As the stock market posts substantial numbers since the start of 2024, February has brought further gains for traders, raising interest in opportunities that could quickly rake in a considerable profit.

Investors are actively pursuing lucrative opportunities, with short squeezes emerging as a notable strategy to navigate the current financial landscape.

Short selling involves borrowing and selling a stock on the market, expecting to profit as the price declines. However, if the stock price rises, short sellers are compelled to repurchase the stock at a higher price to cover their position and return it to the lender.

Considering the current market sentiment, Finbold analyzed the potential picks, highlighting two that have the potential to experience a surge in the coming period.

Imperial Petroleum Inc (NASDAQ: IMPP)

Imperial Petroleum Inc (NASDAQ: IMPP) is an international shipping transportation company headquartered in Greece. The company specializes in transporting a range of petroleum and petrochemical products in liquefied form, and with the current sentiment in the oil industry being positive due to the rising prices amidst conflicts in the Middle East, it has posted substantial numbers.

IMPP is currently the heaviest float shorted, with a short interest of 70.60%. In the Q3 report, revenue amounted to $29.4 million, marking a decrease of $13.2 million, or 31.0%, compared to the previous year. However, the company repurchased approximately 1.1 million shares during the quarter, amounting to roughly $1.9 million.

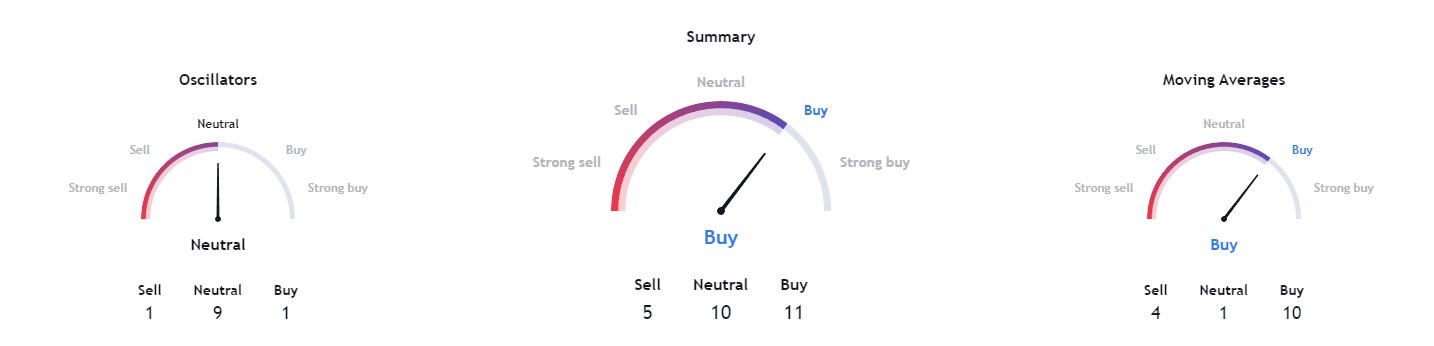

The technicals for IMPP are pretty bullish, with a rating of ‘buy’ at 11 and moving averages tilting towards ‘buy’ at 10. Oscillators point at ‘neutral’ with a rating of 9.

Symbotic Inc (NASDAQ: SYM)

Symbotic (NASDAQ: SYM) is a robotics warehouse automation company specializing in constructing and operating automated warehouse systems. The company serves clients across the United States and Canada. Their software integrates artificial intelligence and is utilized by 1,400 stores, catering primarily to grocery, retail, and wholesale sectors. Notable clients include major corporations like Target (NYSE: TGT) and Walmart (NYSE: WMT).

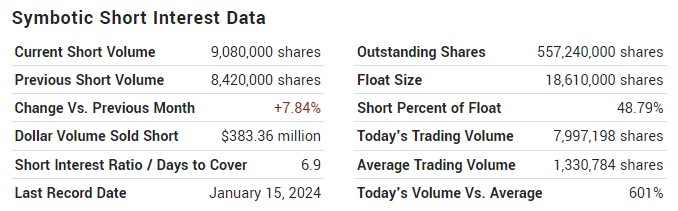

It is currently in the top five most shorted stocks, with float shorted at 48.79%. SYM’s latest report disclosed adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $14 million. Sales experienced a substantial 79% year-over-year increase, reaching $368 million.

Symbotic had previously projected adjusted EBITDA in the range of $11 million to $14 million, alongside sales between $350 million and $370 million for the period.

This fiscal Q1 report represents Symbotic’s second consecutive quarter of profitability on an adjusted basis.

Looking at analyst predictions reveals an optimistic forecast from 14 analysts from TradingView, which awarded this stock with a ‘buy’ rating. Out of these 8 opted for ‘strong buy,’ 2 for ‘buy’, and 4 for ‘hold.’

The average forecast for SYM stock price stands at $54.93, representing a 44.89% increase from the current level of $37.91 at the time of press.

In conclusion, while these highlighted stocks have short squeeze potential, predicting the pattern remains challenging as overall market sentiments significantly influence them.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here