In the financial world of market uncertainties, conservative investors seek sound portfolio advice to protect and grow their hard-earned money.

Looking for guidance, Finbold recurred to ChatGPT and asked artificial intelligence (AI) to build a portfolio for this profile.

In this experiment, we used an API for GPT-4 Turbo called NanoGPT, which allows for payments per prompt using cryptocurrency. The AI’s composition resonates with conservative investors’ ethos: capital preservation, reliable income, and tempered growth.

A sound portfolio for conservative investors

Top of the agenda for conservative investors is fixed-income securities, owning 60-70% of the portfolio’s landscape. ChatGPT anchors this portion with government bonds, earmarking 30-40% of the total investments. These securities are the bulwark against volatility, revered for their steadfastness in economic squalls.

The AI’s financial canvas adds texture with investment-grade corporate bonds, allocated 20-30%. They offer higher interest rates, yet the strategy cherry-picks only those with sterling credit ratings. Municipal bonds also find a niche, suggested at 5-10%, attractive for their tax efficiencies.

“Bonds provide stability and income. Within this category, a mix of government, high-quality corporate, and municipal bonds diversifies the risk and can take advantage of different tax treatments.”

– ChatGPT-4 Turbo

Further allocations for conservative investors

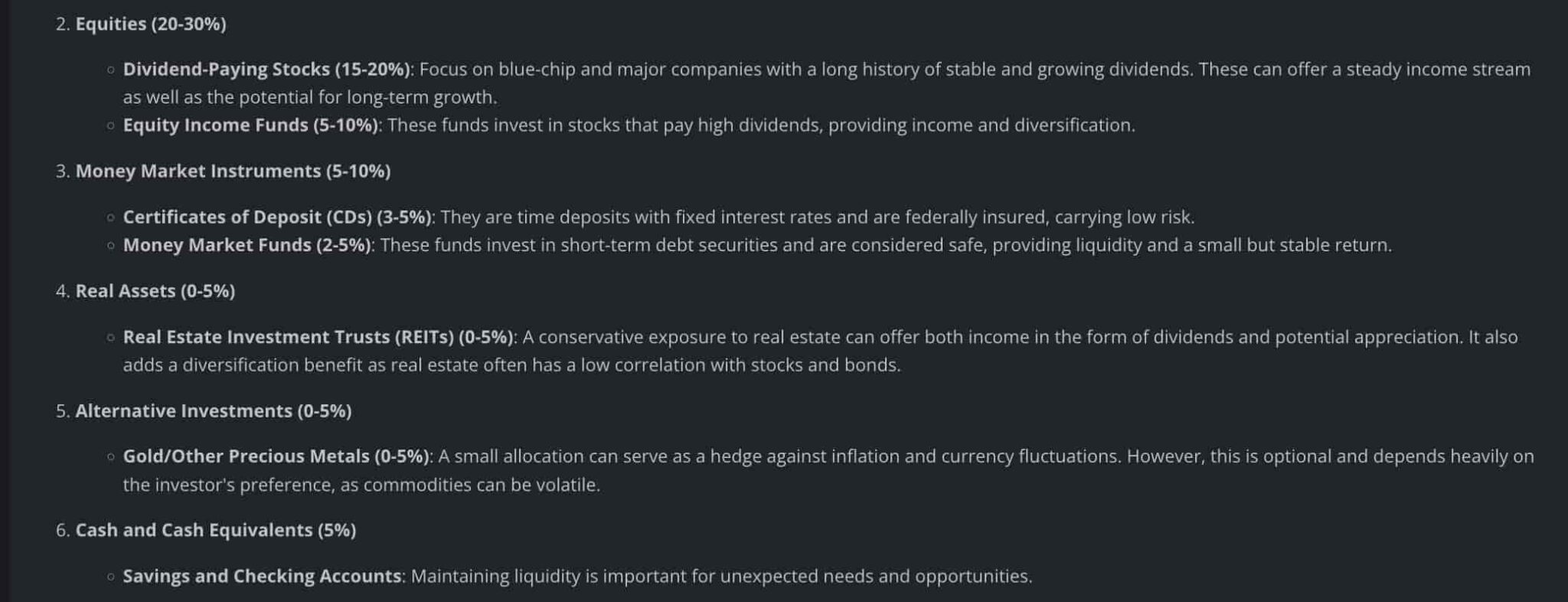

Nevertheless, conservatism doesn’t shun equity; it invites it with open arms, with a moderate allocation of 20-30%. Here, ChatGPT infuses the portfolio with blue-chip stocks, those dividend aristocrats that have stood the test of time and market whims. They comprise 15-20% of the total investment, touted for their dual allure of income and growth potential.

Equity income funds dash another 5-10% onto the palette, diversifying further while still chasing dividends.

“Stocks, specifically dividend-paying ones, are included to achieve some growth. However, they are less weighted than in aggressive portfolios.”

– ChatGPT-4 Turbo

The AI advisor doesn’t skip a beat on liquidity and safety, setting aside 5-10% for money market instruments. It splits between Certificates of Deposit and Money Market Funds, fortresses of security for the wary investor.

Real assets, though often sidelined, make a cameo at 0-5% of the portfolio. Specifically, it sketches a sliver for Real Estate Investment Trusts, balancing dividend appetite with a nod to capital appreciation. Nonetheless, the play is cautious, as ChatGPT recognizes these assets’ intricate dance with market trends.

Occasionally, conservative portfolios flit with the exotic. Here, alternative investments like precious metals hold a tentative spot, a mere 0-5%, as potential inflation shields. And for the finale, cash. The purest form of liquidity, making up 5%, ready for use at a moment’s notice.

This AI-generated portfolio is not a set-it-and-forget-it affair. ChatGPT underlines the importance of personalization, regular rebalancing, and the need for a human financial advisor’s touch, especially for conservative investors who value “making sure” above the easy route for astounding results.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here