As the cryptocurrency market attempts to put behind the recent bearish sentiments, several projects are poised to yield profits on a modest investment. A prevailing consensus suggests that the crypto market, spearheaded by Bitcoin (BTC), will likely experience a rebound.

Market participants anticipate that factors such as the Bitcoin halving, the recent approval of a spot Bitcoin exchange-traded fund (ETF), and a potential similar product for Ethereum will catalyze a long-term rally.

In the meantime, analysts are also projecting a rebound in the altcoin market, noting that positive sentiments in the market will likely drive buying pressure.

In line with this perspective, Finbold has identified three cryptocurrencies that hold the potential to help investors turn a $10 investment into $1,000 in 2024.

Avalanche (AVAX)

Avalanche (AVAX) has established itself as a formidable player in decentralized finance (DeFi). Recognized for its high throughput and low transaction fees, the Avalanche platform is pivotal for developers and users.

Over the past year, Avalanche achieved significant milestones on multiple fronts. Notably, its valuation surged towards the end of the year, targeting the $50 resistance. At the same time, the platform forged partnerships, including notable collaborations with the gaming company BLRD and Amazon’s (NASDAQ: AMZN) AWS, a positive factor for price growth.

With the ecosystem expanding and more projects building on Avalanche, a $10 investment could yield substantial returns as the platform gains widespread adoption.

By press time, AVAX was trading at $31.86, registering daily gains of almost 7%. However, on the weekly chart, AVAX experienced a 4% decline.

Solana (SOL)

Often touted as the “Ethereum (ETH) killer,” Solana (SOL) has gained prominence with its high-performance blockchain. Boasting impressive transaction speeds and low fees, the Solana network is a key platform for decentralized applications and smart contracts.

Notably, in 2023, SOL surpassed the $100, driven by the fear of missing out (FOMO) surrounding Solana’s SPL token airdrops. The rally indicates the token still has the potential for further upside. Additionally, Solana is showing high investor interest as the platform plans to launch a second new smartphone, building on the success of its initial crypto-ready device. With positive market sentiments, Solana will likely rally toward its last all-time high of over $200.

A $10 investment in Solana could witness growth, particularly as more developers and users join its ecosystem.

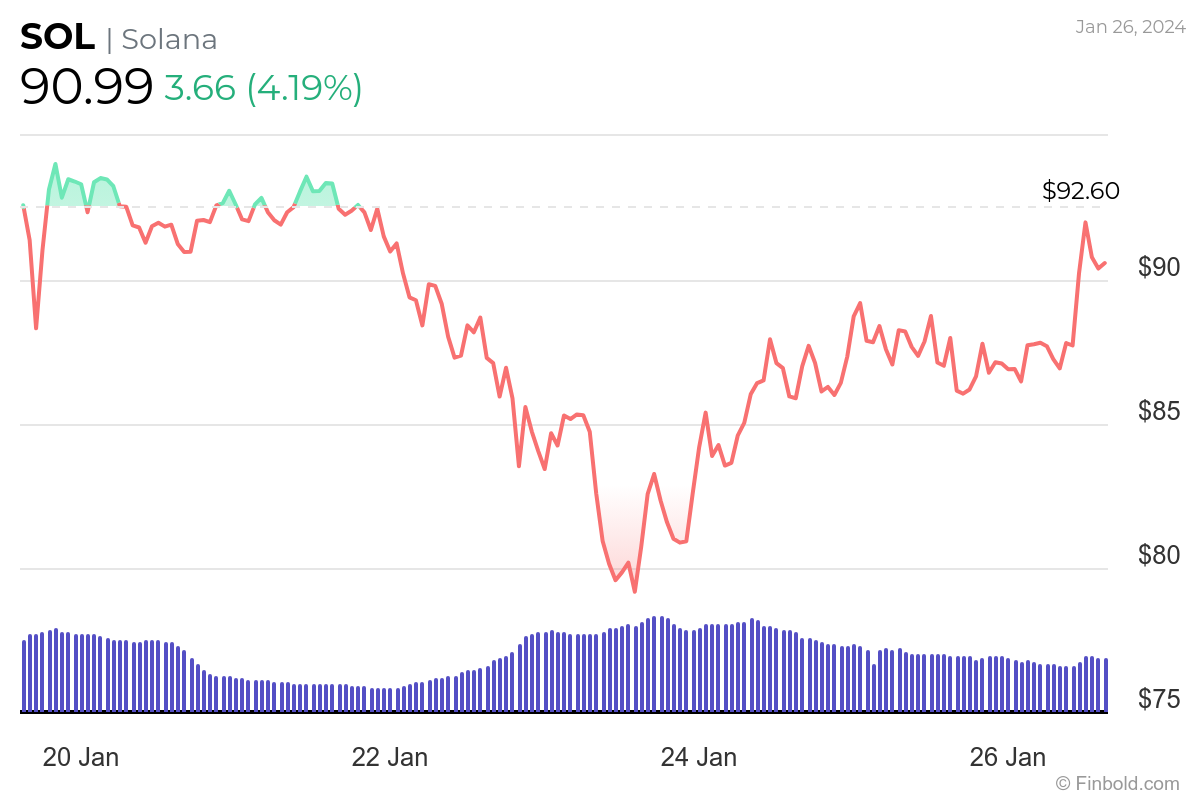

By press time, Solana is trading at $90.99, having rallied over 4% in the last 24 hours.

Polygon (MATIC)

Polygon (MATIC), a layer-2 scaling solution for Ethereum, has become a key entity in enhancing the scalability and user experience of the Ethereum network. With the escalating demand for decentralized applications on Ethereum, Polygon’s infrastructure offers a viable solution.

Given the array of projects building on its platform, a $10 investment in Polygon could capitalize on the network’s increasing importance in the broader blockchain landscape.

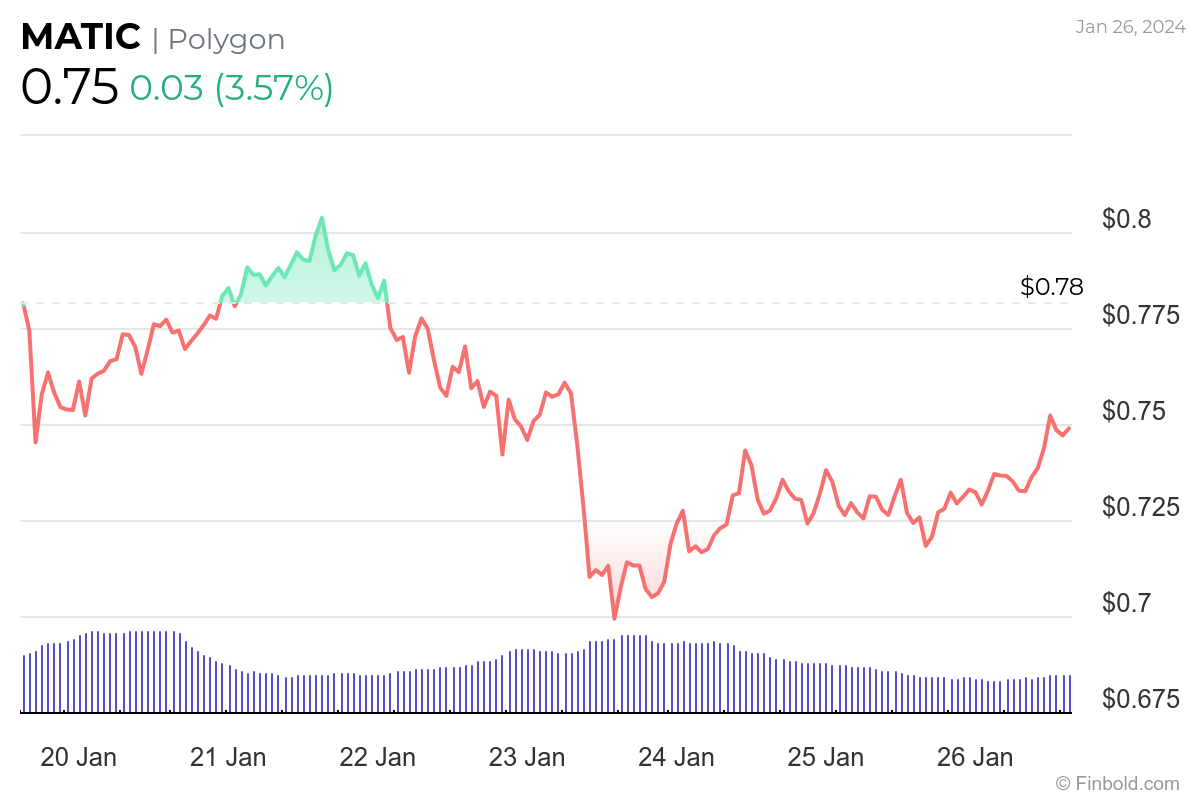

MATIC had recorded weekly losses of about 4% by press time, while on the daily chart, the token was up 3%, trading at $0.75.

Finally, although these projects present exciting opportunities with strong fundamentals, it’s crucial to note that their success will largely depend on overall market sentiments.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here