Cardano Price Prediction: ADA closed out 2023 with a significant rise, soaring towards $0.70 before plummeting back to $0.47 on January 8. This decline, while sharp, was within market expectations. Despite this setback, market analysts remain optimistic about Cardano’s potential for growth in the short term. Presently, ADA oscillates between $0.47 and $0.57 over the past week, with bears appearing to have a slight edge.

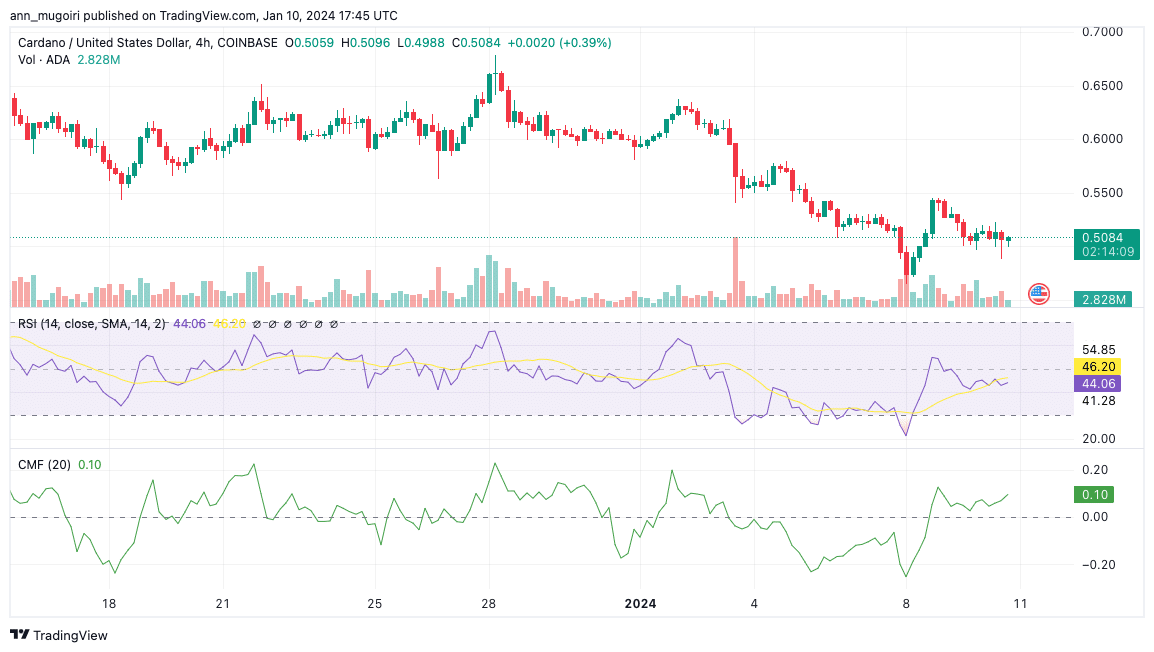

Source: Tradingview

Cardano’s future trajectory hinges on pivotal resistance and support levels. A decisive break above $0.57 could ignite a rally, potentially propelling the price toward the $0.6 mark. Further upward momentum could stretch to $0.65. Conversely, failing to surpass the $0.545 barrier might trigger a decline. The first key support lies at $0.5, followed by a significant one at $0.465. A breach below this could lead to a test of the $0.432 level, with $0.42 emerging as the subsequent crucial support.

Crypto expert Ali has recently identified a significant buy signal on Cardano’s daily chart, attributing this to ADA’s interaction with the critical 0.618 Fibonacci retracement level. This development has sparked optimism in the crypto community, with Ali projecting that maintaining this momentum could see Cardano break through the $0.55 resistance barrier. He further speculates that such a breakthrough might set the stage for ADA to reach loftier heights, targeting $0.69 and potentially escalating to $0.93.

A promising buy signal emerged on #Cardano daily chart, following a recent touch of the 0.618 Fibonacci retracement level!

Should this signal hold true, $ADA could break past the $0.55 resistance, potentially paving the way to higher targets at $0.69, and possibly even reaching… pic.twitter.com/t2H9IvO9Ea

— Ali (@ali_charts) January 10, 2024

In the current market scenario, a surge to the $0.93 mark would represent an impressive 82% increase from Cardano’s present value. As of this report, Cardano price has seen a 0.91% decline over the last 24 hours, hovering around $0.5039. The 24-hour trading volume for ADA is currently at $646 million, indicating a growing level of interest and activity in Cardano’s market. Despite being the 8th largest cryptocurrency by market capitalization, Cardano’s chart paints a predominantly red picture.

Cardano Technical Indicators and Future Outlook

In the latest ADA/USD analysis, the Moving Average Convergence Divergence (MACD) on the four-hour chart exhibits a waning momentum within the bearish territory. The MACD and signal lines are below zero, reinforcing the ongoing bearish trend. The 50- Exponential Moving Averages(EMA) slope at $0.5215 provides additional pullback support to buyers.

Currently, ADA is trading under the $0.570 level, struggling beneath the 100 simple moving average (SMA) for the same four-hour span. Furthermore, the downtrends of both the 50 SMA and the 100 SMA signal a potential sell-off in the market.

ADA/USD 4-hour price chart, Source: Tradingview

Conversely, the four-hour Relative Strength Index (RSI) for ADA/USD, presently below the 50 mark, hovers in a neutral zone. This suggests that the RSI could plunge into the oversold territory if the bearish pressure persists. However, if the bulls return, RSI could propel above the 70 mark, entering the overbought domain. Reinforcing this optimistic outlook is the Chaikin Money Flow (CMF) on the four-hour chart, which currently stands at 0.10 in the positive area, hinting at a potential bullish resurgence soon.

Related Articles

- US SEC Faces Massive Backlash Over Fake Spot Bitcoin ETF ‘Approval’ Post

- Crypto Rally: Whales Accumulate 1 Bln DOGE & Trillions Of SHIB, Bull Run Ahead?

- Bitcoin ETF News LIVE Updates: ARK 21Shares & Others Receive CBOE Approval, SEC Greenlight Awaited

Read the full article here