Prominent market analyst Ali Martinez recently called attention to a pattern he believes could take XRP to the $1.10 zone, identifying a potential buy opportunity for some investors.

Martinez made these disclosures in two separate reports on X. In one of these reports, the market veteran highlighted a pattern that has persistently governed XRP’s price movements since June 2022, when XRP changed hands between $0.29 and $0.42.

According to Martinez, this pattern is an ascending parallel channel, and it has continued to dictate XRP’s price direction for over 18 months.

An ascending parallel channel typically features two parallel trendlines sloping upward. The pattern indicates a gradual but consistent uptrend.

Notably, in this pattern, the upper trendline acts as a resistance level, hedging against any break above the channel. In addition, the lower trendline represents a support level, defending against any breach below the channel.

XRP Ascending Parallel Channel | Ali Charts

XRP has traded within this channel since June 2022, having failed to break upward or downward. While the token might appear to be in a cagey situation to some proponents, the upward direction of the channel is a bullish indicator that XRP’s price has continued to move up, albeit gradually.

XRP Could Clinch $1.10

Interestingly, in November 2023, XRP aimed to breach the middle boundary of the channel when it spiked to a high of $0.7481 on Nov. 13.

Recall that this spike was triggered by reports of a fake BlackRock iShares XRP ETF. When the community discovered the product was fake, XRP eventually collapsed.

This collapse has gradually persisted into the new year when viewed from a wider perspective. As a result, XRP has dropped to the channel’s lower trendline.

Notably, further drops at this point could breach the lower trendline, leading to panic and sustained selling pressure.

However, Martinez holds some bullish sentiments. The analyst confirmed that XRP could recover from this slump to hit the middle or lower boundary of the channel if the current pattern continues.

If XRP stages a recovery and hits the middle boundary of the channel, it would reclaim the $0.80 price level. XRP has not seen this price since it dropped from the $0.93 high in July 2023. Moreover, should XRP rise further to the upper trendline, it would soar to the 31-month high of $1.10.

Potential Buy Opportunity

Meanwhile, the recent drop to the lower boundary of the channel, partly triggered by the broader market’s collapse, has dealt a blow to investor sentiment.

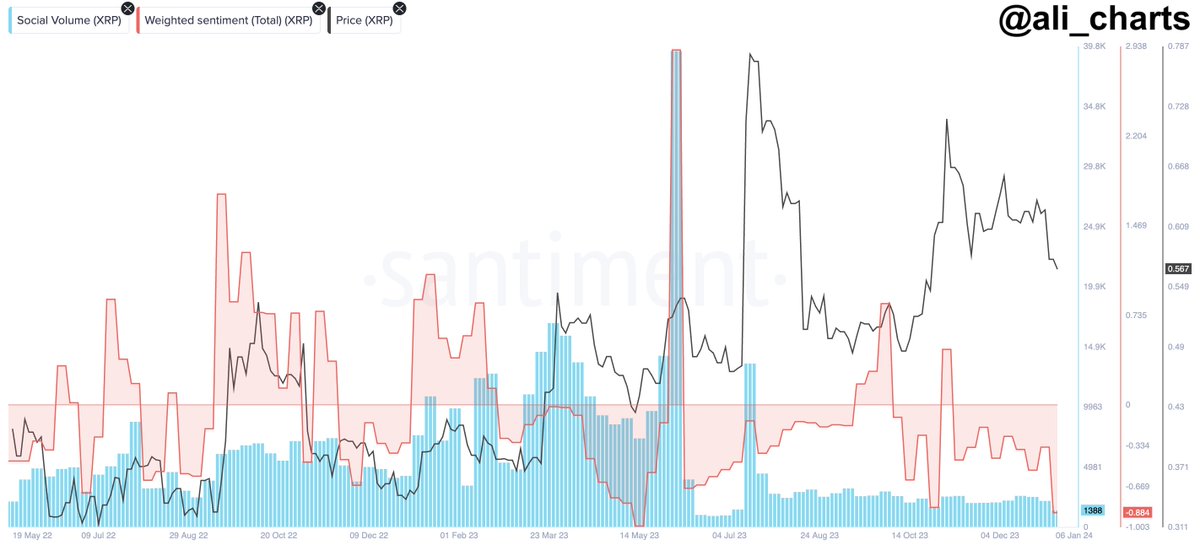

According to Ali Martinez, data from Santiment confirms that XRP’s weighted market sentiment has collapsed to -0.884.

XRP Weighted Sentiments | Ali Charts

This figure, representing a major bearish outlook, was last recorded last May when XRP traded between $0.41 and $0.52.

Amid the bearish atmosphere, Martinez addressed contrarian investors. These are individuals who take positions that are opposite the prevailing market sentiment.

The analyst identified the current position as a potential opportunity for these investors to leverage. As of press time, XRP trades for $0.5707, down 1.25% today and 7.29% this month. 24-hour trade volume has also depleted by 19.7% to $1,354,698,498.

Read the full article here