The discount on the Grayscale Bitcoin Trust (GBTC), the world’s largest bitcoin (BTC) fund, has slipped to its lowest level since April 2021, ahead of an expected conversion to a spot bitcoin exchange-traded fund (ETF).

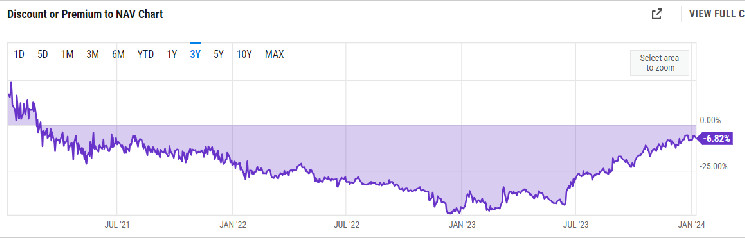

Data shows the discount fell to as low as 5.6% on Monday, reaching a level previously seen in June 2021. The fund has traded at a discount since February 2021 – reaching a high of nearly 50% in December 2022 – but expectations of an ETF approval and rising bitcoin sentiment have steadily narrowed the discount.

It closed Monday at $39. Each GBTC share holds $41.86 in bitcoin as of Tuesday. The trust has no built-in market mechanism to keep the GBTC share price trading close to the underlying value of the bitcoin – opening up discounts and premiums that traders can use as part of a trading strategy.

As of Tuesday, GBTC is one of the only ways for stock traders in the U.S. to gain exposure to the price movements of bitcoin without the need to purchase the actual cryptocurrency.

The discount could be taken as a bearish indicator because it could signal a waning interest in bitcoin among traders, while a premium could signal demand for bitcoin.

Meanwhile, Grayscale is currently awaiting a decision from the U.S. Securities and Exchange Commission (SEC) on uplisting the trust as an ETF, alongside 12 other players.

Grayscale has dropped its 2% management fee to 1.5% as part of its proposed uplift to a spot bitcoin ETF, according to an updated S3 filing on Monday. It has over $27 billion in assets under management (AUM).

If approved, it will be the most expensive offering for investors. Potential issuers such as BlackRock intend to offer their bitcoin ETF at 0.20%, rising to 0.30%, while crypto native fund manager Bitwise is charging the least – 0.24% after a 6-month period of no fees.

Read the full article here