Binance Coin Price Prediction: For the past two weeks, the native token of the world’s largest crypto exchange Binance- BNB has been highly volatile. This sideways action came in response to the market’s long-awaited decision of the US SEC on spot Bitcoin ETF approval. As the regulatory agency increasingly leans towards approving this digital asset, the altcoin market is poised to receive a substantial uplift, extending its ongoing recovery trend.

The BNB price showing sustainability above $300 support could lead a post-correction rally past $400.

Post-Correction Rally May Push BNB Price to $400

- The BNB price correction may witness high demand pressure at $285 and $270.

- A bullish crossover between 100-and-200-day EMA could encourage buying momentum in the market

- The intraday trading volume in the BNB coin is $1.3 Billion, indicating a 23% gain

Binance Coin Price Prediction| TradingView Chart

In line with broader market recovery, the Binance coin price entered a new recovery mode in mid-October 2023, when the price rebounded from $200. Within three months, the coin price witnessed a 66% surge to reach 7 months higher at $338.

Amid this rally, the BNB price offered a decisive breakout from the resistance trendline of a symmetrical triangle pattern on December 26th. This chart pattern developing for the past 21 months indicates a major shift in market dynamic as buyers escape from its key resistance.

By press time, the BNB price traded at $299.6 and witnessed a post-rally correction to recuperate the bullish momentum. As per the Fibonacci retracement tool, this pullback phase may find suitable support at $285 and $270, coinciding with the 38.2% and 50% FIB levels.

With the U.S. Securities and Exchange Commission (SEC) likely to approve Spot Bitcoin ETFs this week, the BNB price might rebound from the aforementioned support level, furthering its recovery trajectory. under the influence of this pattern, BNB could aim for successive targets at $351, followed by $400, and eventually $460.

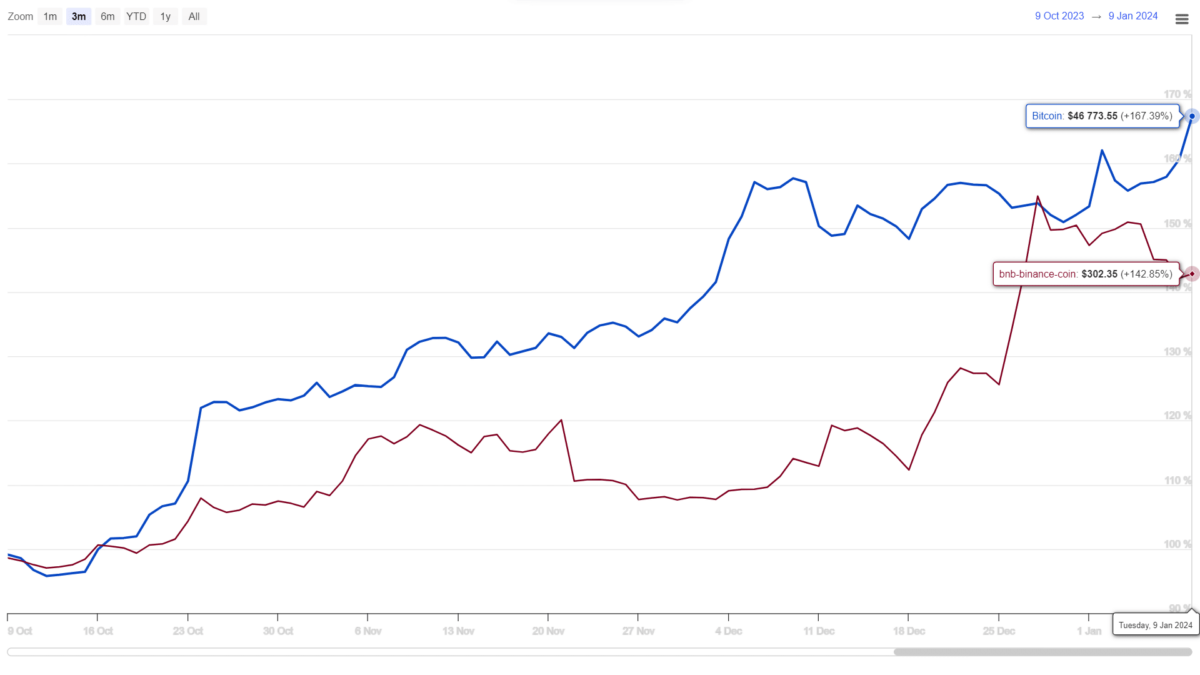

BTC vs ETH Performance

Source: Coingape| Bitcoin Vs Ethereum Price

Over the past three months, BTC and BNB have both shown a pattern of steady recovery with higher highs and lows. However, the Bitcoin price recovery showcased shallow retracement agraduallly rally while the BNB price displayed a more profound pullback indicating the sellers are comparatively active in this asset.

- Exponential moving average. The 20-day EMA slope offers buyers additional support at $300 psychological support.

- Moving average convergence divergence: A bearish crossover between MACD and signal line accentuates a correction trend is active.

Related Articles:

- Top Altcoins To Buy January 8 With Spot BTC ETF Beckoning: ADA, DOGE, ARB

- WisdomTree, VanEck Spot Bitcoin ETF Tickers Listed On DTCC

- Bitcoin ETF Filers Unswayed By US SEC Comments On S-1s, Approval Ahead?

Read the full article here