- Solana’s decentralized finance (DeFi) ecosystem sees a surge as the Total Value Locked (TVL) hits a new yearly peak, reaching over $640 million.

- Despite recent fluctuations, Solana’s price approaches $60, breaking free from a descending channel on the daily chart.

Solana’s decentralized finance (DeFi) ecosystem has achieved a notable milestone as the Total Value Locked (TVL) hit a new yearly peak, coinciding with a positive shift in the asset’s price trend.

Data shows that SOL’s price surged by over 10% in the last 24 hours, reclaiming the $60 level and reaching $61.07 at the time of reporting.

This price increase propelled Solana’s TVL to over $640 million, marking a growth of approximately $40 million or a 5.27 percent increase in the past 24 hours, as reported by DeFillama data. This surge has elevated Solana to the 8th position among the top 10 performing DeFi chains, accompanied by an 8 percent growth over the past week.

The recent growth aligns with Solana’s year-long positive trajectory in its DeFi ecosystem, with the TVL increasing by 204 percent on year-to-date metrics, rising from $210.47 million on January 1 to its current position.

DeFillama data indicates that decentralized exchange (DEX) trading volume on Solana has reached its highest level since November of the previous year, coinciding with the network’s exposure to the collapsed FTX exchange. Artemis data further reveals that the surge in DEX volume aligns with Solana achieving a three-month high in daily transactions, reaching 51.36 million on November 24.

The heightened network activity indicates a growing influx of investors and a heightened interest in the Solana DeFi ecosystem. Over the past year, the blockchain has secured significant partnerships with traditional finance entities such as Visa, Shopify, and others, contributing to increased adoption and usage.

Solana Price Flirts With $60

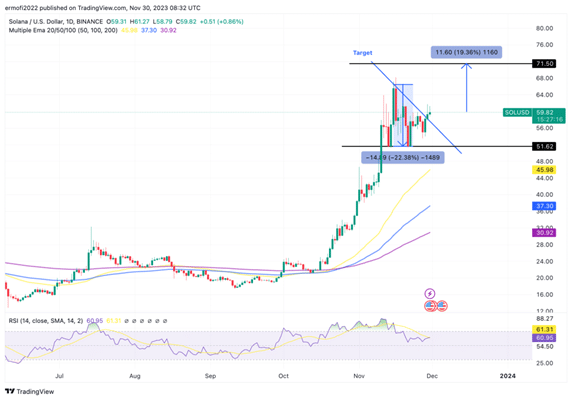

Ethereum Layer-1 competitor Solana has been flirting with $60 levels much recently. At press time, SOL is trading at $59.71 with a market cap of $25.3 billion. Between November 11 and 28, SOL’s price movements formed a descending channel on the daily chart. However, Solana managed to break free from this bearish pattern on Wednesday by surpassing the resistance line at $58.

For the ongoing recovery to be maintained, SOL bulls needed to sustain the price above this level. This required efforts to drive the price towards the psychological threshold of $60. The subsequent targets included the November 23 high at $68 and ultimately the technical target dictated by the prevailing chart pattern at $71.50. Achieving this would mark a 20 percent increase from the current price level.

Recommended for you

• Abu Dhabi Regulator Grants Paxos In-Principle Approval for Stablecoin Issuance• Your Next Smart Investment: $ROE, LINK, ADA• Terra’s USTC Tokens Surge 300% Amid Bitcoin-Centric Resurgence

The upward direction of the moving averages (MAs) also supports Solana’s positive direction. The fact that SOL traded above key MAs indicated strong support on the downside.

Specifically, the 50-day Exponential Moving Average (EMA), the 100-day EMA, and the 200-day EMA were positioned at $45, $37, and $30, respectively, forming robust support levels.

The Relative Strength Index (RSI) remained in the positive region above the midline. With a price strength reading of 61, it suggested a market scenario where buyers outnumbered sellers, indicating ongoing strength in the price.

Read the full article here