Good fundamental cryptocurrencies with lower market caps can present appealing risk-reward potential in the constantly evolving crypto ecosystem. In this article, Finbold has picked three assets that could reach $10 billion in market value in 2024.

However, it is important to understand that the following cryptocurrencies are either experimental projects or require specific conditions to grow. Specifically considering the regulatory environment.

For this list, we looked at fundamental aspects of these projects, including decentralization, security, utility, and competitive advantages against higher capitalized coins.

Monero (XMR) could reach a $10 billion market cap

In particular, Monero (XMR) is a $2.18 billion market cap cryptocurrency despite being one of the most solid projects. This is the leading native-privacy coin in the market, with an innovative, fully decentralized technology already proven over the years.

Nevertheless, Monero is facing huge regulatory pressure, resulting in over 23% losses in the last 30 days. Trading at $118.5 by press time, with a monthly volume of $3.09 billion – 50% superior to its capitalization. This recent sell-off mostly occurred after Binance’s delisting announcement.

Now, Monero will go through the biggest resilience test of its history after losing the largest centralized crypto exchange. Thus, surviving through increased usage and decentralized exchange solutions could fuel the privacy coin to higher grounds in 2024.

A run to a $10 billion market cap would result in nearly 360% gains from current prices. This is supported by Monero’s low and predictable supply inflation of less than 1% per year.

On the other hand, the lack of liquidity is a huge challenge to overcome. This forecast depends on positive developments by the Monero community and user base.

THORChain (RUNE) for decentralized exchange solutions

In the meantime, THORChain (RUNE) could prove itself to be an important ally to Monero’s success in 2024. This cross-chain protocol focused on interoperability and decentralized exchange has relevant potential for the year.

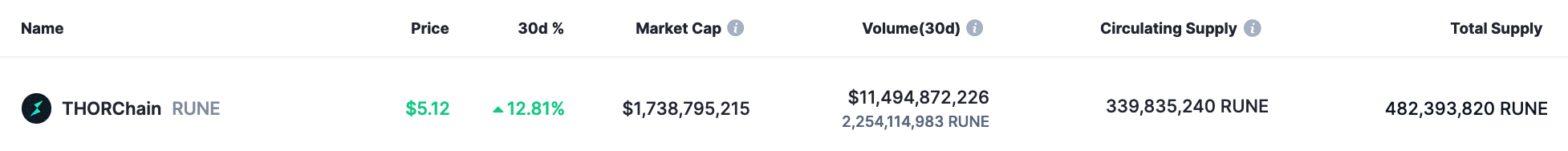

The native token, RUNE, currently trades at $5.12 with a market cap of $1.74 billion. Notably, RUNE is up 12.8% in the last 30 days with a gigantic monthly volume of $11.5 billion.

As regulatory scrutiny pressures centralized exchanges, cryptocurrency investors might start looking for alternatives on Binance and other major markets. This is when THORChain could shine and attract enough capital to grow.

A run to a $10 billion market cap would result in nearly 475% gains from the current market cap. However, RUNE is still fairly inflationary, which might affect these gains’ realization on price.

Can Maker (MKR) reach a $10 billion value?

Lastly, Maker (MKR) also shows relevant potential for a surge in 2024, considering the overall regulatory scenario. Maker is an Ethereum-based protocol that supports the decentralized and overcollateralized stablecoin DAI.

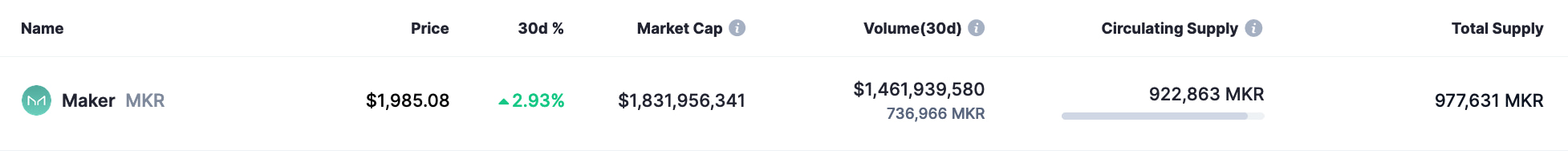

MKR is the protocol’s governance token, valued at $1.83 billion and currently priced at $1,985 per token.

A run to a $10 billion market cap would result in over 465% gains from the current market cap. However, MKR is known for performing under unfavorable circumstances for other cryptocurrencies, usually surging during bear markets. Therefore, this also makes the Maker token a valuable hedge to consider.

Similar to our selection of two cryptocurrencies with the potential to reach a $1 billion market cap in 2024, these cryptocurrencies may not deliver the forecasted scenario unless they manage to acquire meaningful adoption and usage.

All things considered, investors must always do proper risk management and research when investing in the cryptocurrency market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here