(Bloomberg) — For all the bullish milestones notched by November’s big market surge, recent history offers Wall Street a lesson in caution.

Most Read from Bloomberg

Time and time again, speculation breaks out that the Federal Reserve is poised to ease monetary policy soon enough — spurring even cautious investors to erupt in a spasm of cross-asset buying. Stocks jump, bond yields fall, and a dash ensues among equity speculators into shady corners encompassing everything from meme fliers to crypto and profitless tech.

That’s November in a nutshell. Volatility has fallen to pre-pandemic lows and a Goldman Sachs Group Inc. gauge of global risk appetite has hit near the highest level in two years. Yet events in June and July — marked by another all-encompassing rally that gave way to a 10% correction — provide sinister parallels.

Could this time be different? Perhaps. While Fed Chair Jerome Powell pushed back Friday on the prospects for interest-rate cuts, the central bank’s historic tightening campaign is seen as game over across markets. At the same time, the risk-on exuberance is working against Powell’s goal of tightening financial conditions, a back-and-forth dynamic that has contributed to the demise of past rallies.

“The shifting narratives have been swinging markets far more than is warranted by fundamentals — in both directions,” Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors, said. “It’s a constant shifting back and forth between oversold and overbought conditions.”

As always, extreme moves in markets are eliciting warnings about their sustainability. Hedge fund manager Bill Ackman said in an episode of The David Rubenstein Show: Peer-to-Peer Conversations that economic optimism may be misplaced — unless the Fed starts easing a lot sooner than many investors expect. He cited the impact of so-called real rates, noting that as inflation recedes they effectively rise and threaten the business cycle.

“I think there’s a real risk of a hard landing if the Fed doesn’t start cutting rates pretty soon,” said Ackman, noting that he’s seen evidence of a weakening economy.

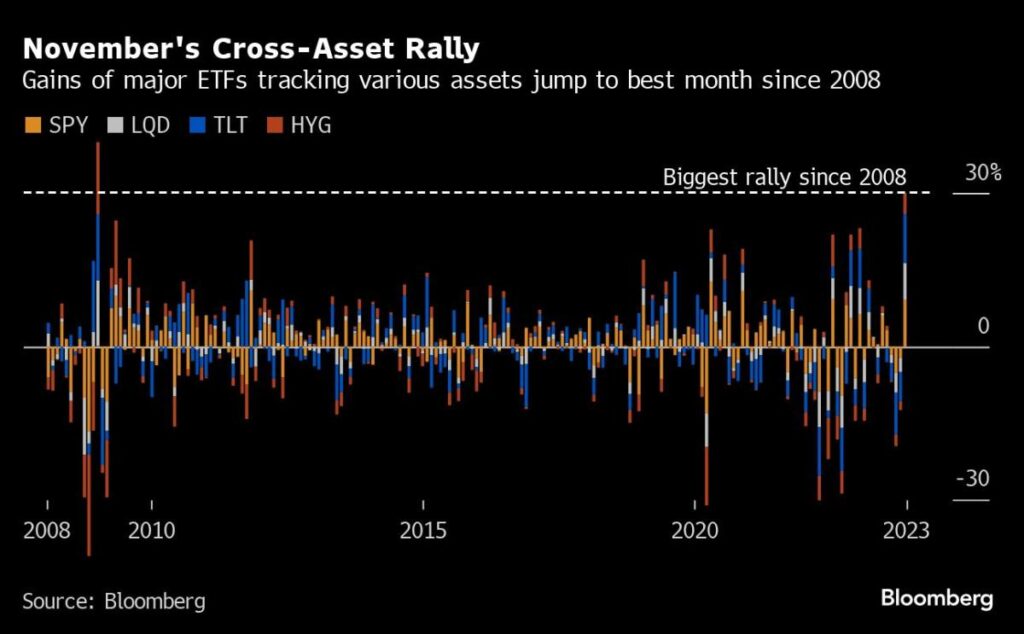

By almost any measure, November’s advance was a huge one. Plunging Treasury yields set the stage for powerful rallies in stocks, credit and emerging markets. The Bloomberg 60/40 index saw one of its best months on record. Indexes tracking crypto, meme stocks, initial public offerings and unprofitable tech — all of which struggled when yields were soaring — surged big time. Cathie Wood’s ARKK Innovation ETF (ticker ARKK) gained a record 31%, its best month on record.

“Optimism that the Fed’s next move is going to be a rate cut, optimism that the US economy is going to avoid a hard landing — they’re strong drivers, and it has been a tremendous pivot,” Fiona Cincotta, senior financial markets analyst at City Index, said by phone. “Could we see a hangover in January? Potentially, if the Fed does stick to the higher-for-longer narrative.”

The forceful rally comes at a delicate time. While a parade of data this week fortified bulls — from jobless claims to gross domestic product and consumer confidence — it remains unclear whether the retreat in inflation portends a more lasting economic slowdown. On Friday, the ISM Manufacturing Purchasing Managers’ Index come in below expectations, while the Federal Reserve Bank of Atlanta’s GDPNow index saw its estimate for US fourth-quarter growth ease to 1.19%.

Along with all the economic uncertainty investors are also contending with dicey market dynamics that were also present over the summer, namely the outsize role of seven tech superstocks in propelling the lion’s share of the wins. Even with a slight broadening in November, the top five contributors account for 68% of the index’s gain this year, and the top 10 make up 90% of the return.

Such narrow leadership is typical before a slowdown, according to JPMorgan Chase & Co., which says equity concentration has reached levels not seen since 1970s.

“Equities are now richly valued with volatility near the historical low, while geopolitical and political risks remain elevated. We expect lackluster global earnings growth with downside for equities from current levels,” wrote JPMorgan strategists led by Dubravko Lakos-Bujas.

–With assistance from Emily Graffeo.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here