© Reuters.

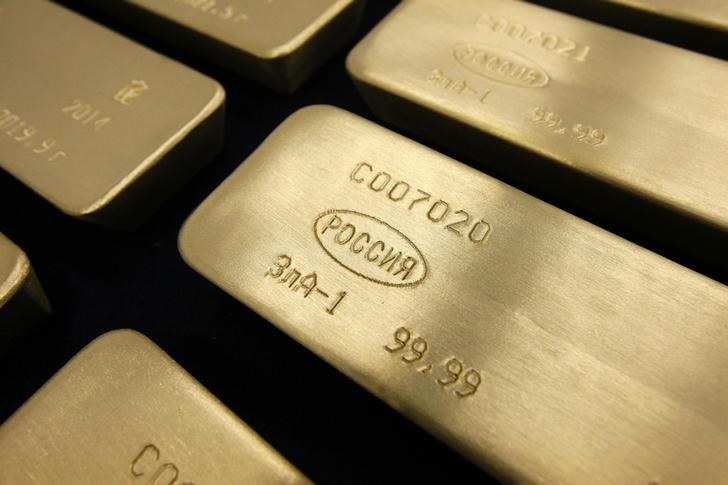

NEW YORK – Gold prices demonstrated a slight increase in the face of a declining U.S dollar, with rising to $2,026.95 per ounce, while also experienced a rise, closing on COMEX at $2,028.60 per ounce. The precious metals market also saw both platinum and silver experiencing an uptick in value, with silver reaching $22.47 an ounce.

Market participants are keenly awaiting the release of several key U.S economic indicators. The flash Purchasing Managers’ Index (PMI) is due out today, while the fourth quarter Gross Domestic Product (GDP) figures and personal consumption data are expected to be released tomorrow. These indicators are anticipated to provide valuable insights into the health of the US economy and potentially influence the Federal Reserve’s stance on interest rate policies.

According to the CME’s FedWatch Tool, no immediate changes to the Federal Reserve’s interest rate policies are anticipated at the upcoming meeting set for January 30-31. Meanwhile, the European Central Bank (ECB) is also predicted to maintain its policy stance during its discussion set for Thursday.

In contrast to gold, platinum, and silver, palladium experienced a slight drop in its value. However, overall, the precious metals market showed stability as investors held their positions in anticipation of these upcoming economic data releases.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here