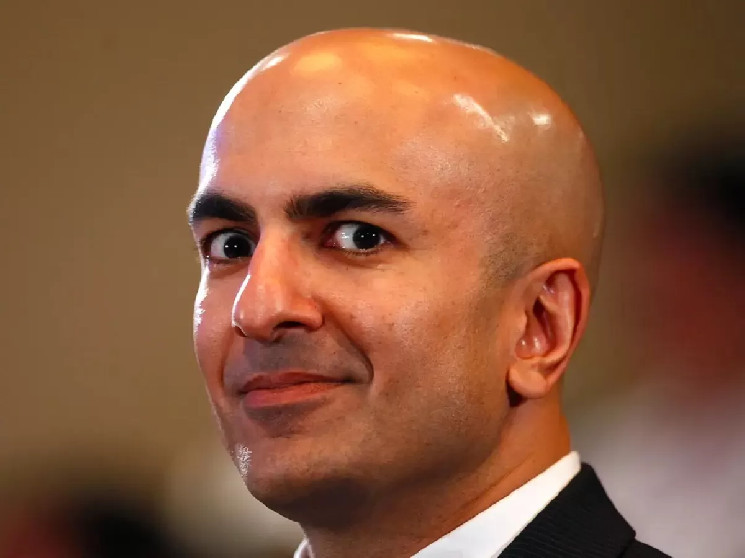

While the Bitcoin halving, which is expected to take place in April, and the FED’s interest rate cuts are expected as an upward catalyst after the approval of the spot ETF in the Bitcoin and cryptocurrency markets, new statements came from FED member Neel Kashkari.

Speaking to CNBC’s Squawk Box program, Minneapolis FED President Neel Kashkari stated in his statement that, considering the current economic data, the FED should reduce the policy rate 2-3 times in 2024.

“As I sit here today, I can say that 2-3 interest rate cuts would be appropriate for me right now.

I say this based on the data we have accumulated so far.

We just need to look at actual inflation data to guide us.

So far the data is extremely positive. I hope it continues. The real question then will be: At what pace do we start lowering rates?

If we can see a few more months of better inflation data, it will give us confidence that we are on track to return to the 2% target.

I would like to point out here that the pace of potential interest rate cuts will depend on labor market conditions.

If the employment market remains strong, interest rate cuts could be implemented more slowly and gradually. “Conversely, if there is a significant economic downturn, it will require a faster response.”

While it is expected that there will be an increase in BTC and cryptocurrencies with the FED starting to reduce interest rates, May is pointed out for the first interest rate reduction.

As you may remember, FED President Jerome Powell stated in his recent statements that a rate cut in March is “unlikely”.

Because in his statement, Powell said, “We said that we wanted to be more confident that inflation would fall to 2%. I think it is unlikely that this committee will reach that level of confidence until its March meeting, which is seven weeks away. However, we will not wait for inflation to reach 2% to reduce interest rates.” he said.

*This is not investment advice.

Read the full article here