This article is an excerpt from “Barron’s 10 Favorite Stocks for 2024,” published on Dec. 15, 2023. To see the full list, click here.

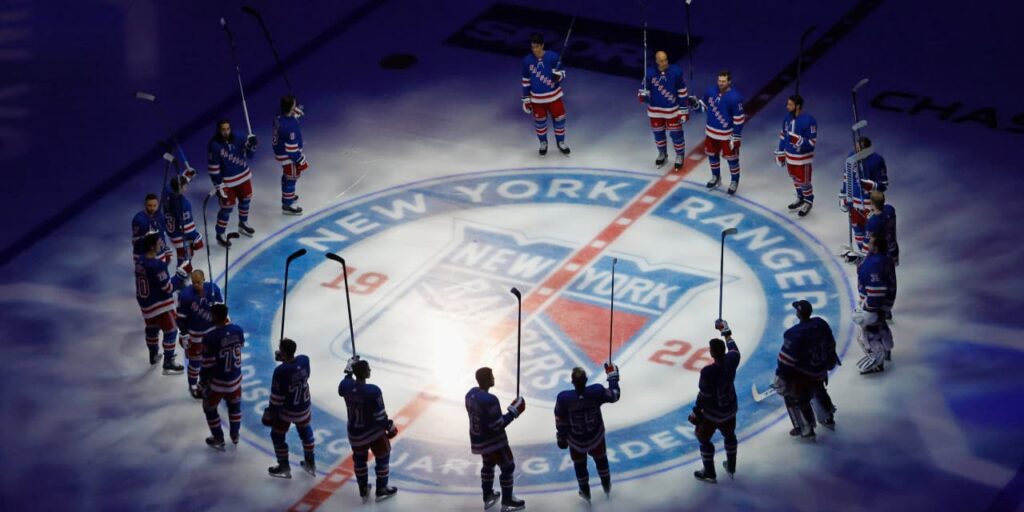

MSG Sports

owns two of the most valuable professional teams in their sports: the New York Knicks and Rangers.

According to Sportico estimates, the Knicks and Rangers are worth $7.4 billion and $2.45 billion, respectively. But the company’s current market value of just $4.2 billion, plus some $300 million of net debt, is worth less than half that. The stock, now around $173, is below where it stood five years ago.

That’s too cheap, even factoring in the “Dolan discount,” a reference to the controlling Dolan family. Chairman Jim Dolan told Barron’s in September that the company won’t entertain a full sale of either team and isn’t interested in a partial sale, either.

“The market is assigning a pretty punitive ‘Dolan discount’ to these trophy assets,” says Jonathan Boyar, president of Boyar Research.

He values the stock at more than $300 a share. He says the company should sell a minority stake in the Knicks or Rangers, buy back a lot of stock, or pay a regular dividend. The ultimate payoff would be a sale of the entire company—and there probably isn’t much downside, given the discount to asset value.

Boyar notes that the Dallas Mavericks’ Mark Cuban, who was thought to be an owner for life, recently sold a majority stake in the team to the Adelson family.

MSGS stock is languishing because investors are tired of waiting for the Dolans to do something. The wait could end in 2024.

Write to Andrew Bary at andrew.bary@barrons.com

Read the full article here