(Bloomberg) — Asian stocks fell early Friday, shrugging off a rally on Wall Street, as traders ratchet up bets the Bank of Japan is nearing the end of its negative interest rate policy.

Most Read from Bloomberg

Japanese shares slipped for a second day, while the yen rose more than 1% amid thin liquidity. Australian shares also fell while contracts for mainland China pointed to losses. Korean shares gained after the Nasdaq 100 index rallied amid renewed optimism on AI.

“The exchange rate fluctuations have been quite dramatic, so it’s inevitable that Japanese stocks fall because of the yen appreciation,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. “Compared to the volatile currency move, since strong yen is not a bad thing for all Japanese companies, the decline in stocks is likely to be limited to a certain extent.”

Traders will be on watch for any clarification from Governor Kazuo Ueda after telling lawmakers his job was going to get more challenging from the year-end, helping fuel speculation the BOJ will start lifting its sub-zero benchmark rate soon. That helped push the yen to its strongest since August as bets against the currency capitulated.

Japan’s economy shrank more than expected in the third quarter, suggesting the recovery is more fragile than thought and may give the BOJ reason to delay normalizing policy.

Krishna Guha at Evercore says he’s not “buying the idea” that the BOJ will seriously consider a surprise hike in December with early in the new year more plausible. “While it is asserting a serious option to go in January, it is actually leaning more to a later hike in April,” he noted. “So while the direction of travel is right,” Thursday’s tactical trades have likely overshot.

Read More: Two-Thirds of BOJ Watchers Expect End of Negative Rate by April

Elsewhere in Asia, investors await the Indian central bank’s policy decision. It is expected to maintain its hawkish policy stance as strong economic growth and a state election victory for Prime Minister Narendra Modi gives policymakers little reason to consider interest rate cuts just yet.

Cooling Labor Market

Attention will soon shift to Friday’s US non-farm payrolls report as traders look for more evidence of a cooling labor market to assess the outcome of next week’s Federal Reserve policy meeting. Data this week showed continuing applications for jobless benefits fell by the most since July. Despite the decline, continuing claims are still near a two-year high amid growing evidence of a cooling labor market.

“The jobs report is likely to provide additional indications of the labor market softening, a welcome sign for employers,” Jose Torres, a senior economist at Interactive Brokers, said. “Its impact on markets, however, will depend on whether investors view the data as a stepping stone to a March rate cut and soft landing, or an adverse effect on consumer spending and a sharper economic slowdown.”

Still, traders brushed off any jitters surrounding the upcoming report as optimism around AI resurfaced, with Alphabet Inc. up 5.3% a day after Google released Gemini, the “largest and most-capable AI model” it has ever built. That re-ignited the rally in stocks, with the tech-heavy Nasdaq 100 gaining 1.5% and the S&P 500 climbing 0.8%, its first gain this week.

“Artificial intelligence has potential to drive productivity gains sharply higher in 2024 and beyond,” said Yung-Yu Ma at BMO Wealth Management. “Resilience, adaptability and innovation have been hallmarks of the economy in 2023, and we see those factors carrying us through in 2024 as well.”

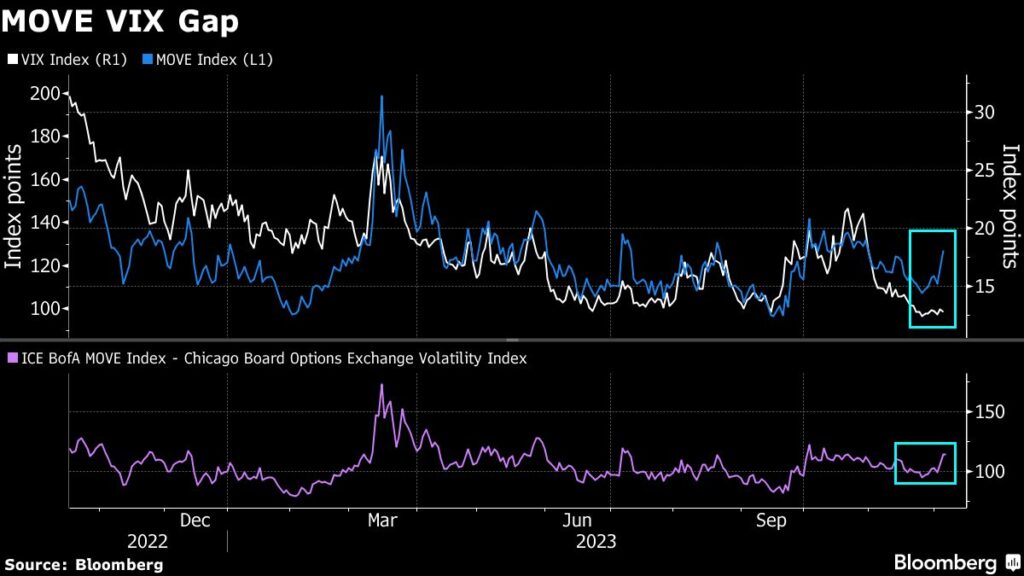

Optimism about disinflation and potential rate cuts next year played a big part in the recent US stock rally. Yet a reading of cross-asset volatility shows risks aren’t as muted as they may appear. The gap between the MOVE Index, which tracks interest-rate volatility, and the VIX gauge of stock price swings has once again widened — suggesting rate markets remain choppy and could spark stress for equities at any time. Treasuries were steady with the 10-year yield trading around 4.16%.

Marko Kolanovic at JPMorgan Chase & Co. warned clients that equities and other risk assets won’t be able to sustain any potential rallies without substantial rate cuts by central banks — and he doesn’t anticipate that unless markets drop severely or the economy stalls. For that reason, he said investors should opt for cash or bonds over stocks.

“This is a catch-22 situation,” Kolanovic said. “This would imply that we would need to first see some market declines and volatility during 2024 before easing of monetary conditions and a more sustainable rally.”

In other markets, oil rose to pare the week’s losses, with low-conviction trading and mounting concerns about excess supplies leaving algorithmic traders calling the shots. Gold was steady ahead of the jobs report.

Key events this week:

-

Germany CPI, Friday

-

Japan household spending, GDP, Friday

-

Reserve Bank of Australia’s head of financial stability Andrea Brischetto speaks at Sydney Banking and Financial Stability conference, Friday

-

Reserve Bank of India policy decision, Friday

-

US jobs report, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 10:03 a.m. Tokyo time. S&P 500 rose 0.8%

-

Japan’s Topix fell 1.1%

-

Australia’s S&P/ASX 200 fell 0.1%

-

Hang Seng futures rose 0.3%

Currencies

-

The Japanese yen rose 0.9% to 142.83 per dollar

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro was little changed at $1.0800

-

The offshore yuan rose 0.1% to 7.1545 per dollar

-

The Australian dollar rose 0.1% to $0.6610

Bonds

Cryptocurrencies

-

Bitcoin was little changed at $43,391.01

-

Ether fell 0.3% to $2,362.45

Commodities

-

West Texas Intermediate crude rose 0.8% to $69.92 a barrel

-

Spot gold rose 0.2% to $2,032.85 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Akemi Terukina and Winnie Hsu.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here