The consumer price index (CPI) report published on the morning of February 13 brought higher inflation figures than was previously expected – 3.1% vs 2.9%. One of the first assets to react to the news was gold.

In the minutes following the publication, the commodity entered into a sharp decline, falling as much as 1.42% by the time of publication. The change saw the price of gold drop below $2,000 for the first time since December 13, 2024.

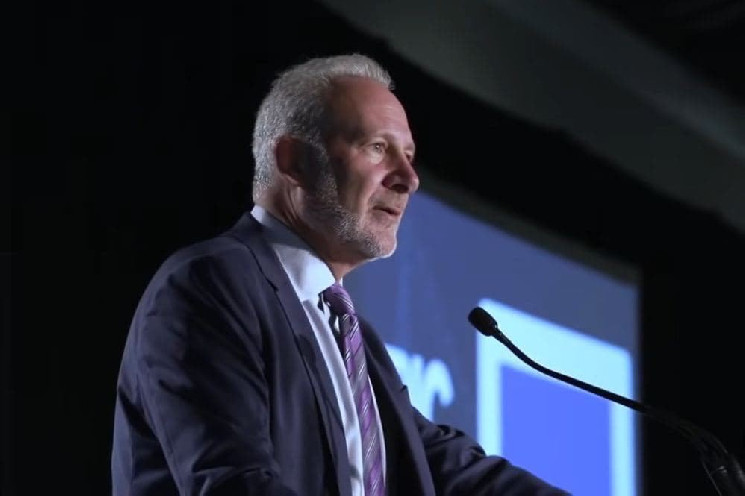

Investor, broker, financial commentator, radio personality, and gold bug, Peter Schiff, quickly took to X to comment that while the hotter-than-expected CPI caused gold to drop, it actually constitutes a bullish event for the commodity “as it confirms that the Fed wasn’t able to raise interest rates high enough to stop inflation from running out of control.”

It is noteworthy, however, that unlike gold, silver, Bitcoin, and the S&P 500, the Nasdaq 100 opened significantly below its latest close but has been on an overall upward trajectory in the first hour of trading.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here