The cryptocurrency market is a realm teeming with opportunities. Although the limelight frequently falls on prominent cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), there are a bunch of hidden gems trading below the $5 mark.

These lesser-known altcoins harbor considerable growth potential. However, it’s imperative to recognize that an elevated level of risk accompanies them.

For investors who possess a higher risk tolerance, allocating a portion of their investment capital, ranging from 10% to 20%, into these altcoins can provide a tantalizing chance to diversify their portfolio and position themselves for substantial gains in the forthcoming bull market.

Near Protocol (NEAR)

NEAR is a public Proof-of-Stake (PoS) blockchain that aims to bring DeFi to the masses with low transfer fees and fast transactions. It competes with Solana (SOL), Cardano (ADA), the new version of Ethereum, and other PoS networks.

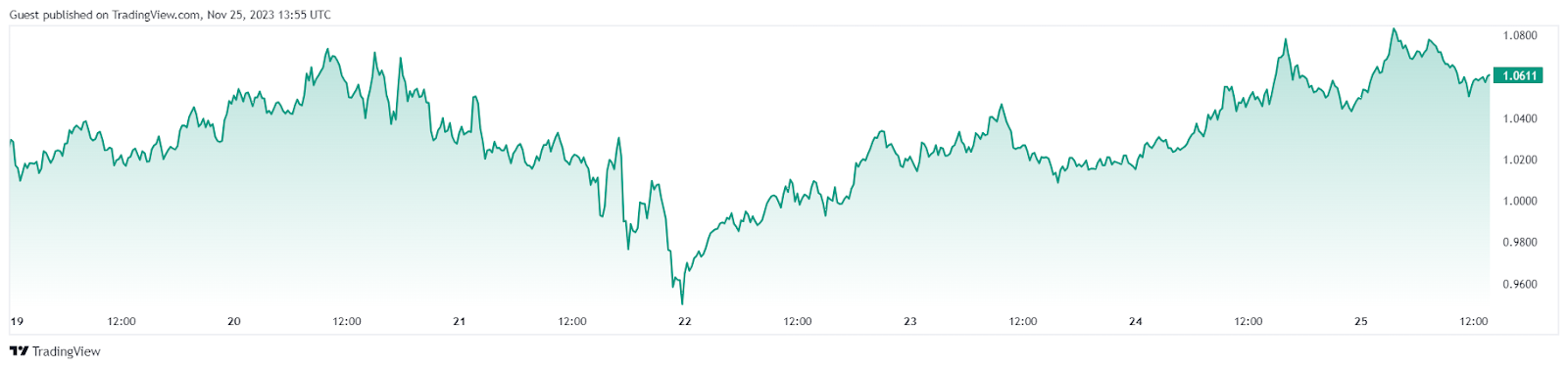

NEAR rose and closed above the resistance of $1.70 on November 24, and this move indicates a potential trend change in the short term.

The ascending 20-day Exponential Moving Average (EMA) at $1.58 and a positive Relative Strength Index (RSI) signal the current dominance of bulls in the market. A minor resistance is observed at $2, and a successful breakthrough could propel the NEAR/USDT pair to $2.40.

On the flip side, bears may attempt to reverse the momentum by driving the price beneath the established breakout point at $1.72, potentially ensnaring bulls who entered aggressively. In such a scenario, the pair could undergo a decline toward the significant 20-day Exponential Moving Average (EMA), a pivotal level demanding close observation.

If the price falls below this critical level, it would serve as a clear indication of renewed selling activity, signaling that sellers have regained control in the market.

The pair has been sustaining above the breakout level of $1.72, but the bulls have failed to start a strong up-move. This suggests that the bears have not given up and are trying to pull the price back below $1.72.

If they can pull it off, the price may drop to $1.60. If this level gives way, several stops may get triggered. The pair may then tumble to $1.45 and thereafter to $1.28. However, if buyers shove the price above $1.95, the pair may start its march toward $2.10.

Theta Network (THETA)

Theta Network (THETA) is currently establishing support at the 20-day Exponential Moving Average (EMA) at $0.88, following a recent correction in the past few days.

This trend suggests that overall sentiment remains positive, with traders interpreting the recent dips as a favorable buying opportunity. The fact that the price is finding support at the 20-day EMA indicates resilience in the market, and investors seem inclined to consider these corrections as a chance to enter or add to their positions.

The anticipated bounce from the 20-day EMA might encounter resistance at the psychological barrier of $1. If successfully breached, the THETA/USDT pair could gain momentum, propelling it towards $1.05 and subsequently to $1.20. Overcoming this level may pose a significant challenge, yet if surpassed, the pair may advance to $1.33.

Arbitrum (ARB)

In 2023, the cryptocurrency community was abuzz with excitement surrounding the launch of the Arbitrum token (ARB), an event highly anticipated by crypto enthusiasts. The token launch didn’t disappoint, as it came with a massive airdrop, offering participants the opportunity to secure up to 12,000 tokens, equivalent to over $10,000.

Since its launch, ARB coin has shown extensive growth in the crypto market and became one of the top 100 crypto projects shortly after its launch. According to some reports, Ethereum whales dumped billions of dollars of investments in ARB tokens after the launch, and it pushed the price.

ABR prices rallied to an all-time high (ATH) of $11.80 in March 2023. However, since then Arbitrum Coin has been showing a bearish performance and is currently trading at $1.6

Arbitrum’s appeal lies in its position as the leading Layer 2 (L2). Arbitrum aims to improve the speed, scalability, and cost-efficiency of the Ethereum blockchain solution.

Arbitrum benefits from the security and compatibility of Ethereum and offers lower fees compared to Ethereum. The Arbitrum developers announced establishing themselves as a decentralized autonomous organization (DAO): the Arbitrum DAO.

The substantial support from major cryptocurrency exchanges further propelled Arbitrum’s rise, quickly establishing it as the second most widely used blockchain network in the crypto space. However, after its initial success, a discordant note emerged when developers expressed an interest in utilizing a significant portion of the project’s funds, a proposal that was met with opposition from the community.

Regrettably, the developers chose to proceed with their plans, disregarding the community’s vote and characterizing it as a mere ‘poll to gauge community sentiment.’ This decision led to a division, causing Arbitrum, once the second most used blockchain network and its associated token to lose favor within the community.

Arbitrum blockchain is rapid and user-friendly, but an investment in ARB is now considered a high-risk high-reward due to the controversy surrounding the vote and the perceived disrespect toward the community.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here