(Bloomberg) — Asian stocks were set to open lower as fresh doubts emerged on whether the Federal Reserve has finished with rate hikes, with Wall Street shares struggling to gain much traction amid a rise in bond yields.

Most Read from Bloomberg

Futures point to early losses on Japan and Hong Kong share markets after the S&P 500 edged slightly higher on Monday, while Australian stocks opened down. A reversal of the moves in bonds weighed on sentiment, with 10-year yields up eight basis points amid a heavy slate of corporate debt sales and ahead of a series of auctions beginning Tuesday.

Wall Street’s Monday malaise came after it notched its best week of 2023 amid dovish Fed bets, oversold technical levels and positioning. Traders are now predicting the central bank will lean against the recent easing in financial conditions by saying it will keep its options open on policy. US equity futures were slightly lower in early trading.

In Asia, attention will turn to Australia’s central bank which is forecast to end a four-meeting pause by raising interest rates as broader economic resilience suggest a further clampdown is needed to cool prices. Meanwhile, China is due to release key trade data that will provide clues on whether the world’s second-biggest economy is emerging from its post-pandemic torpor.

A raft of Fed officials — including Chair Jerome Powell — are due to speak over the next few days. Swaps are pricing in more than 100 basis points of rate cuts by the end of 2024 from an expected peak rate of 5.37%. On Monday, investors also waded through the Senior Loan Officer Opinion Survey — known as SLOOS — which showed tighter standards and weaker demand persist at US banks.

Read: Winner-Take-All Rally Spurs Big Distortion Among S&P 500 Members

“There may be a reality check ahead on the Fed,” said David Donabedian, chief investment officer of CIBC Private Wealth US. “We expect the rest of the year to be volatile, going through ‘manic-depressive swings’ based on where interest rates are headed.”

Is This Rally Real? Alas, BNY Mellon’s Yu Says No: Surveillance

To Chris Larkin at E*Trade from Morgan Stanley, the question on whether the market momentum can be sustained comes down to upcoming economic numbers continuing to point in the same direction as last week’s jobs report, which showed the labor market slowed in October.

“If that cooling trend persists, bulls may embrace the idea that the Fed will grow less hawkish,” Larkin noted. “Regardless, the market has a tendency to pull back in the short term, at least temporarily, after exceptionally big moves like the one that unfolded last week.”

Testing Technicals

The S&P 500 currently sits at 4,365.98 — and chartists are monitoring the 4,355 level, which marks a 50% retracement from the peak-to-trough decline from its July highs to October lows. If it holds above that, the 4,400 level, where the index hovered during its mid-October highs, is the next number to watch, according to Keith Lerner, co-chief investment officer at Truist Advisory Services.

“To reverse this downtrend, the S&P 500 still needs to break above 4,400,” said Lerner, whose firm is overweight US stocks.

The S&P 500’s best week in a year was just a bear-market rally, according to Morgan Stanley’s Michael Wilson. Citing a gloomy earnings outlook, weaker macro data and deteriorating analyst views, “we find it difficult to get more excited about a year-end rally,” he added.

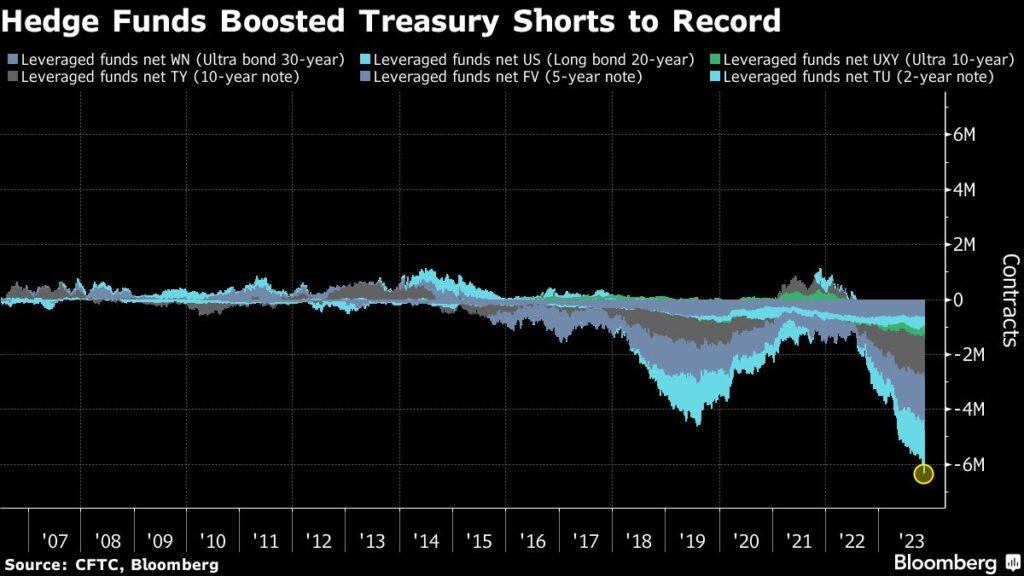

Yields on 10-year Treasuries have tumbled since their 5.02% peak on Oct. 23 as traders for the $26 trillion bond market swung back to pricing the end of rate hikes. The combination of more benign US refunding needs, weaker-than-expected jobs data and signs of the Fed turning less hawkish may have spurred widespread covering of short positions.

Leveraged funds ramped up net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the Commodity Futures Trading Commission figures as of Oct. 31. The bets persisted even though the cash bonds had rallied the week before.

Elsewhere, oil slightly gained in Asian trading after Saudi Arabia and Russia reaffirmed they will stick with oil supply curbs of more than 1 million barrels a day through the end of the year. Gold was steady after declining Monday.

Corporate highlights:

-

Dish Network Corp. plunged to the lowest level in 25 years after posting third-quarter earnings that fell well below Wall Street’s expectations and reporting steep customer losses.

-

Tesla Inc. will produce a new model that will cost €25,000 ($26,863) at its factory near Berlin, Reuters reported, as competition intensifies to produce more affordable electric vehicles for the European market.

-

Tyson Foods Inc., the largest US meat producer, is recalling almost 30,000 pounds (13 metric tons) of chicken nuggets aimed at children due to possible contamination with metal pieces.

-

Berkshire Hathaway Inc.’s cash pile scaled a fresh record at $157.2 billion, bolstered both by elevated interest rates and a dearth of meaningful deals where billionaire investor Warren Buffett could put his money to work.

-

Bumble Inc. Chief Executive Officer Whitney Wolfe Herd will step down from the company she founded nearly 10 years ago.

-

Ryanair Holdings Plc will pay out a dividend of €400 million ($430 million) and plans to hand over about a quarter of annual profit to shareholders as Europe’s biggest discount airline benefits from growing traffic.

Key events this week:

-

Australia rate decision, Tuesday

-

China trade, forex reserves, Tuesday

-

Eurozone PPI, Tuesday

-

US trade, Tuesday

-

UBS earnings, Tuesday

-

Kansas City Fed President Jeff Schmid and his Dallas counterpart Lorie Logan speak, Tuesday

-

Eurozone retail sales, Wednesday

-

Germany CPI, Wednesday

-

BOE Governor Andrew Bailey speaks, Wednesday

-

US wholesale inventories, Wednesday

-

New York Fed President John Williams speaks, Wednesday

-

Bank of Japan issues October summary of opinions, Thursday

-

BOE chief economist Huw Pill speaks on the economy, Thursday

-

US initial jobless claims, Thursday

-

Fed Chair Jerome Powell participates in panel on monetary policy challenges at the IMF’s annual research conference in Washington, Thursday

-

Atlanta Fed President Raphael Bostic and his Richmond counterpart Tom Barkin speak, Thursday

-

UK industrial production, GDP, Friday

-

ECB President Christine Lagarde participates in fireside chat, Friday

-

US University of Michigan consumer sentiment, Friday

-

Dallas Fed President Lorie Logan and her Atlanta counterpart Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 8:23 a.m. Tokyo time. The S&P 500 rose 0.2%

-

Nasdaq 100 futures fell 0.2%. The Nasdaq 100 rose 0.4%

-

Hang Seng futures fell 0.7%

-

Australia’s S&P/ASX 200 fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0721

-

The Japanese yen was little changed at 149.96 per dollar

-

The offshore yuan was little changed at 7.2849 per dollar

-

The Australian dollar was little changed at $0.6490

Cryptocurrencies

-

Bitcoin fell 0.1% to $34,984.23

-

Ether rose 0.3% to $1,897.61

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here