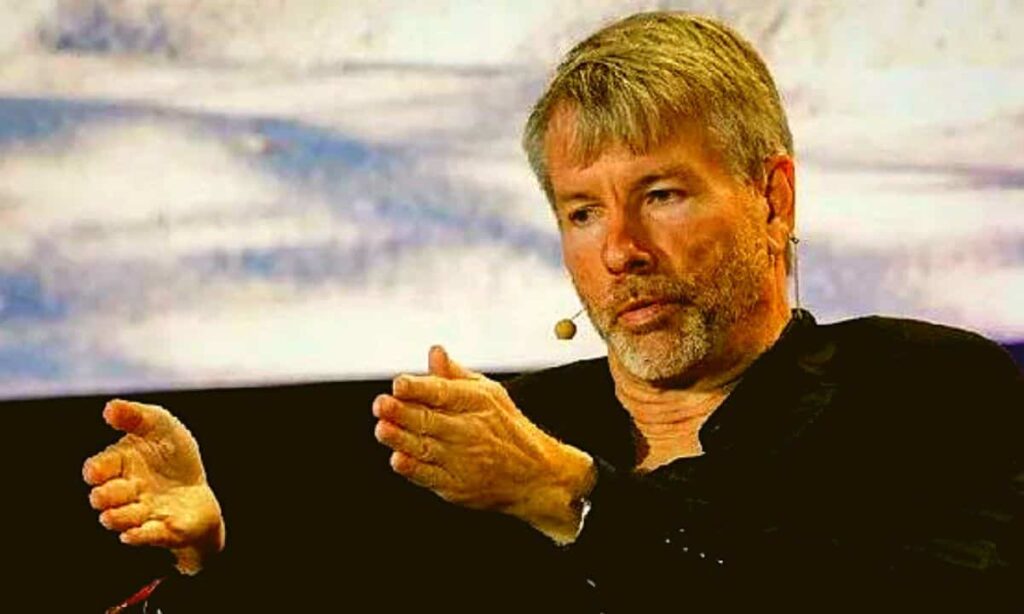

Michael Saylor-led business intelligence firm, Strategy announced today that it has entered into a sales agreement to offer up to $21 billion of 8% Series A Perpetual Strike Preferred Stock, according to a filing with the US Securities and Exchange Commission (SEC).

The shares, which carry a $0.001 par value, are convertible into Strategy’s class A common stock and will be sold under an at-the-market (ATM) offering program.

$21 Billion Stock Offering

In its official press release, the company stated that proceeds from the offering will be used for general corporate purposes. This includes the acquisition of additional Bitcoin and working capital. Sales of the perpetual strike preferred stock will be conducted over time, and Strategy indicated that shares will be issued in a “disciplined manner,” depending on trading prices and volumes.

According to the filing, the preferred stock may be sold through various methods deemed compliant with Rule 415(a)(4) of the Securities Act of 1933, as amended. This includes at-the-market offerings, negotiated transactions, and block trades.

The offering will be made pursuant to a prospectus supplement filed on March 10th under Strategy’s existing automatic shelf registration statement, which became effective on January 27th this year.

Strategy is already the largest corporate holder of Bitcoin, and the proceeds from this offering are expected to fund further accumulation of the leading cryptocurrency. The company has previously indicated that Bitcoin acquisition remains a core component of its long-term corporate strategy.

Strategy Rebranding

The firm recently dropped “Micro” from its name as part of the rebranding process to highlight its focus on Bitcoin and AI as transformative technologies. This came amidst a record-breaking fourth quarter of 2024 which marked its largest-ever increase in quarterly Bitcoin holdings.

As of the latest update by Bitcoin Treasuries, Strategy holds a Bitcoin balance of 499,096 BTC, which is approximately worth around $39.87 billion.

Despite the announcement, Strategy’s (MSTR) stock is trading near $252, down by over 12% from the previous close.

Read the full article here