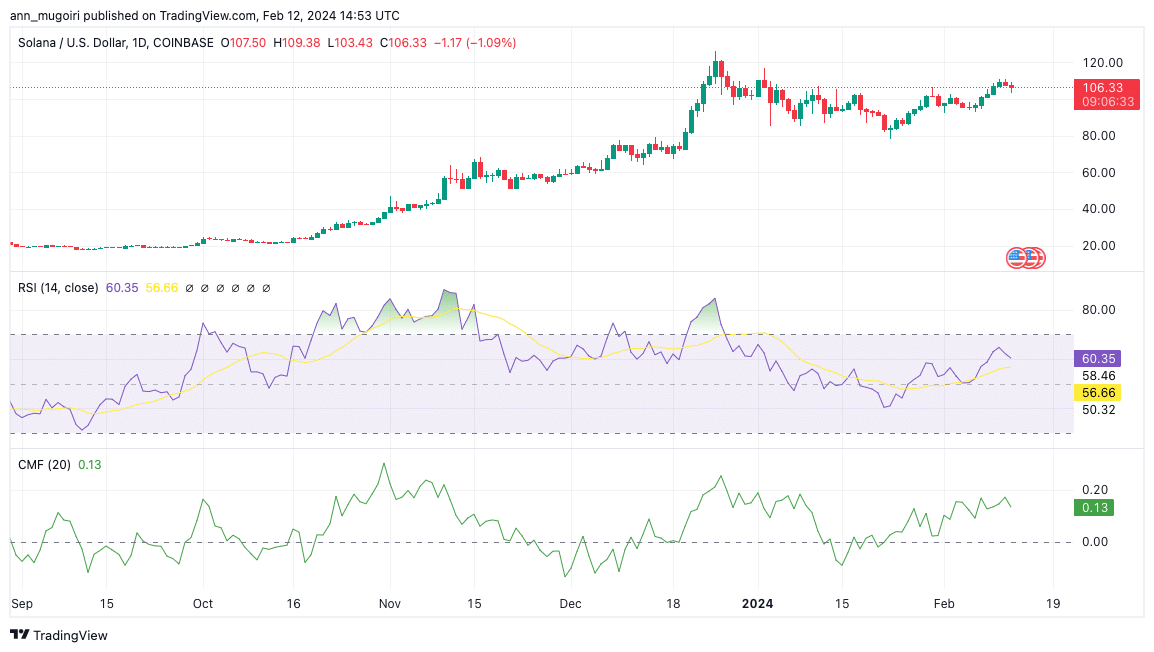

Solana price chart: Tradingview

Moreover, the daily Relative Strength Index (RSI) is just above 60, signaling a neutral to slightly bullish market sentiment. The Chaikin Money Flow (CMF) index signals a positive trend with a reading of 0.13. Additionally, positioning the 20 Exponential Moving Average (EMA) above the 50-EMA reinforces the potential for future gains, bolstering the optimistic market outlook for Solana.

Related Articles

- 5 Heavily Discounted Crypto To Buy After Super Bowl 2024, Including XRP And LUNC

- Crypto Headlines of The Week: Bitcoin, Solana, & Shiba Inu Fuels Inferences

- What’s Next for ADA, IMX, and ICP? Crypto Price Predictions for February 12

Read the full article here