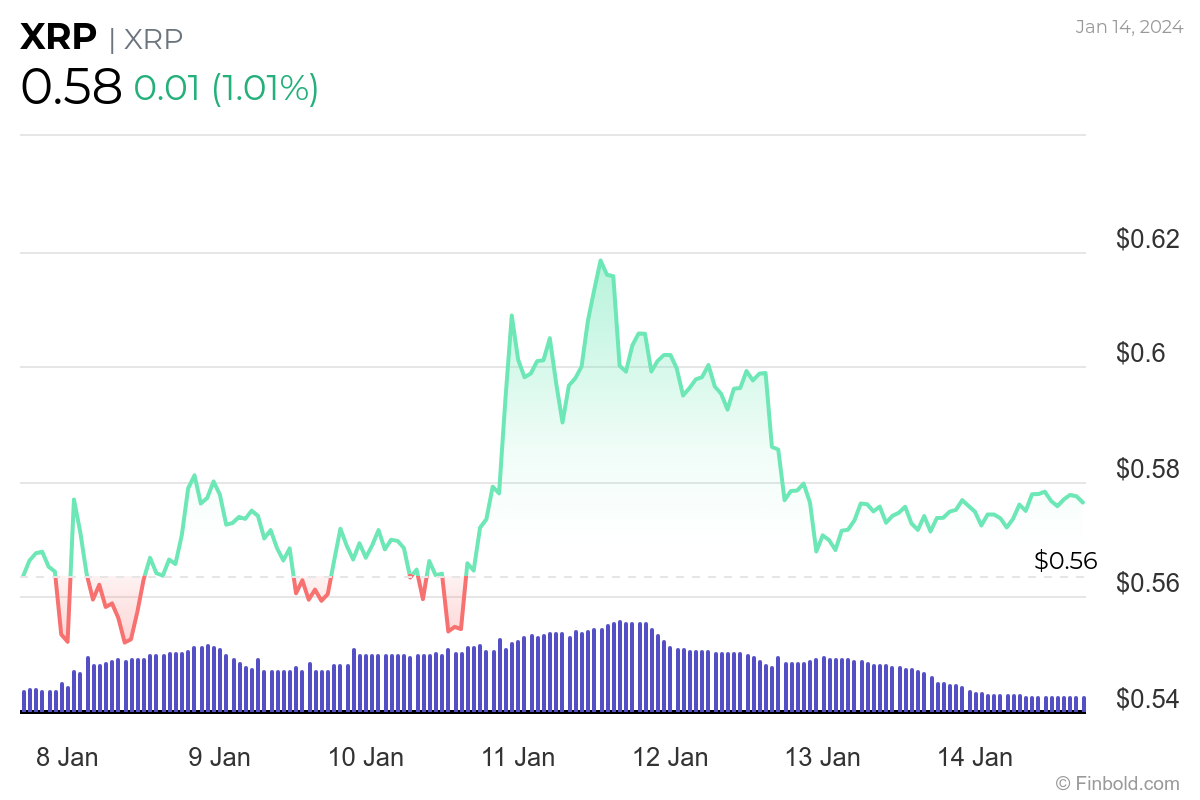

Although the general cryptocurrency space is experiencing a bearish trend, primarily attributed to the diminishing excitement surrounding the Bitcoin exchange-traded fund (ETF), XRP stands out as one of the most affected cryptocurrencies. The token has suffered significant losses recently, falling below the $0.60 support level.

In response to this trend, analysts are now forecasting substantial declines in the valuation of XRP in the coming days. Notably, in a TradingView post on January 12, prominent cryptocurrency analyst Alan Santana pointed out, based on recent price movements and technical indicators, that investors should brace for impact, forecasting XRP will undergo ‘a very strong correction’.

In arriving at this projection, the analyst shared several technical analyses. For instance, on January 11, he highlighted a critical rejection point just below the Exponential Moving Average 50 (MA), where XRP briefly exceeded the level of $0.6054 but ultimately closed below it.

The upper triangle trendline also witnessed a touch, signaling a potential reversal. The subsequent day, January 12, marked a full-red session, leading Santana to predict a correction based on the day’s market action but remained optimistic about prospects.

“It will be a very strong correction based on the action today. Since this is just the start, brace for impact. We will have plenty of time to buy at lower prices and enjoy and entire year of growth (2024). I will be here sharing with you the best time to enter when support is found,” he said.

Looking back to Santana’s analysis from January 5, he highlighted the alarming signs of an imminent crash, where he pointed out that XRP had consistently moved below EMA200 with a weak Relative Strength Index (RSI) of 34.33, signaling a bearish momentum.

The descending triangle formed since mid-November, coupled with lower highs and decreasing volume, painted a concerning picture for the XRP market.

“This combination of signals can lead to a major drop. First slow, as it is happening now, and then a sudden crash to liquidate all those who are long,” he added.

XRP struggles to reclaim $1

It is noteworthy that XRP has been unable to make significant strides towards the crucial $1 mark despite high expectations following partial legal clarity affirming its non-security status in the Securities and Exchange Commission (SEC) case.

The ongoing case remains a pivotal factor influencing the future price movements of XRP, as it is yet to reach a conclusive resolution.

In the most recent update on January 11, the SEC has taken steps to compel Ripple to furnish financial documents and information related to its XRP sales. The SEC portrays this action as essential in determining the necessary remedies. Overall, the outcome of this legal development is expected to impact the trajectory of XRP substantially.

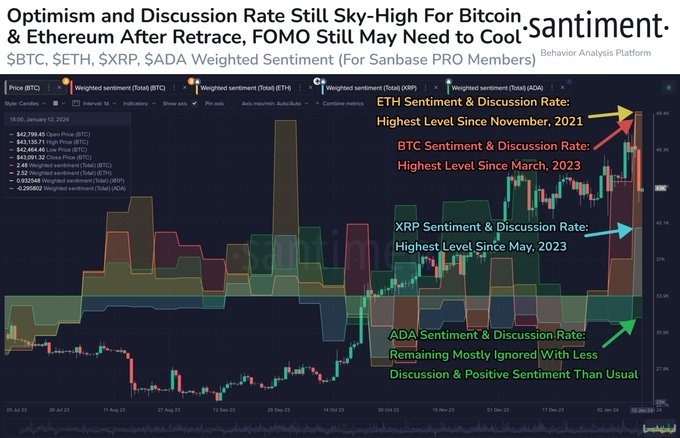

Despite the prevailing bearish price movement, on-chain data suggests a growing social interest in XRP. According to data from the crypto analysis platform Santiment, there is a noticeable bullish sentiment towards XRP and Bitcoin. This indicates a potential shift in market sentiment, adding a layer of complexity to the current dynamics influencing XRP’s performance.

“Time since May, 2022. There is also a notable bull bias toward Bitcoin and XRPNetwork. While traders are discussing the possibility of ETH or XRP ETFApproval possibilities, Cardano is overlooked compared to its normal level of trader optimism,” Santiment said on January 13.

XRP price analysis

As of press time, XRP was trading at $0.58, reflecting a gain of over 1% in the last 24 hours. Over the past seven days, the token has rallied by 2%.

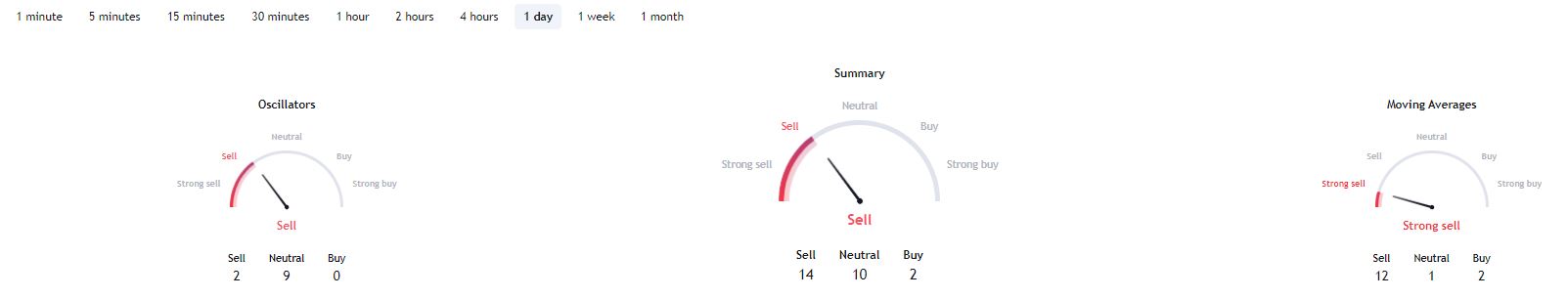

Regarding technical analysis, a summary of one-day gauges obtained from TradingView aligns with a ‘sell’ sentiment, registering at 14. Moving averages indicate a ‘strong sell’ at 12, and oscillators recommend a ‘sell’ at 2.

At the moment, XRP investors will be hoping the correction does not extend further below the $0.5 mark.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here