Bitcoin (BTC) reached a new multi-year high at $47,281 on January 8, 2024. Following its leadership, some cryptocurrencies have traded at higher prices and are threatening a retracement.

While most people wait for good price performance to deploy capital into a given cryptocurrency, smart money avoids trading overextended speculative assets as part of a good risk management strategy.

Interestingly, investors can find cryptocurrencies to avoid trading this week using fundamental and technical analysis. In particular,‘overbought’ coins according to the Relative Strength Index (RSI).

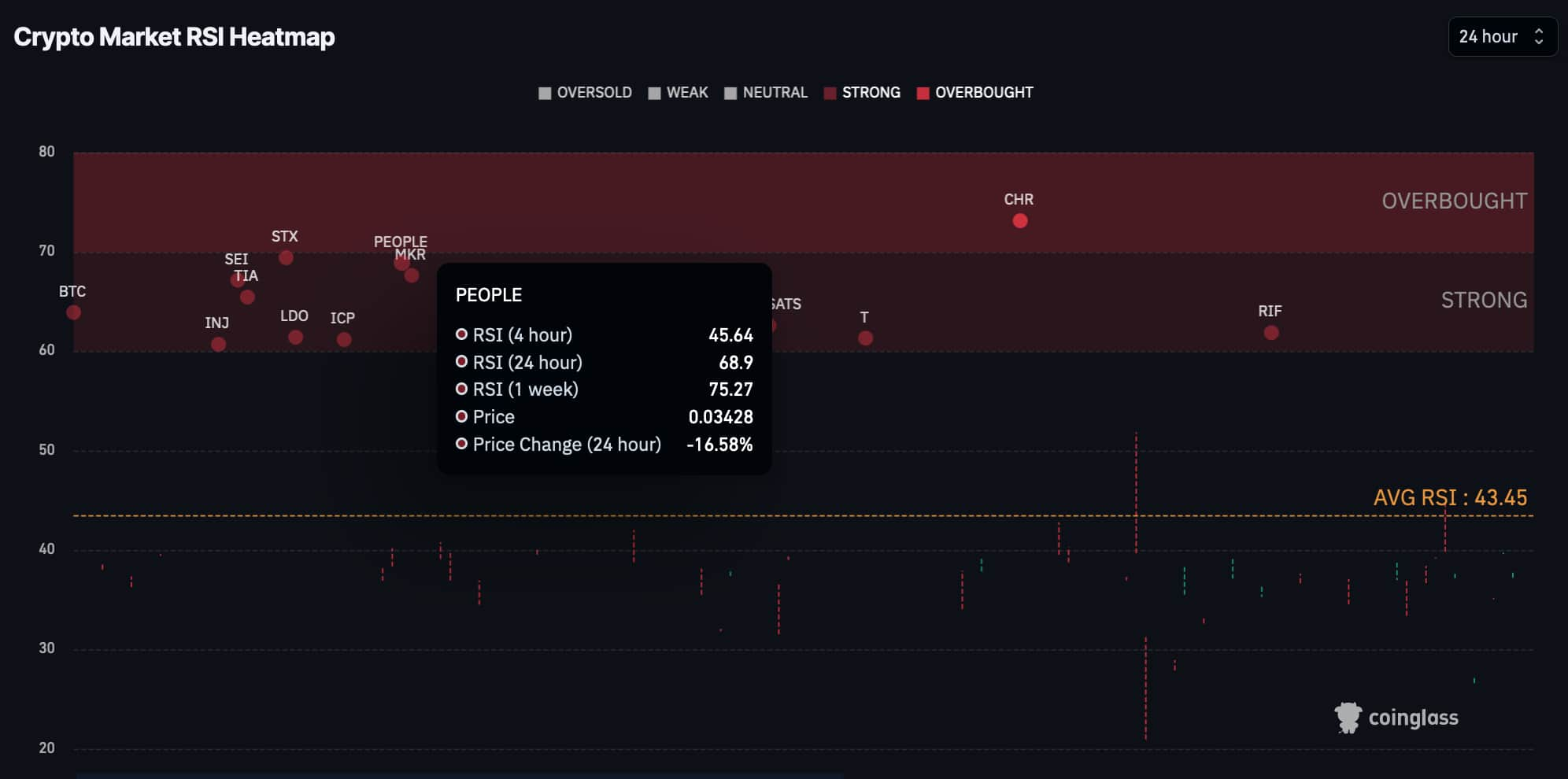

Avoid trading ConstitutionDAO (PEOPLE)

ConstitutionDAO (PEOPLE) is the first cryptocurrency to avoid trading. The token has lost close to 17% in the last 24 hours, priced at $0.034 by press time.

Notably, the $178.16 million market cap PEOPLE has seen a daily volume of $316.16 million — 238% of its capitalization. According to CoinMarketCap, the DAO was an experiment and had already dissolved.

Despite its lack of use with the ConstitutionDAO’s dissolution, PEOPLE features as a strong asset, according to CoinGlass’ RSI heatmap on January 9.

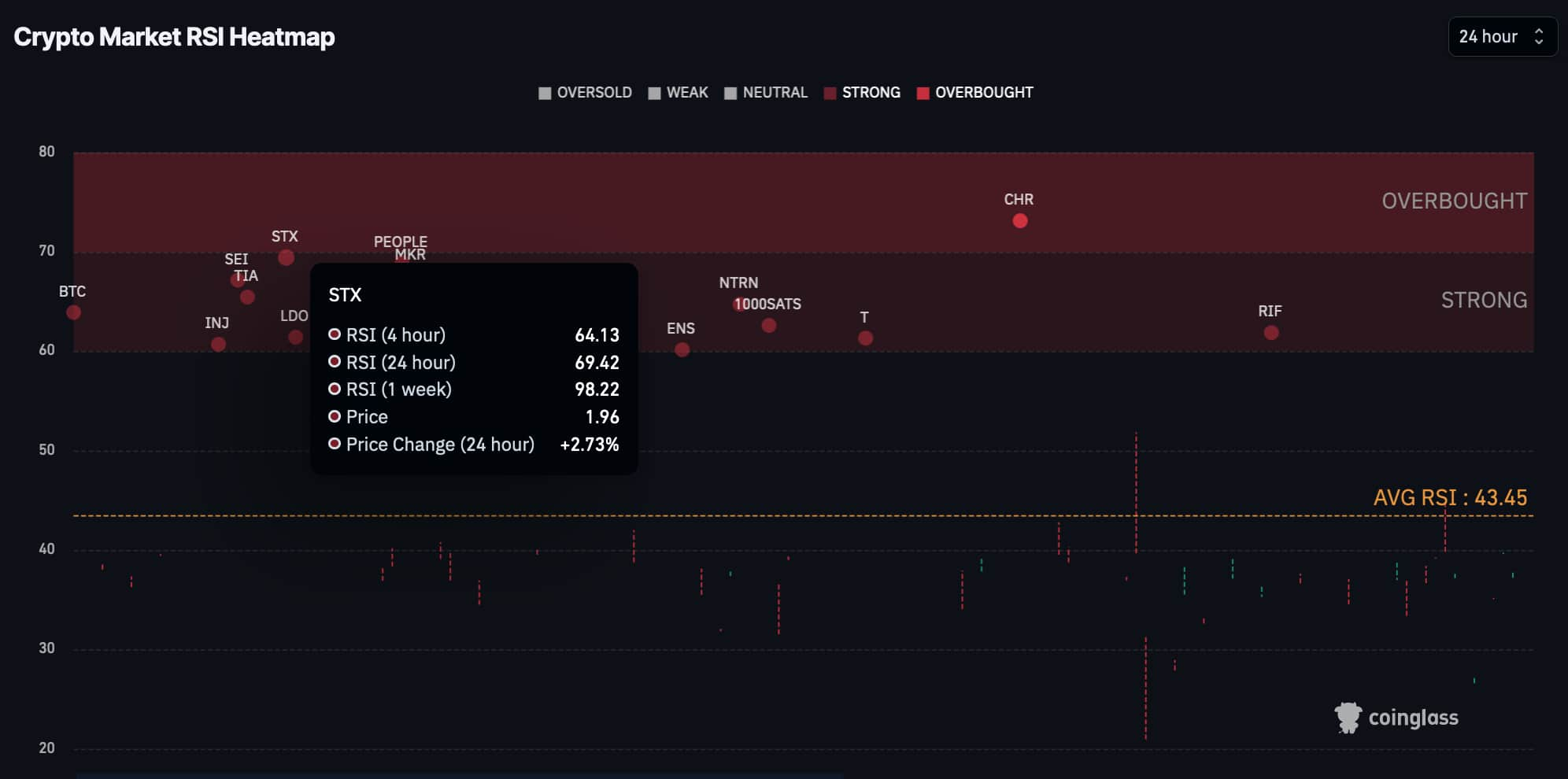

Stacks (STX) is overbought in the weekly RSI

In this context, Stacks (STX) is increasing its momentum in the 24-hour time frame, with 69.42 RSI. However, the weekly RSI is close to its maximum level, at 98.22. This suggests a massively overbought token, prone to a mid-term retracement.

Following Bitcoin’s leadership, STX is trading at $1.96 by press time, up 2.73% in the last 24 hours.

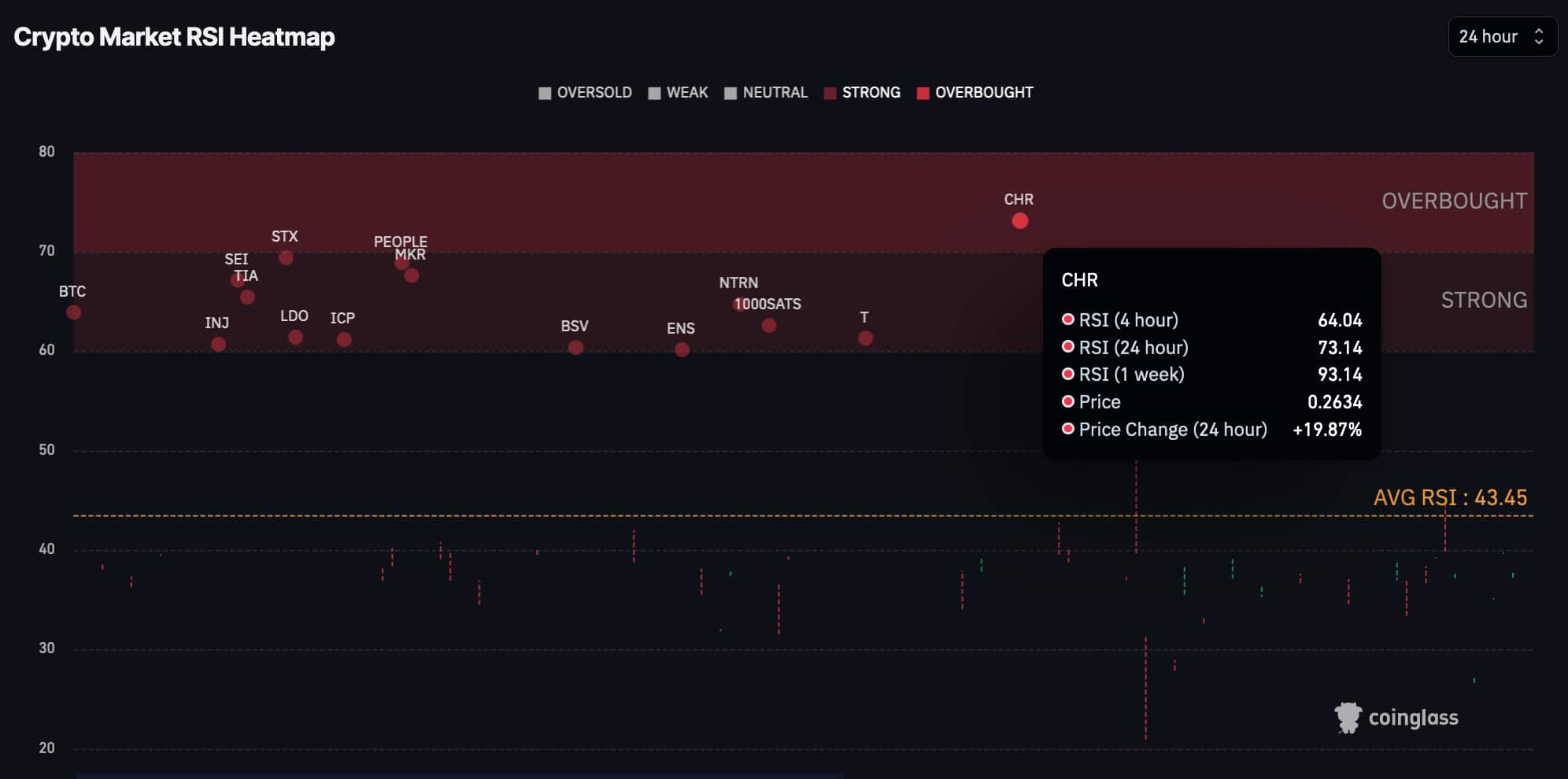

Avoid trading Chromia (CHR) this week

In the meantime, Chromia (CHR) is back to an overbought status on the daily RSI, with 73.14 points. The token is up 19.87% on the day, trading at $0.26 at the time of publication.

CHR also shows an overbought weekly Relative Strength Index with 93.14 points.

All things considered, knowing which cryptocurrencies to avoid is crucial in trading. Speculators should always monitor relevant indicators and understand what they are investing in.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here