U.S.-based cryptocurrency exchange Coinbase has revealed it received over 13,000 requests from law enforcement agencies.

According to Coinbase‘s latest “Transparency Report” published on Nov. 29, 2023 the crypto exchange says it received a total of 13,079 requests from law enforcement agencies from Oct. 2022 through Sept. 30, 2023, representing a 6% increase from last year.

The U.S. appeared to be the most active country with 5,868 requests, a 57% share of the total amount of inquiries the exchange received during the reporting period. Coinbase highlighted in the report the data reflect the requests received and “not necessarily requests responded to.” It is unclear how much data Coinbase provided to law enforcement agencies, but noted that it aims to hand out “anonymized or aggregated data.”

“We also aim to provide anonymized or aggregated data that aids law enforcement and government agencies with their work, where it is possible to do so, instead of providing individual customer information.”

Coinbase Chief Legal Officer, Paul Grewal

In addition to the U.S., other countries such as Germany, U.K. and Spain also sent requests, with Armenia sending its requests to the San Francisco-based exchange for the first time in 2023.

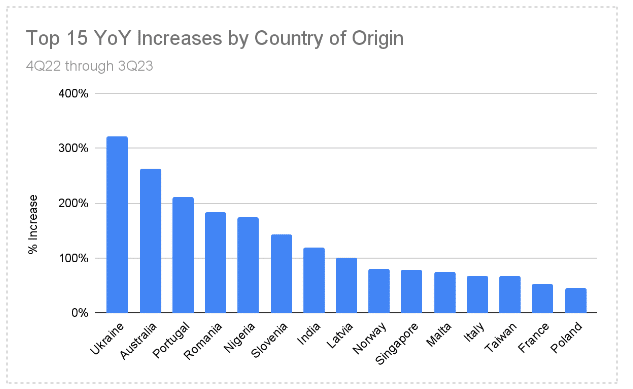

Ukraine appeared to be the most active country in terms of year-over-year increase, surging the amount of its requests to Coinbase by over 300% in 2023, the data show. In 95.6% of requests, law enforcement agencies around the world were seeking information as part of a criminal case, with only 4.4% were related to civil or administrative legal actions.

Coinbase said it may produce certain customer information, such as name, recent login/logout IP address, and payment information “depending on the nature and scope of the request,” but pointed out it does not give any government in any jurisdiction “direct access to customer information on our or any third-party’s systems.”

In late November 2023, crypto.news reported that the Biden administration is urging Congress to consider the most significant updates to the Treasury’s sanctions authority since 2001. As per U.S. foreign trade representative Wally Adeyemo, there’s a need to introduce a “secondary sanctions regime” as the Treasury has already provided Congress a set of “common-sense recommendations to expand our authorities and broaden our tools and resources to go after illicit actors in the digital asset space.

Read the full article here