Meme coin market leader Dogecoin is retesting its macro downtrend line, forming support for a potential bullish uptrend.

A recent analysis by crypto trader and analyst Rekt Capital disclosed that Dogecoin broke its long-term downtrend and is currently in a retest phase, building support for a more significant upside.

Dogecoin Macro Downtrend Break and Retest

Notably, in Q1, Dogecoin significantly broke out from its macro downtrend that originated from its 2021 peak. DOGE soared to a multi-year high of $0.2054 on March 5 during this time. As the analyst noted, this significant move marked the end of a prolonged bearish phase, ushering in a bullish era.

Meanwhile, since the breakout, Dogecoin encountered a major setback, reaching a low of $0.09379 early this month.

Rekt Capital observed that following the bearish performance, Dogecoin has been retesting its macro downtrend line, which now serves as a crucial support level. The analyst noted that Dogecoin holding above this level would confirm the end of the macro downtrend and the onset of a new macro uptrend.

$DOGE

Dogecoin broke the Macro Downtrend months ago

And since then, #DOGE has been successfully retesting the Macro Downtrend as new support

Successful retest here would fully confirm the end of the Macro Downtrend and the beginning of a new Macro Uptrend#BTC #Dogecoin https://t.co/ZJG1w9oCri pic.twitter.com/0OlDzZzMg3

— Rekt Capital (@rektcapital) July 22, 2024

Dogecoin Wallet Sees 867% Surge in Inflows

Recent data from IntoTheBlock highlights substantial inflows of Dogecoin by holders, reflecting increased market interest that could lead to a buying spree. Over the past week, investors accumulated 800.95 million DOGE at a price of $0.139250.

The figure translated to an 867.04% positive seven-day change to the inflow of tokens to Dogecoin wallets, suggesting heightened accumulation and buying interest.

Despite these inflows, the price of DOGE has fluctuated, currently standing at $0.136387, a decrease of 2.09% on the day of the snapshot. These accumulation trends and price movements illustrate the relationship between market demand and price action.

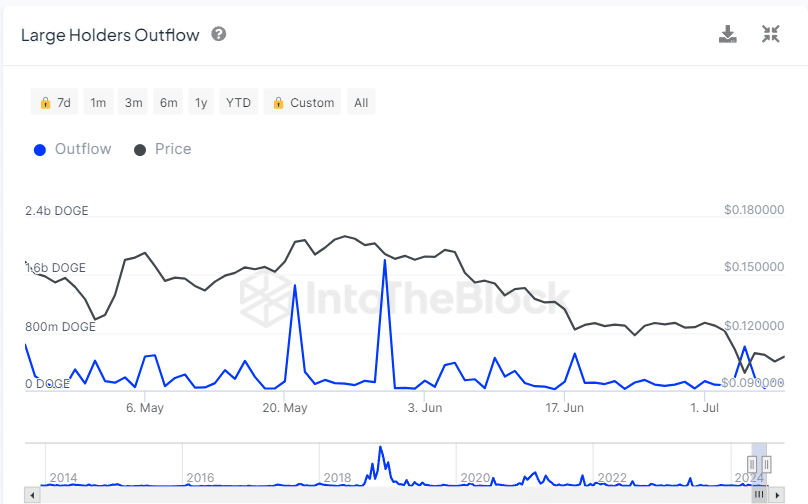

On the other hand, heightened outflows from Dogecoin wallets over the past few months correlated with the asset’s price decline, represented by the black line in the chart below.

The data suggests that substantial sell-offs by large holders have exerted downward pressure on the price of DOGE in the past weeks. However, the trend is gradually changing course with the massive percentage surge observed in the seven-day inflow.

At press time, Dogecoin trades at $0.1325. While this reflects a 5% decline today, the asset maintains an 8.28% gain in weekly performance.

Read the full article here