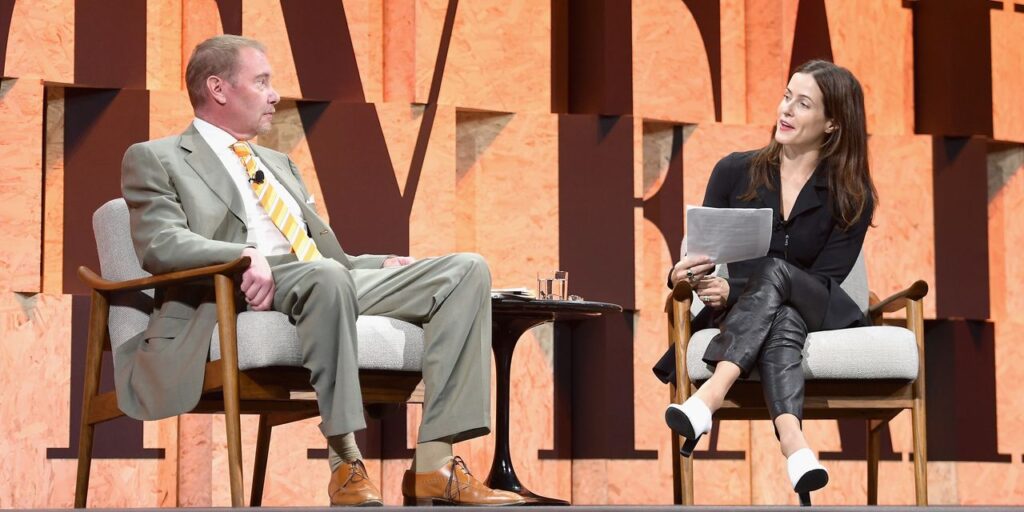

“‘We have a massive interest expense problem. A massive interest expense problem, in this country, that is going to be, I believe…the next financial crisis. And so that’s what I’m more focused on. ‘”

That’s Jeff Gundlach, chief investment officer and founder of DoubleLine Capital, sounding caution on what he thinks could be the next financial crisis for the market.

The money manager doesn’t see the crisis playing out as a result of arcane financial securities, but rather, simpler ones: Treasury bonds and short-term T-bills.

The CEO and CIO, speaking Wednesday on CNBC’s “Closing Bell,” said the mounting federal deficit — which stood at $1.7 trillion, up $320 billion, or 23%, from a year ago as of Sept. 30, according to the Treasury Department — could eventually overwhelm the government’s ability to service its debts.

That deficit marks the third-highest on record, after fiscal years 2020 and 2021.

Gundlach’s comments came on the heels of the Federal Reserve’s closely watched decision to keep interest-rates steady at a range of 5.25% to 5.50%, as the central bank assesses its next steps in its mandate of squelching inflation.

Servicing the country’s debt has become increasingly expensive as Jerome Powell’s Fed has attempted to cool the economy by raising key interest rates over a relatively rapid period, from at or near 0% to more than 5%.

This year, some $659 billion was directed to pay interest on accumulated debt, up from $475 billion in 2022 and $352 billion in 2021, according to Treasury Department data.

“We can’t afford this government that we’re running at today’s interest-rate level, ” Gundlach told CNBC.

Gundlach’s concerns also appear to be front of mind for Powell and Co.

Speaking at the Economic Club of New York last month, the Fed chairman said U.S. debt levels could, indeed, become a problem going forward. “The path we’re on is unsustainable, and we’ll have to get off that path sooner rather than later,” he said.

As for stocks, Gundlach appeared to be more sanguine about equities even as he appeared to see the strong possibility that a recession was in the offing, considering the impact of all the Fed’s hard-charging monetary policy on business and jobs.

“I really believe that layoffs are coming,” Gundlach said.

Wednesday’s trading action saw the Dow Jones Industrial Average

DJIA

end up 222 points, or 0.7%, while the S&P 500

SPX

rose by about 44 points, or 1.1%, to 4,237.86, and the Nasdaq Composite Index

COMP

rose 210 points, or 1.6%, to 13,061.47 in its fourth straight day of gains.

Meanwhile, the 2-year Treasury

BX:TMUBMUSD02Y

closed at its lowest level since Sept. 7, while the 10-year Treasury note

BX:TMUBMUSD10Y

touched its lowest level since Oct. 16.

Read the full article here