The IOTA token jumped 43% after registering an ecosystem development foundation in Abu Dhabi.

The IOTA Ecosystem DLT Foundation will be funded by $100 million worth of tokens vested for four years.

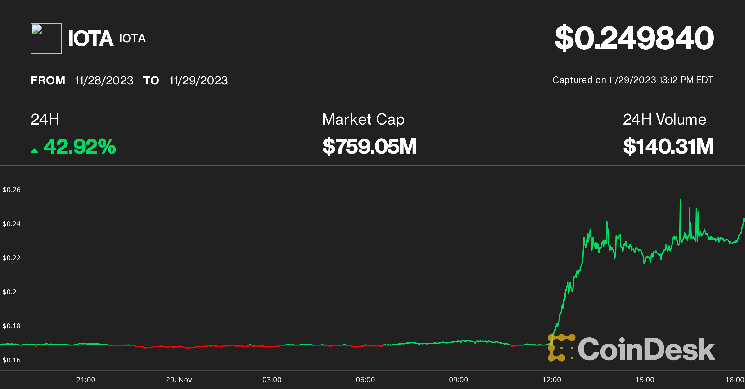

Native token of the IOTA ecosystem (IOTA) jumped 43% Wednesday on news about registering a development foundation in Abu Dhabi, the capital of United Arab Emirates.

The IOTA Ecosystem DLT Foundation claims to be the “first” foundation being registered under the regulatory framework called the DLT Foundations Regulations, set up by the city’s financial watchdog Abu Dhabi Global Market (ADGM), according to an IOTA press release.

The new organization will be funded by $100 million worth of IOTA tokens, locked up for four years, the press release added.

The cryptocurrency’s price surged to 25 cents from 17 cents immediately after the announcement, hitting its highest level since February.

The development came after IOTA unveiled plans in September to establish a regulated entity in Abu Dhabi to foster the network’s global expansion.

Iota is one of several crypto-adjacent firms that clinched approvals from Abu Dhabi’s regulators recently. Paxos also received a go-ahead to operate in the Emirati city Wednesday. Liminal, a digital asset custody and wallet infrastructure provider also secured an in-principle approval from ADGM earlier this month.

The rash of approvals comes as Abu Dhabi amps up its efforts to establish itself as a crypto-friendly hub. Earlier this year, the emirate announced it would pour roughly $2 billion into web-3 and blockchain startups to attract builders to its economic free zone.

“Working with companies like IOTA, ADGM aims to move towards a future characterized by setting global benchmarks in the ever-evolving blockchain and Web3 landscape,” Hamad Sayah Al Mazrouei, CEO of the Registration Authority of ADGM, said in a statement.

Read the full article here