Cardano (ADA) was not left out of the all-inclusive crypto market recovery, as Bitcoin (BTC) hit $35,500. For ADA, it was also a defining moment as the token crossed the almighty $0.30 psychological resistance.

As of this writing, ADA’s value had increased by 6.70% in the last 24 hours. This increase was also accompanied by a rise in its trading volume to $350.89 million. The spike in its volume points to high interest in ADA, and if the trend becomes stronger, there is a probability of a further price increase.

ADA Finds Support at $0.28

ADA’s jump to $0.30 was not just connected to the BTC pump. According to the ADA/USD 4-hour chart, crossing the psychological zone was born out of the fact that bulls were able to resist another plunge at $0.28.

Seeing that sellers had become exhausted, the $0.28 level became a strong support level, which bulls took advantage of as ADA rose to $0.31. At press time, there has been a minor rejection at $0.31. So, ADA was back to exchanging hands at $0.30.

Meanwhile, the rejection does not seem strong enough to keep ADA out of another price increase. This inference was taken from the reading of the Relative Strength Index (RSI). At the time of writing, the RSI was 62.64, indicating how solid the bullish bias is for ADA.

Should the RSI rise to 65.00, there is a chance for ADA to add a 10% increase and hit $0.33 over the next few days. However, this potential jump would depend on the buying momentum, giving strength to the ADA price action.

In a case where strength wanes, ADA might only be able to hold $0.30 and prevent bears from coming into the picture. A close look at the Awesome Oscillator (AO) showed that a significant drop was currently not an option for ADA.

ADA/USD 4-Hour Chart (Source: TradingView)

The $0.33 Level May Be Next

At press time, the AO was 0.0063, with increasing green histogram bars. Since the reading was above zero, it means ADA’s uptrend is intact.

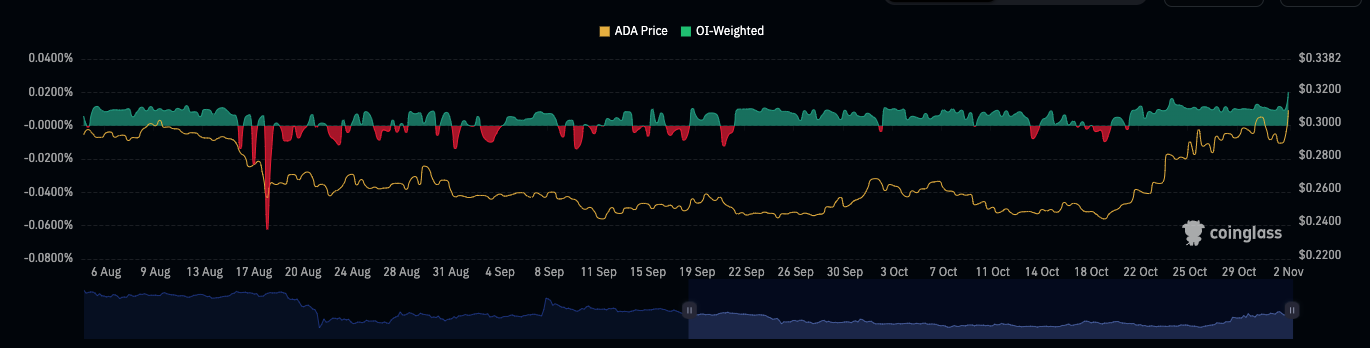

In line with the price increase, derivatives information portal Coinglass showed that a lot of traders are inclined toward an ADA long position. This assertion was derived from the funding rate.

As a way to asset market sentiment, the funding rate checks the position held by long and shorts while concluding which is dominant. A positive funding rate means the average sentiment is bullish, while a negative one implies otherwise.

ADA Funding Rate (Source: Coinglass)

ADA’s funding rate (as indicated by the chart above) was 0.092%, confirming the bullish thesis traders have. In the meantime, the most important level to watch out for remains the $0.28 support. If ADA maintains this support, then a rise to $0.33-$0.35 could be on the cards.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here