Cardano price forecast: ADA showcased an impressive performance this week amid a general upswing in the market. The price of Cardano has seen a rise of 1.27 percent, bringing its price to $0.6027. Over the last seven days, Cardano’s ADA has experienced a noteworthy uptick of 11 percent. This trend points to a promising future with potential for additional gains.

With a market cap of $21.35 billion, Cardano securely ranks among the top ten digital currencies. The past day alone saw a 21 percent increase in trading volume, amounting to $729 million. This indicates a continued strong interest from investors amidst the current upward price movements. ADA’s price fluctuated between $0.58 and $0.62 throughout the week, showing a stable ascending pattern.

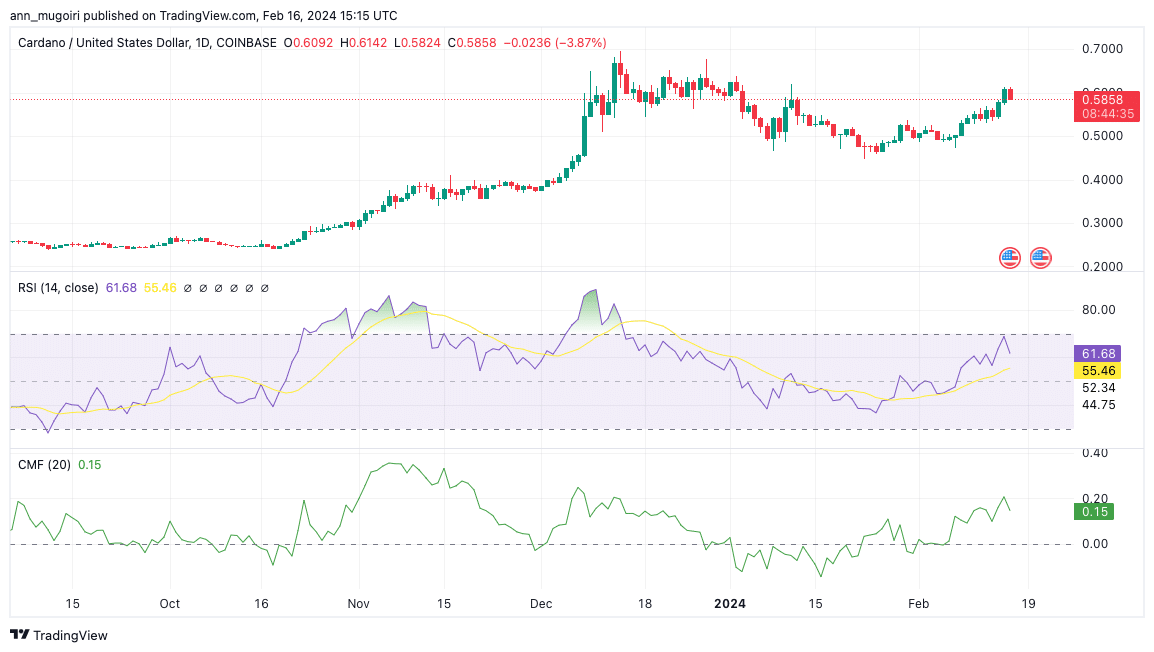

Cardano price forecast

Bitcoin, the cryptocurrency market leader, has also been riding a wave of bullish momentum, surpassing the $51,000 resistance mark. This positive trend, coupled with the anticipation surrounding Bitcoin’s upcoming halving, positions Cardano’s ADA for potentially significant growth.

Cardano Price Forecast: Analyzing ADA’s Path to $1

In a recent analysis, crypto expert Dan Gambardello offered insights on the potential for Cardano’s ADA to reach the coveted $1 milestone amid current market enthusiasm. Despite widespread expectations for ADA to have surpassed this threshold already, Gambardello presents a different perspective, anchored in the study of past cycle trends, suggesting ADA is performing better than anticipated.

He pointed out the influence of Bitcoin’s market movements on ADA’s trajectory, highlighting the uncertainty surrounding ADA’s climb to $1 if Bitcoin undergoes a period of decline and consolidation before attempting a fresh surge pre-halving. Conversely, the scenario could be favorable for ADA if Bitcoin maintains its upward momentum towards the halving event.

To underline his analysis, Gambardello drew parallels with Cardano’s historical performance, notably in November 2020, when Bitcoin’s bull market rally began. This approach sheds light on the intricate relationship between Bitcoin’s market behavior and the potential success of ADA in reaching its price goals.

Navigating Cardano Technical Indicators and Market Sentiment

If optimism prevails among investors, Cardano could first aim for the $0.8 resistance barrier. Positive market dynamics could propel ADA closer to the $0.9 mark shortly. Further amplification of bullish forces might see ADA reaching the $1 milestone ahead of Bitcoin’s next halving event. On the flip side, ADA could retreat to a support level of $0.55 if pessimism takes root. A deeper descent into bearish territory might push prices down to $0.50.

Cardano price chart: Tradingview

The landscape of daily technical indicators offers a varied view of the market’s direction. The Moving Average Convergence Divergence (MACD) suggests a positive trend is underway, with its MACD line and signal line both positioned above the baseline, signaling strength in the ongoing bullish trend. The Chaikin Money Flow (CMF) indicator indicates a positive trend at 0.15, hinting at bullish sentiments. Most oscillators maintain a neutral stance, indicating that a bullish breakthrough could be on the horizon.

Related Articles

- 5 Crypto To Buy Before The Next Bitcoin Halving In 2024

- Crypto Price Predictions for February 16 As MarketCap Teases $2 Trillion Mark: BTC, ADA, LINK

- Cardano’s Chang Hardfork & Plutus V3 Upgrade Set To Redefine ADA’s Future

Read the full article here