- 1 The total number of short positions in the LINK crypto are added in the last 24 hours is $80.36K against longs of $1.17 Million.

- 2 The Chainlink crypto plummeted by 3.83% in terms of market value and by 3.32% in trading volume in the last 24 hours.

Chainlink’s major goal is to aid originators in linking their smart contracts to credible, secure data sources called oracles. These oracles furnish significant data for the smart contracts to work efficiently. The LINK token is used within the Chainlink network to pay for these oracle services, encourage honest data delivery, and reward node operators.

By facilitating a stable and reliable connection, Chainlink stipulates that the data is always authentic and current. This allows a range of applications, like economic services, supply chain management, and numerous other use cases inside a disseminated framework.

The Chainlink crypto plummeted by 3.83% in terms of market value and by 3.32% in trading volume in the last 24 hours, as per CoinMarketCap, which is a crypto data and info website. Its market value is $8,056,422,634 and its trading volume is $578,073,112. There are currently 568,099,970 LINK coins in circulation.

Source: By CoinMarketCap

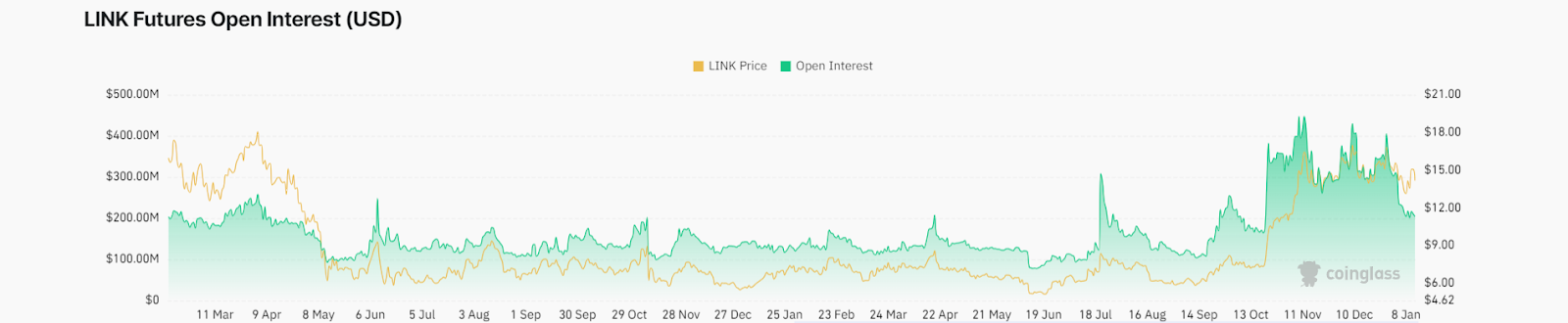

Chainlink’s (LINK) open interest is $202.52 Million, as per CoinGlass, which is a crypto analysis website. The open interest fell by 3.41% in the previous session. The long versus short ratio for 24 hours is 0.9554. The total number of short positions added in the last 24 hours is $80.36K against longs of $1.17 Million.

Source: By Coinglass

Furthermore, LINK has not shown good performance this month as it fell by 4.68% during this period but surged by 114.44% in the past six months. Additionally, the year-to-date return of LINK is negative with a 5.40% decrease.

Technical Overview of Chainlink Crypto on the Daily Time Frame

Source: LINK/USD COINBASE.1.D. by TradingView

The LINK crypto chart is displaying bearish qualities and is expected to plummet further. It has demonstrated a poor weekly outlook in the chart as the price is trapped in a range-bound situation and is facing rejection from a supply region.

As of now, the LINK price is in the lower band of the parallel channel and gearing up for a steep fall. Furthermore, the LINK crypto experienced a 0.42% fall in the last 24 hours, and was trading at $14.88 at press time.

The LINK crypto has shown a sign of a steep fall as the price faced strong resistance, preventing it from surpassing the $17 level on the chart. Therefore, if the price doesn’t sustain the immediate level, then the fall is imminent and it could slip to $11.

However, if the demand for the LINK rises, the asset price could bounce back from the current level inside the lower band as well. Then the next goal for the LINK price could be to reach $20.

Overall, examining the technical tools on the chart, it seems all are highlighting the negative views on the chart. The RSI, EMAs, and MACD, point towards the fall in the probably future sessions.

Source: LINK/USD COINBASE.1.D. by TradingView

Summary

The LINK crypto asset is displaying bearish qualities and could plummet further. It has demonstrated a poor weekly outlook in the chart as the price is trapped in the range-bound situation and faced rejection from the supply region.

Therefore, if the price doesn’t sustain at the immediate level, then the fall is imminent and it could slip to the $11 mark.

Technical Levels

Support Levels: $11

Resistance Levels: $20

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Amanda Shinoy

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

Read the full article here