Following the market’s stabilization after the post-ETF sell-off, most leading cryptocurrencies have experienced a significant rebound over the past two weeks. Amid this positive turn, LINK, the native token of the decentralized oracle network Chainlink, has significantly outshined its counterparts, registering a 35% increase in the last eight days. With market participants eagerly anticipating the first wave of an Altcoin rally, there’s growing speculation on whether the Chainlink price will continue its upward trajectory beyond the $30 threshold.

Is Chainlink Price Ready to Escape 3-Month Consolidation?

- A bullish breakout from the Channel pattern will release the build-up buying momentum

- The development of the Cup and Handle pattern encourages further growth in the LINK price

- The intraday trading volume in the LINK coin is $1.6 Billion, indicating a 43% gain.

Chainlink Price| TradingView Chart

The Chainlink price had been an underperforming asset for nearly three months, wobbling between two diverging trendlines of expanding channel patterns. While the sideways action may bore the retail trader, the smart money participants were actively accumulating this asset as Coingape mentioned in its previous analysis.

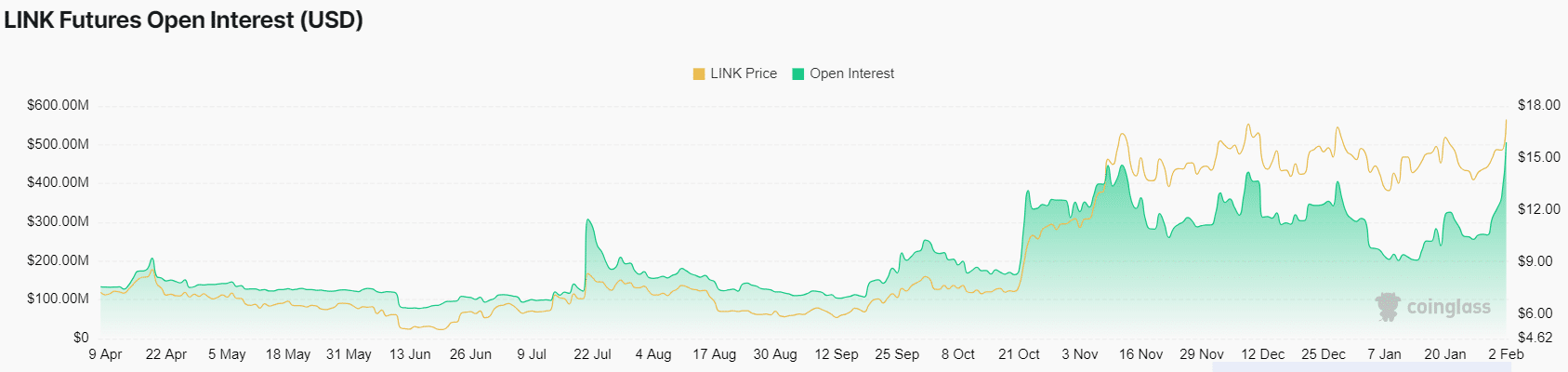

With the renewed buying pressure in the crypto market, the LINK price showcased its suitability above $13.6 and surged a recovery to a new yearly high of $18.34. In tandem with the price recovery, The value of open futures contracts linked to LINK surged from $256M to a current high of $506M. This notable growth in open interest indicates a substantial influx of new capital into the market.

LINK Futures Open Interest (USD)| Coinglass

With an intraday high of 6.73%, the buyers currently challenge the upper boundary of the channel pattern. With a successful bullish breakout, the bullish momentum will accelerate and chase a potential target of $24.5, followed by $28.7.

Having said that, the Chainlink price may consolidate above the recently reclaimed $17.5 for the coming week and stabilize the price trend for future growth.

LINK Price Set For a Crucial Weekly Close?

Chainlink price| TradingView Chart

A look at the weekly time frame chart shows the recent price surge has breached the neckline resistance of the Cup-and-Handle pattern. This pattern commonly spotted at the bottom of major downtrends reflects a potential for trend reversal. If the weekly candle closes above the $17.5 neckline, the buyers will get a suitable launch pad to aim for $30 potential.

- Bollinger Band: The upswing in the upper boundary of the Bollinger band is a sign of active buying of this asset.

- Average Directional Index: The ADX uptick at 15% hints the buyers managed to regain its strength during the recent consolidation.

Related Articles:

- Top 3 Altcoins To Buy Today February 2: Solana (SOL), Chainlink (LINK), Jupiter (JUP)

- Chainlink Price Prediction: Will $LINK Consolidation Fuel a Rise to $25?

- Chainlink (LINK) Price Surges 6.5% Eyeing A Potential Rally to $25-$30

Read the full article here