Bitcoin continues to trade sideways around the $40,000 mark with little to no actual movements over the past 24 hours.

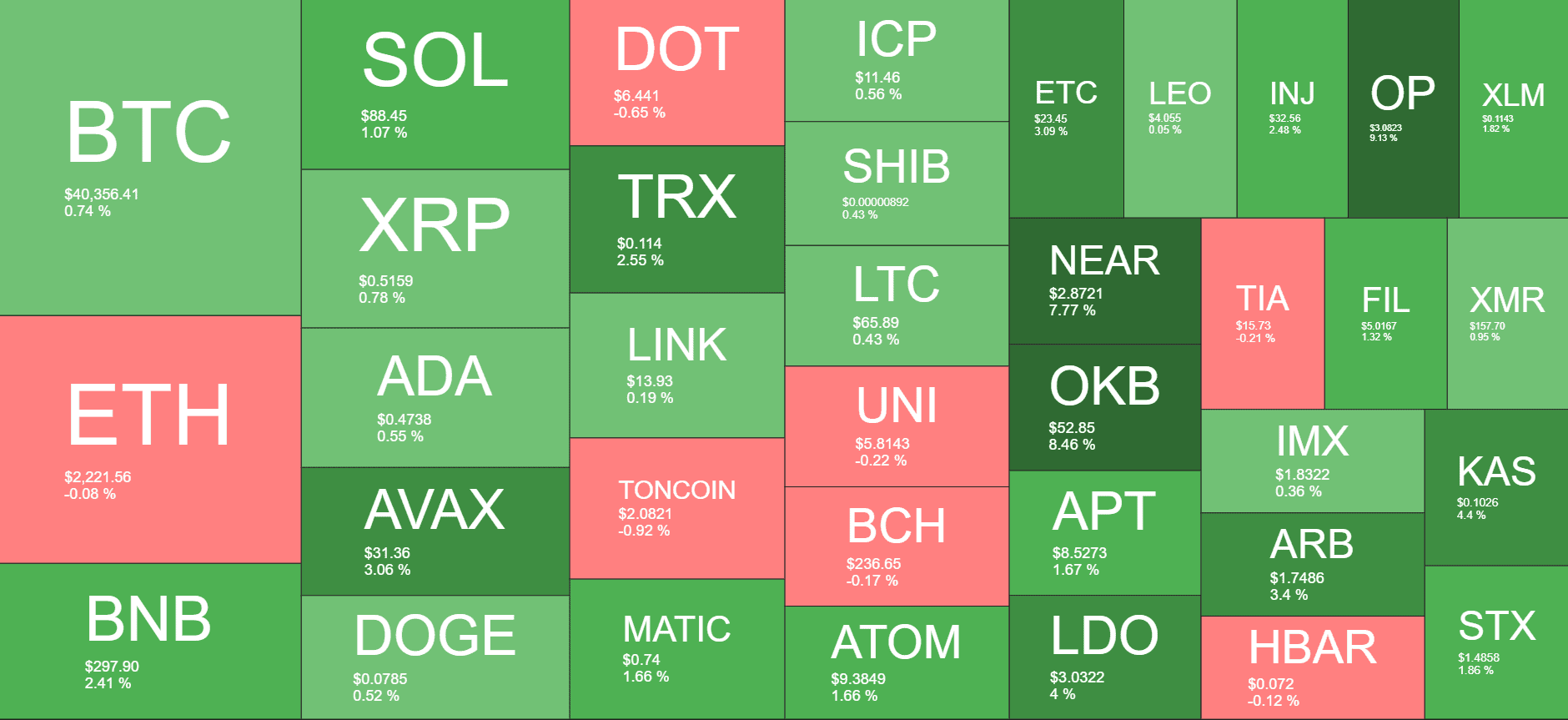

The alternative coins are in a similar state. There are only a few notable gainers within this time frame, including OKB, NEAR, and OP.

BTC Stagnates

The primary cryptocurrency faced enhanced volatility two weeks ago when the SEC finally greenlighted spot Bitcoin ETFs to reach the US markets. There were numerous pumps and dumps by several thousand dollars.

However, the landscape started to change when that weekend arrived, with BTC standing close to $43,000 back then. The next week or so was quite uneventful.

Last weekend is when Bitcoin started moving again, but in the wrong direction. It dropped by a few grand on Monday and even further on Tuesday. In fact, the asset slumped to a multi-month low of $38,500.

It managed to bounce off and jump to $40,000 in the following days and has failed to make a big move ever since then. The past 24 hours didn’t bring any noteworthy price movements either, and the cryptocurrency remains still at $40,000.

Its market cap is still below $790 billion, while its dominance over the alts is at 50.5% on CMC.

Alts Are Quiet

Although the alternative coins are known for their volatile price movements, this hasn’t been the case in the past few days, and the last 24 hours are no different. There are some minor gains charted by the likes of BNB, SOL, XRP, ADA, DOGE, and LINK. Avalanche and Tron have jumped the most from this cohort of alts, by around 3%.

ETH, DOT, and TON are with insignificant losses within the same timeframe.

The most substantial price increases come from OP, OKB, and NEAR. All of these have jumped by somewhere between 8% and 9%. As a result, OP sits above $3, OKB is north of $50, and NEAR is close to $2.9.

The total crypto market cap has maintained its position from yesterday and is over $1.550 trillion on CMC.

Read the full article here