Japanese Yen Prices, Charts, and Analysis

- The USD/JPY line in the sand has been crossed

- FOMC decision will steer USD/JPY in the short-term

Recommended by Nick Cawley

Get Your Free JPY Forecast

The Japanese Yen is less than one point away from trading at its weakest level against the US dollar in over thirty-three years, as the Bank of Japan continues with its ultra-dovish monetary policy. The Japanese central bank was seen intervening in the bond market today as JGB 10-year yields came close to trading at 1%, a level now seen as a reference point for intervention, not a hard ceiling.

Japanese Yen Craters after BoJ Fails to Appease Bears, USD/JPY and EUR/JPY Soar

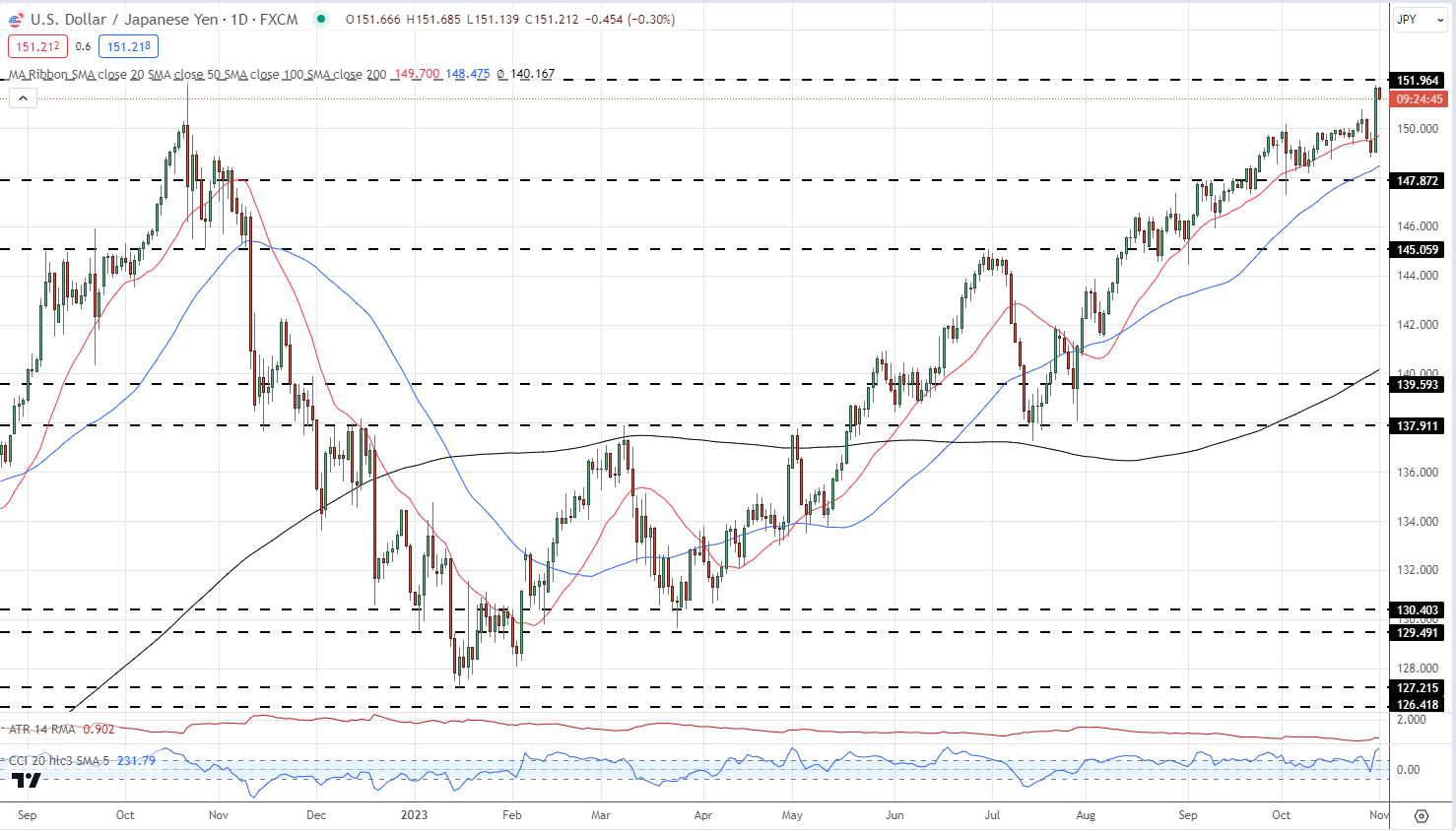

USD/JPY 3-Month Chart

Recommended by Nick Cawley

How to Trade USD/JPY

BOJ intervention

According to a recent Bloomberg report, Japanese Prime Minister Fumio Kishida is preparing to announce a 21.8 trillion Yen stimulus package in order to promote growth and cushion inflationary pressures. The Bank of Japan left all policy settings untouched at this week’s central bank meeting apart from tweaking the yield curve control language and ending the daily bond-buying program. This ongoing accommodative policy is leaving the Japanese Yen vulnerable to further losses.

The daily USD/JPY chart shows the pair within touching distance of last year’s 151.94 high, a level that prompted the Bank of Japan to intervene. It is unlikely that any official intervention will have the same outcome as last year when USD/JPY dropped by around 24 big figures in three months. Later today we have the latest FOMC decision and any dovish or hawkish rhetoric at the post-decision press conference will likely drive the next move in USD/JPY. Trading the Yen at the moment is a very tricky proposition and it may be best to stay on the sidelines until the outlook becomes clearer.

USD/JPY Daily Price Chart – November 1, 2023

Download the Latest IG Sentiment Report to See How Daily/Weekly Changes Affect the USD/JPY Price Outlook

| Change in | Longs | Shorts | OI |

| Daily | 6% | 3% | 3% |

| Weekly | -8% | 1% | 0% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Read the full article here