(Bloomberg) — A rally across all asset classes powering the S&P 500 to its best month in over a year has finally caught the attention of retail investors.

Most Read from Bloomberg

The same traders who created the so-called meme-stock mania, with big bets on speculative companies, are back. And they are piling into the market’s favorite stocks — think Amazon.com Inc. and Nvidia Corp. — while also buying riskier bets like profitless tech and all things crypto, according to data from investing platform eToro and chatter on social media, the same platforms used to fuel a surge in GameStop Corp. more than two years ago.

Individual investors are “showing optimism and buying into the rally” after a few weeks of economic indicators bolstered overall sentiment, said Jason Goepfert, founder and senior analyst of Sundial Capital Research, by phone.

Softening economic data has reassured investors that the Federal Reserve’s interest-rate hiking campaign is coming to an end. This time retail traders have been slow, even “hesitant to join the rally,” said Goepfert. Their late arrival, however, could be further fueling the run-up.

The S&P 500 Index notched one of its biggest November gains on record, jumping 8.9% for its second-best performance for the month since 1980 as speculative corners including Bitcoin and meme stocks like GameStop posted gains. The world’s largest cryptocurrency by market value soared to its highest level in 18 months.

Retail investors make up about 18% of daily volumes in the equity market, according to Bloomberg Intelligence. An eToro September Retail Investor Beat survey said 93% of those traders in the US plan to invest the same amount of money or more in stocks through the end of the year.

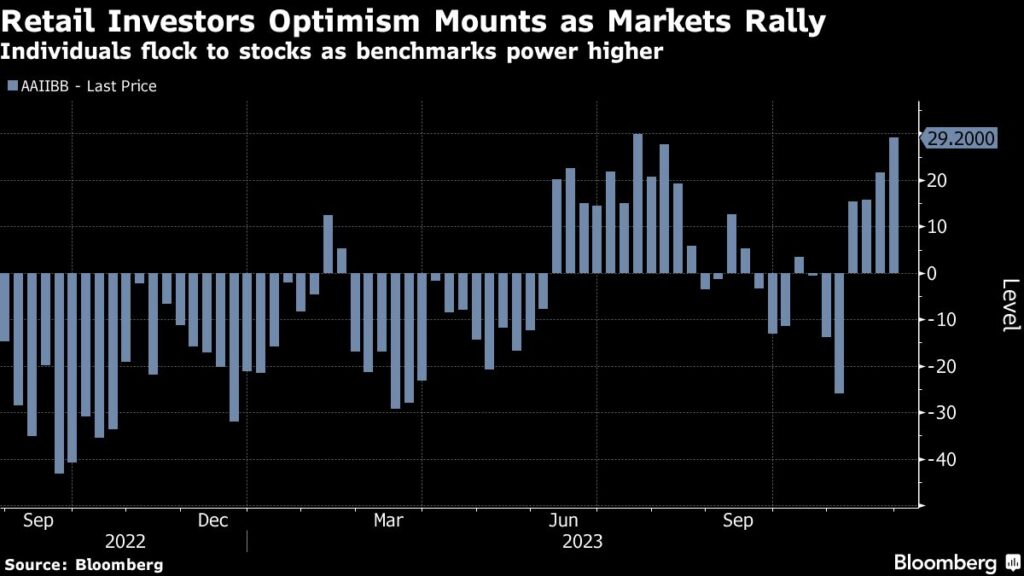

The buying comes as the closely watched bull-bear spread from the American Association of Individual Investors survey showed the most bullish stance for the group since July, nearing levels not seen since April 2021, when the bull market was still raging.

eToro saw a big jump in trading of stocks like Tesla Inc., Amazon, and chipmaker Nvidia. Opened positions in crypto on eToro’s US platform also grew 28% in November month over month.

“Average trade sizes have been noticeably higher, which tells me that people are feeling comfortable enough with the future to risk larger sums of money,’ said eToro US investment analyst Callie Cox.

The five most popular stocks on eToro mostly mirrored those mentioned on Reddit’s WallStreetBets and chatroom StockTwits. Tesla remained the group’s favorite company while Nvidia and Meta Platforms Inc. held the retail crowd’s attention.

The group’s infatuation with short-dated call options, a calling card of the 2021 meme stock boom, fueled an eye-popping rally in GameStop with Reddit users egging each other on to buy shares ahead of results next week.

While trend-following traders have become more comfortable with the idea of a further rally, “big institutional investors have started to express some doubts,” said Goepfert.

Investors looking for signs the market is hitting a near-term peak in terms of optimism may be getting exactly the message they need from the bubbling excitement among meme-stock traders.

“Strictly from a contrarian sentiment perspective, it’s now time to be cautious in the short term,” wrote Peter Boockvar, author of the The Boock Report, referencing the latest AAII reading. “The individual investor’s positivity has now gotten extreme.”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here