GOLD OUTLOOK & ANALYSIS

- War between Israel and Hamas ramps up, gold bid.

- Light economic calendar will see risk sentiment drive market volatility.

- Bearish technical signals could see gold head back down towards $2000.

Elevate your trading skills and gain a competitive edge. Get your hands on the GOLD Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL FORECAST

Gold prices recorded news all-time highs at market open due to escalating geopolitical tensions as Israel and Hamas resume fighting after the ceasefire ended last week. The safe haven allure of the yellow metal supported this move but has since pulled back below the $2100 mark once again; this despite a stronger US dollar. An update from my weekly gold forecast shows a similar implied Fed funds futures path with pricing showing roughly 125bps of cumulative interest rate cuts by December 2024.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

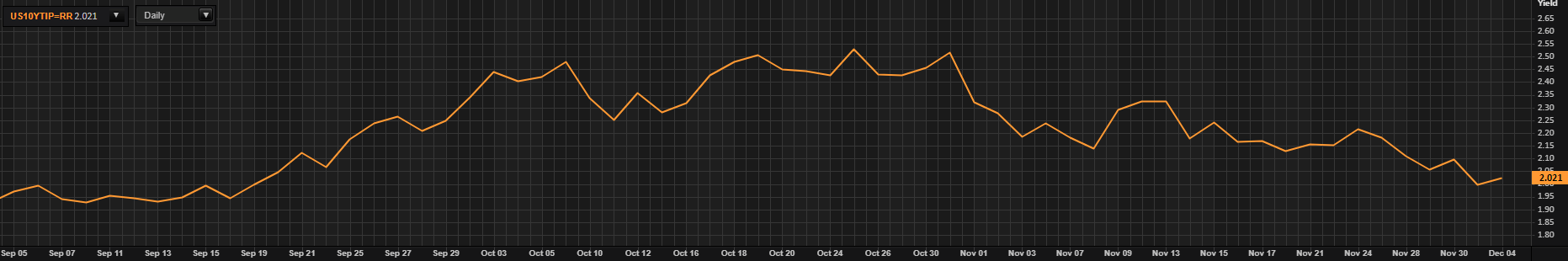

US real yields (see below) is trading higher following US Treasury yields. Technically, this makes limits gold’s attractiveness due to increasing opportunity cost but for now safe haven demand is the dominating variable.

US 10-YEAR REAL YIELD

Source: Refinitiv

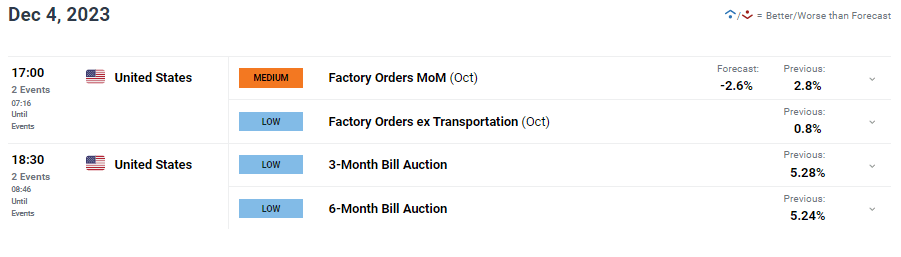

With no real high impact data today, price action will likely be dictated by updates in Gaza as well as expectations surrounding the upcoming ISM services PMI and Non-Farm Payrolls (NFP) respectively. With many analysts expecting upside surprises, gold may be negatively impacted should this come to fruition.

GOLD ECONOMIC CALENDAR

Source: DailyFX

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

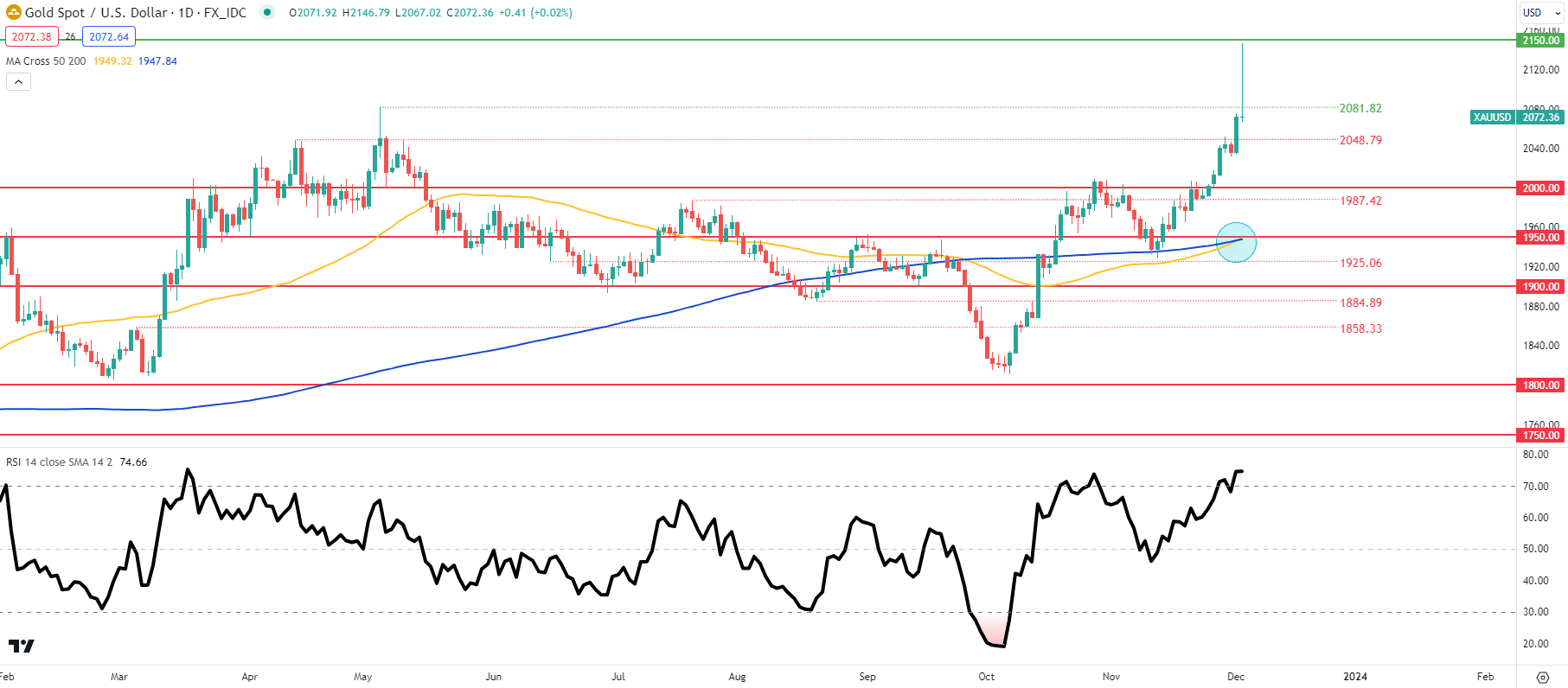

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, TradingView

The daily XAU/USD chart above shows the massive rally in early trade with a long upper wick candlestick now forming. Should the candle close in this fashion, bears will be looking for subsequent downside to come which will support fundamental projections for stronger US economic data as mentioned above. Supplementing the bearish bias is the Relative Strength Index (RSI) that remains within the overbought zone. From a bullish perspective, bulls will hold on to some hope as we see the first signs of the golden cross formation (blue).

Resistance levels:

Support levels:

- 2048.79

- 2000.00

- 1987.42

- 1950.00

GOLD IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently net SHORT on GOLD, with 52% of traders currently holding short positions.

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Read the full article here