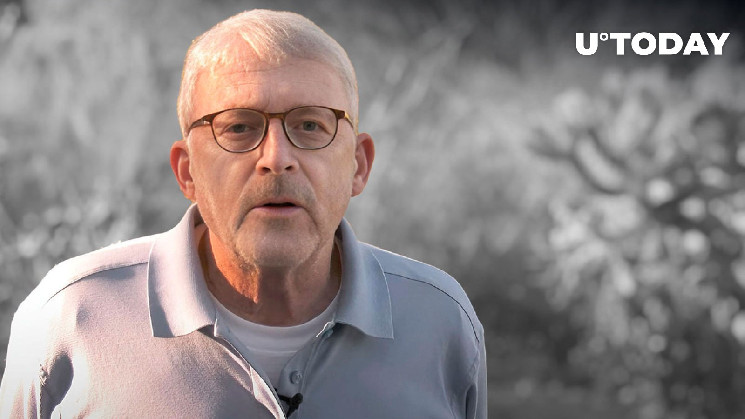

Renowned trader Peter Brandt recently took to X to share valuable insights and dispel common myths surrounding crypto trading success.

In a series of posts, Brandt’s valuable experience spanning decades in traditional markets and adapting to the crypto space provides a unique perspective on what it takes to thrive in this volatile environment.

Peter Brandt dispels myth of quick gains

Brandt began by addressing the common misperception of making large profits quickly in the crypto trading community. He noted that those who accumulate wealth rapidly often fall victim to bad habits and may eventually lose everything they gained through sheer luck.

Brandt emphasized the importance of time and experience in achieving success as a trader. According to him, it takes three to five years of being slapped around by the market before gaining enough knowledge and competence to succeed. Drawing from his history, Brandt revealed that it was not until 1979, five years after his first futures trade in 1974, that he felt halfway competent enough to trade successfully.

There is a VERY unfortunate reality in the business of market speculation

People who make ton of $$ very quickly (like in crypto) develop bad habits and often lose everything they made via luck

And, most others who begin trading wipe out before they before they learn enough to be… https://t.co/m4mCZQa6TF— Peter Brandt (@PeterLBrandt) January 24, 2024

In a previous post, Brandt likened market speculation to a marathon, debunking the myth that trading is a sprint. He explained that long-term success is built gradually, much like assembling a mosaic. The urge to make quick profits, he warned, often leads to predictable and unfavorable outcomes. Brandt’s emphasis on patience and endurance underscores the importance of adopting a measured and sustainable approach to trading.

In a world where instant gratification is often sought, Brandt’s perspective serves as a reality check for those entering the crypto trading space. The importance of perseverance and continuous learning cannot be overstated, as gaining traction in the market requires time and resilience.

Role of self-knowledge in successful crypto trading

In an earlier report, Brandt stressed the limited contribution of technical analysis, indicators and global macro fundamentals to trading profitability.

Instead, he highlighted the paramount importance of self-awareness and understanding the ways emotions can sabotage trading decisions. “Knowledge of self and the ways our emotions sabotage us at every turn – this is the beginning of profitable market speculation. Know thyself,” he advised.

Read the full article here