Solana price prediction: SOL, a blockchain ecosystem tailored for decentralized apps and cryptocurrency initiatives, is experiencing bullish momentum. The digital asset’s value is now lingering above the critical $115 resistance mark, following a market movement that suggests a pivotal shift could be bullish. At the time of reporting, Solana price is currently at $115, showcasing a growth of over 1% in the last day, a rise propelled by Bitcoin’s upward movement.

Solana Price Prediction: A Bullish Trend Amidst Market Optimism

This particular price point is teetering on the brink of the upper resistance line of its trading channel, which is mapped out between $115 and $117. Historically, this range has proven to be a tough hurdle, often leading to price declines after attempts to breach it. SOL has witnessed an impressive ascent of more than 20% in the preceding month, a testament to the increasing investor interest.

Solana Price Prediction

Within a remarkable week, Solana saw its price skyrocket by over 23%. This surge boosted its market valuation to $51.60 billion as of Wednesday, February 14, momentarily surpassing Binance Coin (BNB) with its $49.75 billion market cap. Despite a minor market adjustment, Solana has reclaimed its position as the fifth-largest cryptocurrency by market capitalization, currently at $50.66 billion.

Crypto analyst Rekt Capital recently shared insights on X, focusing on Solana’s (SOL) market movements. He highlighted that Solana is currently exhibiting an Ascending Triangle pattern. Interestingly, SOL managed to continue its upward momentum without significant dips.

$SOL

The path Solana could take to confirm a breakout from its Ascending Triangle#SOL #Solana #Bitcoin https://t.co/TLmc87rY7q pic.twitter.com/r7O242CEWA

— Rekt Capital (@rektcapital) February 15, 2024

According to Rekt Capital, if Solana can successfully sustain the triangle’s upper boundary as a support level, it would signify a confirmed breakout. Such a development could push its value past the $123 resistance mark, currently highlighted in black. This analysis offers a promising outlook for SOL, suggesting a bullish scenario if the technical conditions are met.

Solana Price Prediction: Technical Analysis and Future Prospects

If current positive trends in the market continue, SOL price could climb above the $115 mark. Market analysts suggest this could pave the way for an upward movement toward the $120 resistance zone. Further bullish behavior may challenge the higher resistance level at $130. Conversely, a shift toward bearish sentiment could see SOL retracting to the $100 support level, with potential declines extending to $90 if market conditions worsen.

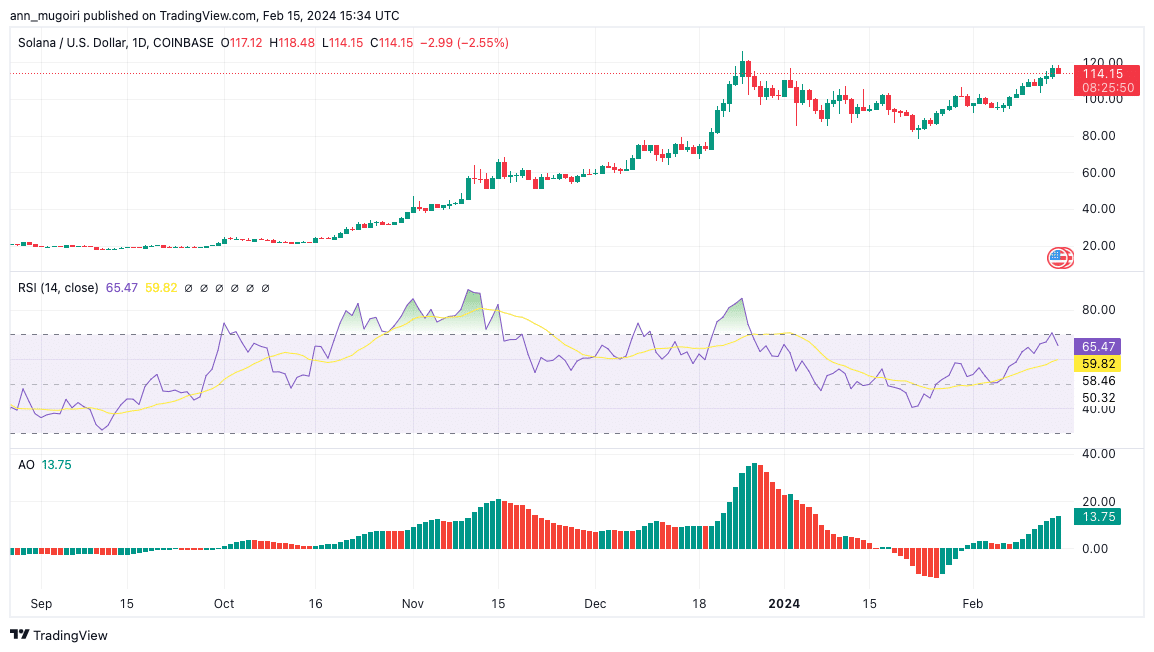

The daily trading technical chart analysis reveals encouraging signs for its near-term trajectory. The Moving Average Convergence Divergence (MACD) indicator shows optimistic signs. A significant bullish signal is noted as the MACD line has surpassed the MACD Signal line, indicating buy.

Solana Price Chart: Tradingview

The gap between these lines also widens, intensifying SOL’s upward trend. The market’s buying strength appears robust, as evidenced by the Relative Strength Index (RSI) moving above the 65 threshold. This indicates a prevailing buying momentum over selling pressure. Moreover, the Awesome Oscillator supports this positive outlook, displaying green bars, further confirming the market’s bullish sentiment.

Related Articles

- Solana Price Prediction: Why Buying SOL Is A Steal As Breakout To $140 Beckons

- Bitcoin Tops $52,000 – But Why Are These 5 Altcoins To Buy Soaring Even Higher?

- How Bitcoin Price 35% Monthly Surge Will Trickle Capital Down To Large And Low-Cap Altcoins

Read the full article here