Traditional finance (TradFi) institutions are gearing up for a reboot of the financial system with the accelerated adoption of blockchain technology in 2024.

Recently, TradFi institutions have recognized the potential of blockchain and distributed ledger technology. Undoubtedly, this technology provides faster and more cost-effective transactions, prompting financial institutions to seek ways to leverage its power.

TradFi Institutions Re-Engineer Financial Market With Blockchain

Sandy Kaul, the head of digital asset and industry advisory services at Franklin Templeton, told Bloomberg:

“Adoption of the technology is actually accelerating very quickly. For the first time, you can really now see the pathway to us re-engineering the global financial markets ecosystem.”

Franklin Templeton is one of the world’s largest fund managers, with over $1.5 trillion in assets under management (AUM).

Earlier this year, it launched a mutual fund on the Polygon blockchain called the Franklin OnChain U.S. Government Money Fund (FOBXX). As of November 30, 2023, the FOBXX has $329.38 million worth of total net assets.

Read more: What is a Layer-1 Blockchain?

Franklin Templeton FOBXX Fund Information. Source: Official Website

Not to mention, Franklin Templeton filed for a spot Bitcoin exchange-traded fund (ETF) with the US Securities and Exchange Commission (SEC) on September 2023. As per BeInCrypto data, the SEC is expected to respond to the Franklin Templeton ETF filing between January 5 and January 10, 2024.

However, the final deadline falls on March 31, 2024.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Not just Franklin Templeton but many other TradFi institutions have plans to upscale their infrastructure around blockchain technology. Notably, one of the world’s largest banks – JPMorgan, has been using blockchain to enhance the transfer of payments.

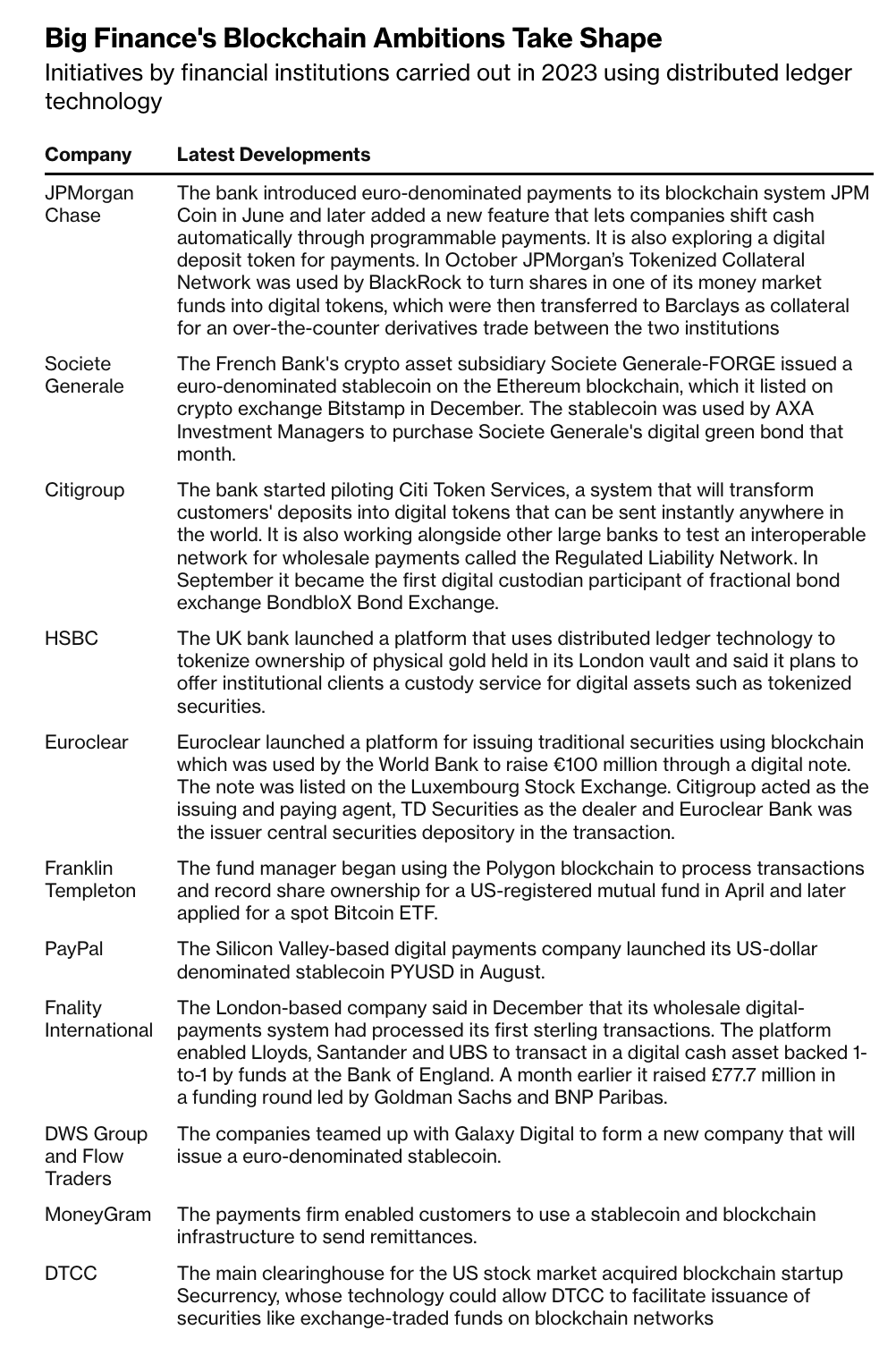

The JPM Coin is available 24/7 to speed up US dollar payments between the banks’ clients. The screenshot below shows some of the initiatives carried out by notable TradFi institutions in 2023.

List of TradFi Institutions With Blockchain Plans. Source: Bloomberg

Read the full article here