The recent Terra Luna Classic (LUNC) price rally is a testament to strength of the community and resilience of the chain. Despite challenges and FUD, Terra Luna Classic community pushes for efforts to evolve and grow. The holders are bullish amid the crypto market recovery.

Reasons for Recent Upswing in Terra Luna Classic (LUNC) Price

Terra Luna Classic (LUNC) price has rallied 25% in February after a reversal in January end. LUNC hit a high of $0.0001225 today, with most gains coming this week as the community deliberates on crucial decisions.

Binance LUNC Burn

One of the primary reasons for the price hike is the recent Binance LUNC burn. The world’s largest crypto exchange Binance burned 2.1 billion Terra Luna Classic (LUNC) tokens in the 18th batch as part of its LUNC burn commitment. The total LUNC burned by the crypto exchange to date reaches over 50 billion, which is 52.1% of the net LUNC burned by the Terra Luna Classic community.

Notably, the total LUNC burn by the Terra Luna Classic community approaching 100 billion. At present, it stands at almost 98.5 billion LUNC.

LUNC Breakout Above Downsloping Trendline

CoinGape Markets on Feb 4 reported LUNC price breakout from the downsloping trendline. The flipped support of $0.0001 validated the altcoin’s suitability for the higher rally. The intraday trading volume in the LUNC coin reached over 1000%.

Moreover, the latest analysis predicts that Terra Classic is in consolidation, undergoing a squeeze before the ultimate break out to $0.0002.

Proposals Passed by the Terra Luna Classic Community

Furthermore, proposals passed by the Terra Luna Classic community have also contributed to the LUNC price rise. Terra Luna Classic proposal 12033 “Compulsory KYC for all L1 developers” was approved by the community, which passed with a narrow margin. The proposal saw a massive voting turnout of 90.5%.

The proposal aims to introduce KYC for all L1 developers, prevent short selling of Terra Luna Classic, and enhance security and safety.

Meanwhile, the community approved Genuine Labs, a new developer group to fix issues with the chain. The community also approved a spending proposal as the developers successfully completed all developments.

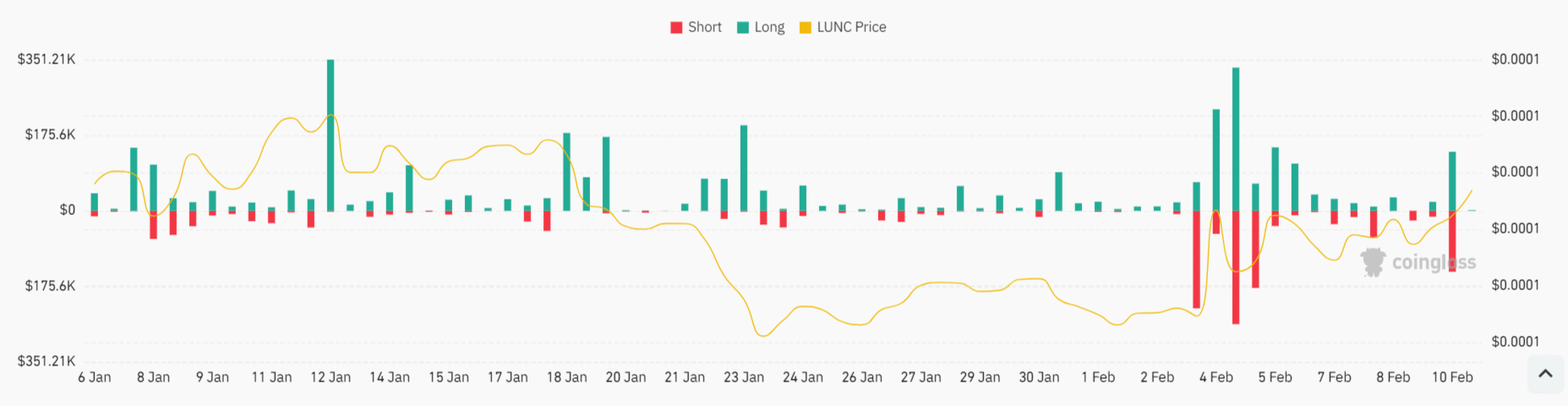

Short Liquidations

There have been numerous LUNC shorts liquidated this week, along with a rise in trading activity. The demand for LUNC increasing as the overall market sentiment is quite bullish right now, with many investors and traders expecting a strong recovery after the recent market correction.

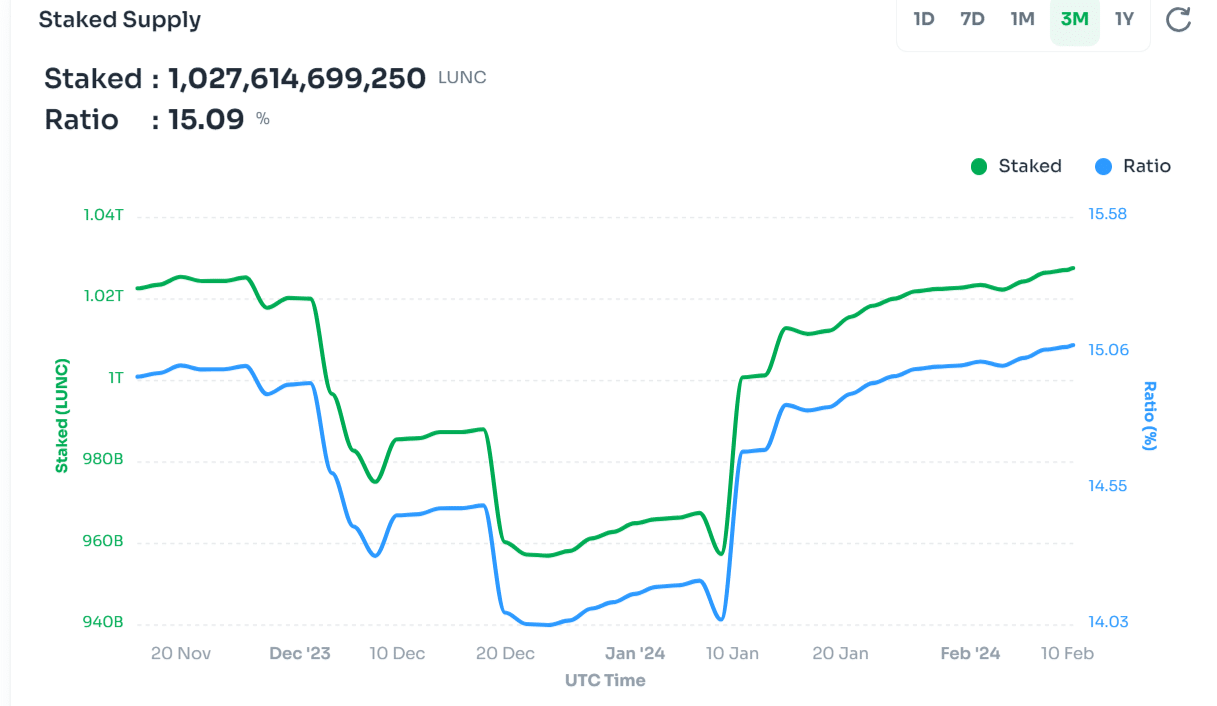

LUNC Staking Rises Above 1 Trillion

After a drop in total LUNC staked to nearly 950 billion in December and January, LUNC staking has again been rising lately. The staked supply is now at over 1.027 trillion LUNC, rising continuously this week. The staking ratio has hit 15.09%.

LUNC staking is crucial for validators and the project. It’s a process where users lock their assets with a validator to earn rewards.

Also Read:

- Bonk Price Soars 30%, Here’s Why Rally Could End Soon

- Bitcoin ETF Records Huge Net Inflow of $542 Million, Experts Reveals What’s Next?

- Ripple CTO Weighs in on Ex-Employees and XRPL Developments

Read the full article here