The XRP Ledger blockchain has recently integrated a new amendment, dubbed Clawback (XLS-39), enabling issuers to reclaim tokens distributed to accounts. While this update has sparked various discussions within the XRPL community, one notable conversation revolves around the concept of a “Clawback-enabled tokenomics” proposed by Neil Hartner, a senior staff software engineer at Ripple.

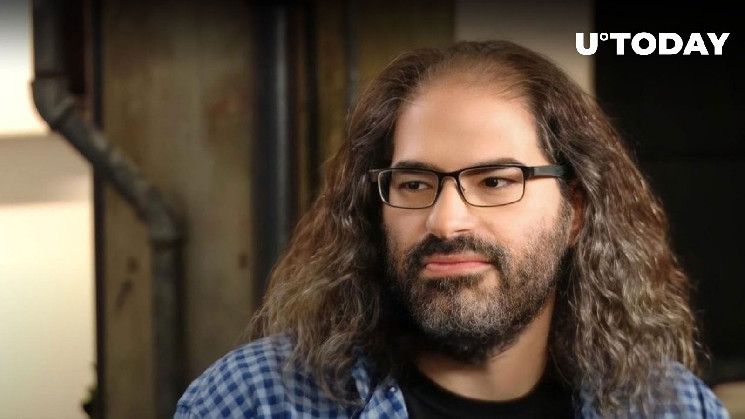

Hartner suggested the creation of a Robinhood (RHD) token, envisioning a redistribution of tokens from the top 10% holders to the bottom 90% at random intervals. However, Ripple CTO and co-creator of the XRP Ledger, David Schwartz, expressed skepticism toward this idea, stating sarcastically, “I love that idea.”

Adding to the discourse, XRPL developer Wietse Wind questioned the necessity of accumulating large amounts of such a token, drawing parallels to the ethos of the legendary Robin Hood. Wind implied that a true Robin Hood token, like its namesake, would inherently possess value to its users, eliminating the need for excessive hoarding.

Schwartz echoed Wind’s sentiment, suggesting that individuals desiring substantial holdings of the token could easily distribute them across multiple accounts, thereby circumventing the proposed clawback mechanism.

Use authorized trust lines so people can’t just create accounts on their own.

— Neil Hartner (@illneil) February 9, 2024

In essence, the debate surrounding the feasibility and desirability of Hartner’s proposition underscores broader questions about the effectiveness and practicality of implementing clawback mechanisms within token ecosystems.

Ripple CTO David Schwartz elucidated the shortcomings of the Robinhood token concept, emphasizing the potential for users to game the system and the fundamental necessity for tokens to derive their value intrinsically.

Read the full article here