- The Total2 (excluding Bitcoin

) Crypto Market Value has witnessed a significant increase to the $820 billion region. - According to Wyckoff patterns, this area is considered a correction zone.

- “We are not at the peak yet; the market is trending upwards despite corrections,” experts suggest.

This article explores the recent surge in the cryptocurrency market, highlighting key indicators and potential opportunities for investors and traders.

Market Surge: Analyzing the Current State

Recently, the Total2 Crypto Market Value, excluding Bitcoin, experienced a remarkable rise to the $820 billion mark. This movement aligns with the Wyckoff distribution patterns, suggesting a correction phase could be imminent. However, this volatility may present lucrative opportunities, particularly for those involved in scalp trading.

Understanding the Correction Phase

The current market conditions indicate a consolidation phase, with the potential for a fluctuating market that could be taxing for investors. Despite this, the bullish trend hasn’t concluded. The market requires a period of rest, and an adjustment in the EMA (Exponential Moving Average) averages is necessary. If an upward movement occurs, investors should view it as a clear exit opportunity. This shift could lead to a short squeeze.

USDT.D and Altcoins: A Closer Look

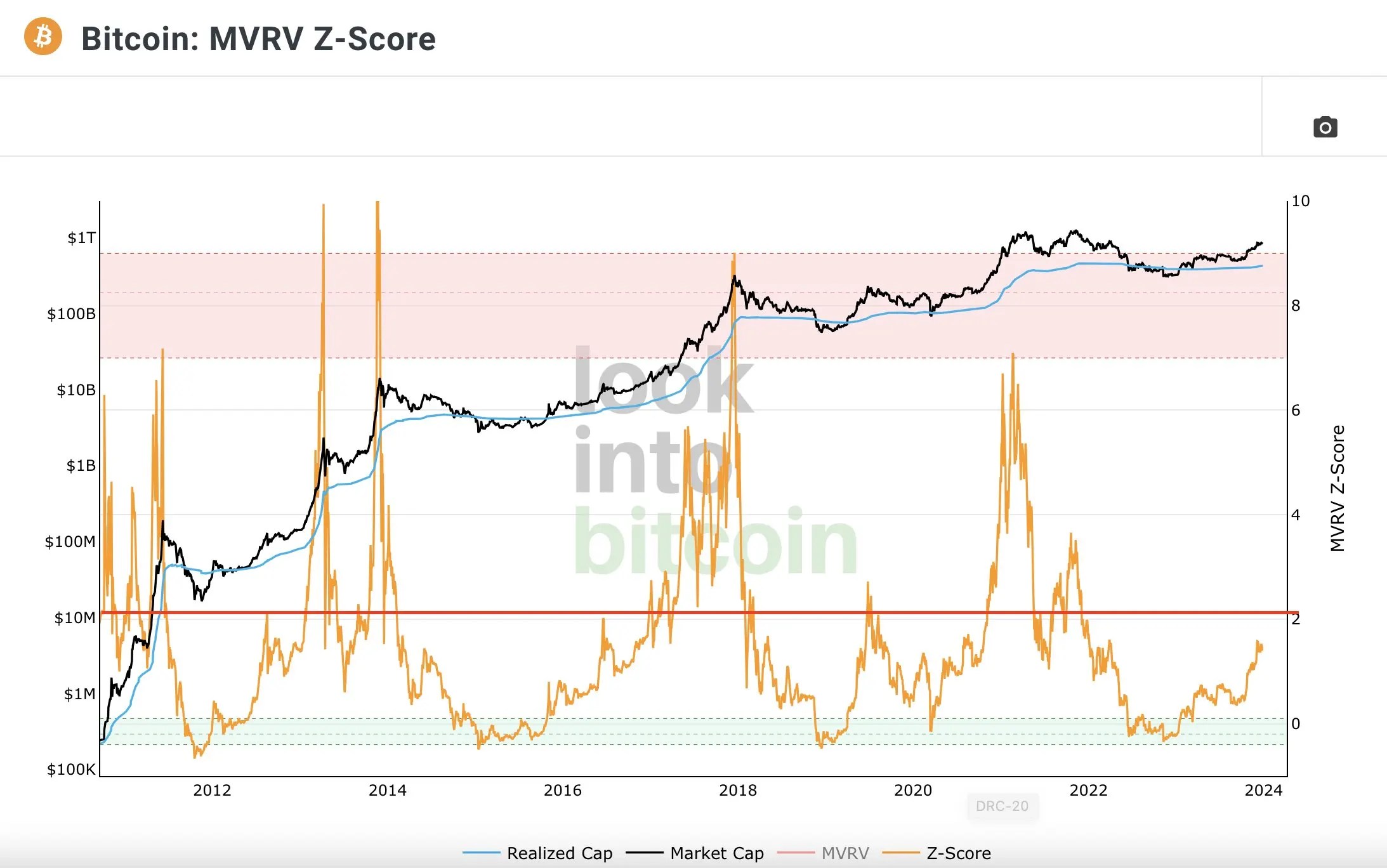

On the USDT.D front, a decline to the 4.84% region is plausible. This suggests that capital may circulate within the market, potentially leading to the pumping of certain altcoins. The MVRV-Z Score is approaching a value of 2, which historically indicates an increased likelihood of a market correction; the current value is at 1.61. Thus, the next surge might offer a short-term exit opportunity for savvy traders.

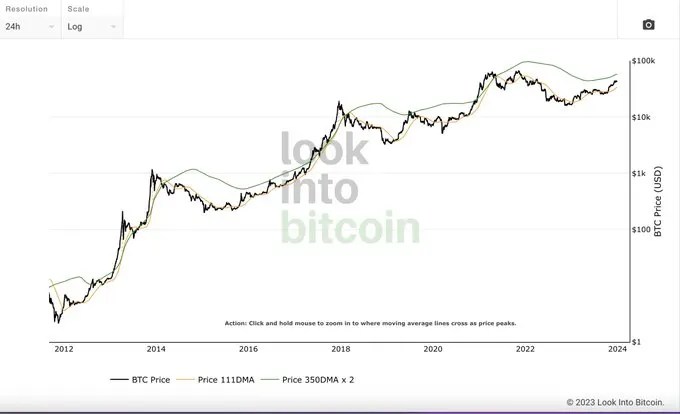

Pi-Cycle Top Indicator: Not a Peak Yet

According to the Pi-cycle top indicator, we are not currently at a market peak. Instead, we are in an ascending trend, which is expected to continue despite ongoing corrections. This trend underpins the belief that “the worst is behind us” and suggests that a significant rally is yet to commence. We are still far from the peak, indicating that opportunities are not just ongoing but may be just beginning.

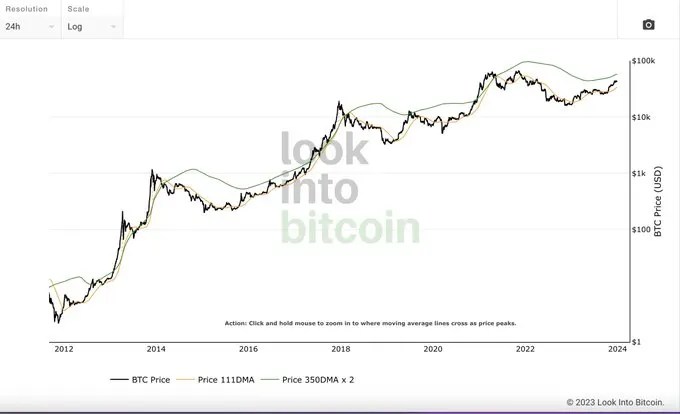

Bitcoin’s 200 Week Moving Average Heatmap

Turning our focus to Bitcoin, the 200 Week Moving Average Heatmap shows that we are still in a phase of growth and far from the market top. This is a critical indicator for long-term market trends and supports the view that the cryptocurrency market, especially Bitcoin, has more room to grow.

Conclusion

In conclusion, the crypto market is showing signs of a bullish trend with opportunities for both short-term and long-term investors. While corrections are anticipated, underlying indicators suggest a continuing upward trajectory. This period could be strategically significant for investors looking to capitalize on the market dynamics.

Read the full article here