Despite a sluggish growth in the crypto markets, Sonic posted a strong rally this week, fueled by notable DeFi expansion and bullish technicals.

While fears over escalating tariffs continue to weigh on investor sentiment, Sonic (S) broke out on Friday, April 4, reaching a daily high of $0.514, marking an 11% increase in 24 hours. The rally appears to have been driven by multiple milestones in Sonic’s decentralized finance ecosystem, which has shown steady growth in both usage and capital inflows.

The total bridged value locked across the Sonic decentralized finance ecosystem is approaching the $2 billion milestone. On April 4, the figure, which represents all assets bridged to and from the Sonic network and multiple other chains, reached an all-time high of $1.8 billion.

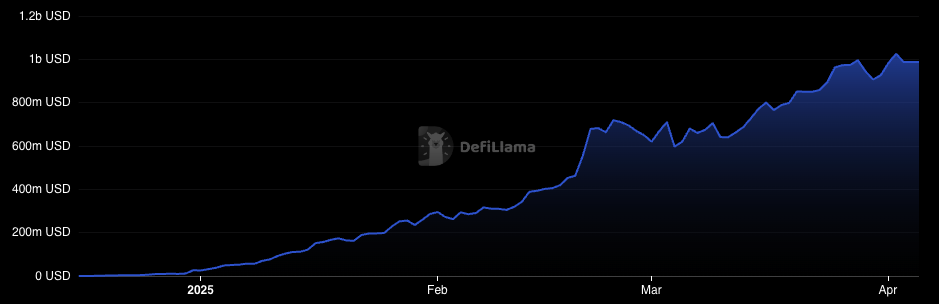

This development came after Sonic broke $1 billion in average TVL on April 2. Both of these figures have been up consistently since the platform’s launch, showing the steady growth of the Sonic DeFi ecosystem.

Sonic DeFi Ecosystem Grows Despite Bear Markets

What makes Sonic’s rally more notable is that it came amid a bearish market backdrop. The ongoing global trade war has dragged down most crypto and stock assets, but Sonic’s DeFi sector appears resilient. Since rebranding from Fantom on December 18, Sonic’s DeFi total value locked has surged from $520,540 to $987 million, representing a 189,510% price increase.

By contrast, Solana’s DeFi TVL has fallen from its January 22 high of $11.7 billion to its current level of $6.4 billion. For this reason, some analysts are pointing out that Sonic may be undervalued when taking its DeFi growth into account.

Notably, on March 24, DeFi analyst DeFi Plug noted that Solana’s market cap was trading at a multiple of 12 compared to its DeFi TVL. At the same time, the figure for Sonic is 2, suggesting more potential upside for the network.

Read the full article here