(Bloomberg) — Oil enters the final stretch of the year on a two-month losing streak, even after the Organization of Petroleum Exporting Countries and its allies agreed to deepen production cuts. Spot gold is a whisker away from surpassing the record high it set in August 2020 after surging above $2,000 an ounce in the past week. Elsewhere, agriculture traders will be focused on the monthly World Agricultural Supply and Demand Estimates (WASDE) report for clues about the US harvest and the state of international crops.

Most Read from Bloomberg

Here are five notable charts to watch in global commodity markets as the week gets underway.

Oil

The US oil benchmark has been on an extremely volatile trading path. On a closing basis, West Texas Intermediate futures have swung by more than $2 a day in either direction a total of 42 times this year through Friday’s close. That pales in comparison with 2022’s surge, but is above the 10-year average. The choppiness has come amid uncertain demand, inventory concerns and OPEC+’s ongoing supply cuts. But that’s not all of it: Speculative forces have also played a part.

Metals

Spot gold is once again flirting with a record high. The precious metal has jumped almost 14% since early October, first sparked by haven buying due to the Israel-Hamas war and then from expectations of Federal Reserve monetary policy shifting to a loosening cycle next year. In the process, bullion has breached the upper limit of its trading envelope — a technical measure built around moving price averages — which can often precede a reversal of fortune. At the same time, its 14-day relative strength index is above 70, indicating the advance may have moved too far, too fast.

Shale

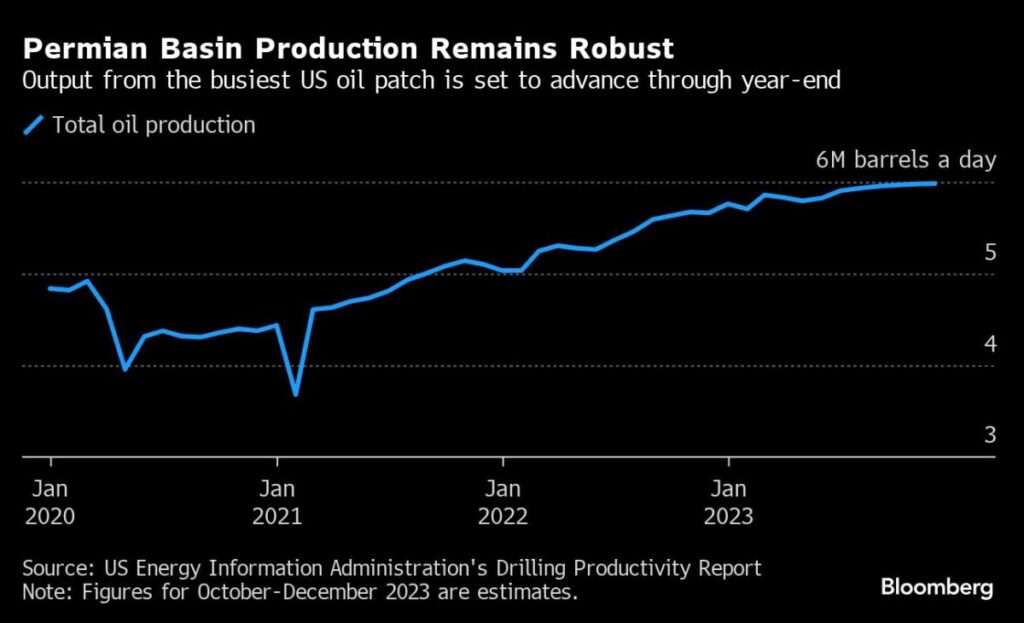

The most prolific US shale basin has seen its prospects improve, with the region now expected to increase production every month since June through the end of the year — the longest run of monthly gains in two years. Output from the Permian is forecast to hit a record 5.98 million barrels a day in December, according to the most recent government data. The US Energy Information Administration had previously said output would contract during every month between August and November. The forecast for expansion follows supply pullbacks from OPEC+. Friday’s monthly US payrolls report will shed light on the state of the shale jobs market.

Agriculture

Grains prices have been walloped this year, thanks to a bountiful US harvest — particularly corn — and bigger-than-expected global grain supplies. A Bloomberg gauge of near-term futures contracts for soybeans, corn and wheat has tumbled more than 20% in 2023 and is on track for its worst slump in a decade. Traders will await the US Department of Agriculture’s monthly WASDE report on Friday for the latest assessment of the foreign and domestic harvests.

Electric Vehicles

Last week, the Biden administration released long-awaited rules designed to block electric-vehicle manufacturers from sourcing battery materials from China and other foreign adversaries. The guidelines may ultimately reduce the number of EV models that qualify for a $7,500 consumer tax credit, impacting adoption. Sales of EVs in the US had been on a steady climb over the last few years.

–With assistance from David Wethe and Dominic Carey.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here