Bitcoin price prediction continues to show strength, shrinking the chances of a correction before the pre-halving rally. If anything, BTC may have already confirmed the early stages of the pre-halving rally. Most bullish intraday traders are closely watching the $52,000 level, established as solid support.

On the upside, $53,000 is an area of concern due to the liquidity anticipated. This range may extend to $53,400. A successful retest of the hurdle could act as a price magnet, paving the way to $58,000.

Read Also: Bitcoin Ordinals Dev Leonidas “Largest Ordinals Airdrop Ever” Runestone Almost Here

Bitcoin Price Prediction: Has The Pre-Having Started?

As Bitcoin gradually moves closer to the halving hype cycle, investors are keen to spot opportunities before time runs out. The halving, which reduces miner rewards by half every four years, is anticipated in April. Crypto trader and analyst Rekt Capital suggests that the transition to the pre-halving rally has started.

#BTC

It’s now fully confirmed

Time has officially run out

Bitcoin has now completely transitioned into the Pre-Halving Rally phase$BTC #Crypto #Bitcoin https://t.co/Egqxs9ritl pic.twitter.com/VSRkbXLAvB

— Rekt Capital (@rektcapital) February 19, 2024

With rewards halved, supply tends to shrink. This supply cringe coupled with high demand for BTC especially with the spot ETF catching the attention of institutional investors, many people believed the next rally, possibly several months after the event, would be the ‘mother’ of all bull runs.

Traditional investors are impressively warming up to crypto through the introduction of spot Bitcoin ETFs in the US. So far, the cumulative total net inflow crossed the $5 billion mark, with $1.47 billion in total value traded, according to SoSoValue.

Bitcoin ETFs data | SoSoValue

Index funds such as Byte BOLD Index are doubling down on their efforts to get more exposure to Bitcoin, with 25% of the fund accounted for in BTC while gold takes up the remainder of the portfolio, 75%.

Leading analyst James Van Straten believes more index funds, hedge funds, and pensions among others will soon be considering the allocation of at least 1% of their portfolios into Bitcoin, which “will inevitably increase to 5-10%.”

Bytree BOLD Index is 25% #Bitcoin, 75% Gold.

I am not commenting on the weighted percentage.

I think this Index is indicative of what is to come.

In 2021, it was 18%. #Bitcoin is now up to 25% allocation.Pensions, etc, will start to allocate a mere 1% into the #Bitcoin… pic.twitter.com/EPLnSSe7H6

— James Van Straten (@jvs_btc) February 19, 2024

Historical data shows that Bitcoin tends to soar to new peaks after each halving, but this is not a sure thing. Bitcoin’s price is influenced by many other factors, so investors should only risk what they can afford to lose.

Navigating Bitcoin Price Technical Outlook

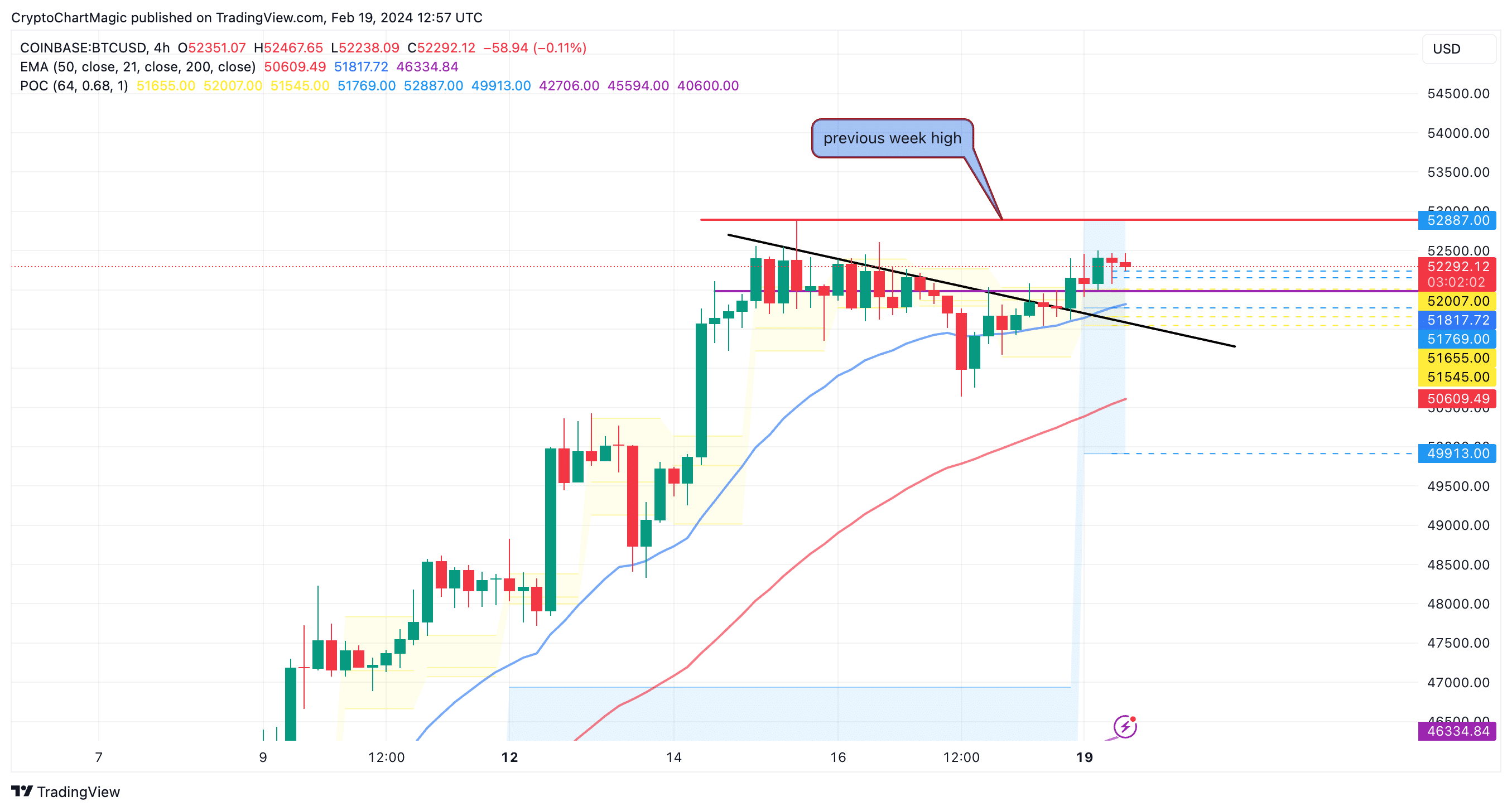

Bitcoin price holds above the weekly open of $52,168 and the point of control (POC) of $52,236. If these levels don’t give in, a bullish outcome will be highly likely amid expectations of a break above the previous week’s high of $52,891.

Above this, FOMO may kick in with BTC gaining momentum toward $54,000, affirming the potential for an extended pre-halving rally toward $60,000, although many analysts are pointing to $58,000 as a local peak and consequently an area of concern.

Bitcoin price prediction chart | Tradingview

The Moving Average Convergence Divergence (MACD) indicator is about to flash a buy signal in the four-hour range, making BTC more attractive to intraday traders.

Losing $52,000 as support and closing below $51,800 could change the outlook of the market. This would imply that a dip occurs to allow for the collection of liquidity to steady the uptrend into the pre-halving rally.

Related Articles

- Cryptocurrency Market Analysis For February 19th: ETH, STX, WLD

- South Korean Ruling Party Eyes Bitcoin ETF and Easing IEO Investment Ban

- Top AI Tokens GRT, NEAR, AGIX Drive AI Sector Rally Amid OpenAI Sora Hype

Read the full article here