This week’s economic calendar is another busy one with a Federal Reserve decision on interest rates due, setting the tone for future cuts. Moreover, crypto markets have rebounded recently, but will this week’s economic events halt their progress?

The big event in this week’s economic calendar is the US central bank’s rate-setting policy meeting on January 31.

Interest Rate Impact

Consumer confidence reports are due on Tuesday, January 30. They are expected to be marginally better than the previous month. Consumer spending accounts for around 70% of US economic activity, so economists pay close attention to gauge how it may affect the broader economy.

Additionally, the Labor Department releases its December data on US job openings on Tuesday.

However, all eyes are on Jerome Powell and the Federal Reserve on Wednesday. He is due to speak at a press conference. The central bank is expected to hold its key short-term rate steady at a 22-year high of 5.25% to 5.5% for a fourth straight meeting.

This week’s economic calendar: X/@martkets_bot

Some analysts think that the Fed will begin lowering the benchmark rate as soon as March. Therefore, it could signal its intentions after this week’s meeting.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

In a note to clients, Goldman Sachs economist David Mericle wrote,

“The (Fed) will likely aim to keep a March cut on the table without sending a decisive signal.”

Meanwhile, Andrew Slimmon, senior portfolio manager at Morgan Stanley Investment Management, said that he’s expecting Powell to be “patient” regarding rate cuts.

“That’s because, as he sees it, the economy appears strong and the Fed has time to be patient and make sure the true secular trend in inflation is lower.”

According to reports, markets are projecting six rate drops in 2024, ranging from 3.75% to 4%, double the amount forecast by the Fed last month.

Nevertheless, the consumer price index, which is a broad measure of inflation, increased above the Fed’s target last month. With the specter of inflation yet to be vanquished, the Fed may keep those rates higher for longer.

Crypto Market Impact

High-interest rates are generally not great for crypto markets. Savers can earn good returns on safe investments such as cash deposits, and debt repayments are usually higher. This means less money available for high-risk investments such as crypto.

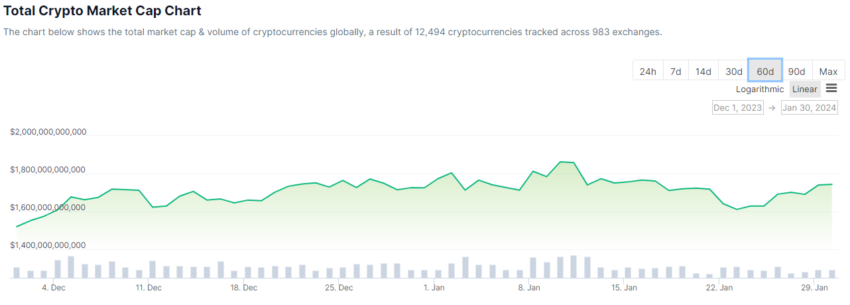

Crypto markets have rebounded 2.8% on the day to reach $1.75 trillion at the time of writing.

Total crypto market cap. Source: CoinGecko

Bitcoin is leading the pack with a 2.6% rise to $43,533, while Ethereum has made 1.7% to reach $2,313.

Other altcoins making solid gains at the moment include Solana with 5.3%, Cardano at 7.6%, and Dogecoin topping 3% on the day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here