Chainlink (LINK) has maintained sideways price actions over the past three months, with unclear directional bias. Meanwhile, the declined momentum highlights potential retracement before possible surges. The altcoin hovers within the $14 vicinity at press time, following an 11% price dip over the past week.

LINK 7D Chart on Coinmarketcap

Chainlink’s prolonged price consolidation

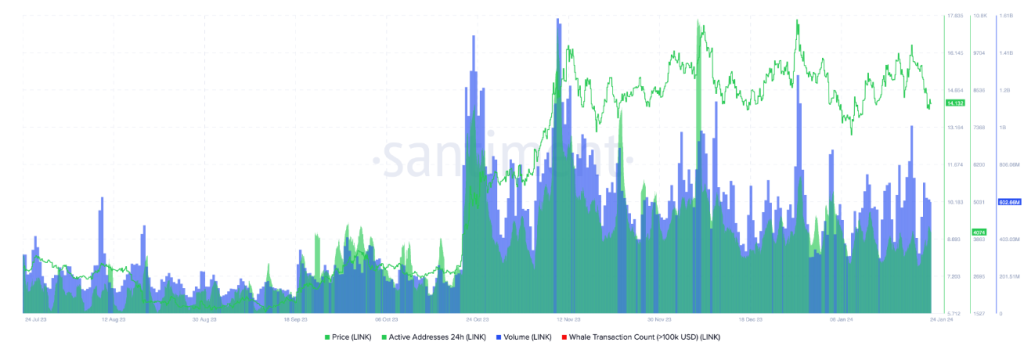

Chainlink flourished between 19 October and 9 November 2023, with prices soaring 125% within three weeks. That saw LINK forming a local high at $16.60. However, the alt could not sustain the uptrend and lost 22% to the range’s lower limit at $12.87.

Since then, Chainlink has touched the local top twice, with the latest retest of 19 January leading to an 18% dip to press time levels just above $14.

On-chain indicators highlight plunging interest

Santiment data indicates that Chainlink has recorded significant declines in active addresses since November 2023. The network’s 24-hour active users plummeted from around 9.7K to 4K in less than 90 days. Further, on-chain volume dipped to 0.60 million from 1.60 billion within that timeframe.

Source – Santiment

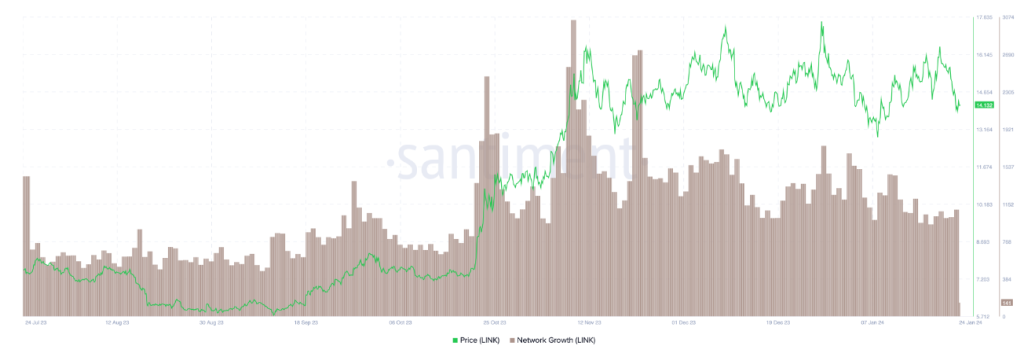

Also, the Network Growth indicator flashed similar trends. The metric tracks new wallets joining the blockchain, and it has dipped to 1,100 from 3,000 within three months.

LINK price and Network Growth Trends on Santiment

Indeed, on-chain metrics confirm faded investor interest in Chainlink since LINK dipped into consolidation. That magnifies the chances of probable sell-offs, and the crypto market’s current outlook supports such a narrative.

LINK bulls should ensure a massive closing beyond the $16.60 range high amid friendly market condition to boost investor enthusiasts with solid price revivals.

The post Chainlink (LINK) experiences dwindling investor interest amid prolonged consolidation appeared first on Invezz

Read the full article here