I was saddened and truly shocked when I heard that Charlie Munger died. Partly because I was making plans to fly out to Los Angeles to interview him in a few weeks on the occasion of his 100th birthday on Jan. 1—and I had received an email just yesterday from his office confirming the plan.

Much more than that, though, I realize that I somehow thought Charlie, along with his

Berkshire Hathaway

running mate Warren Buffett, would always be here. That was just plain foolish, of course, but I bet I wasn’t alone.

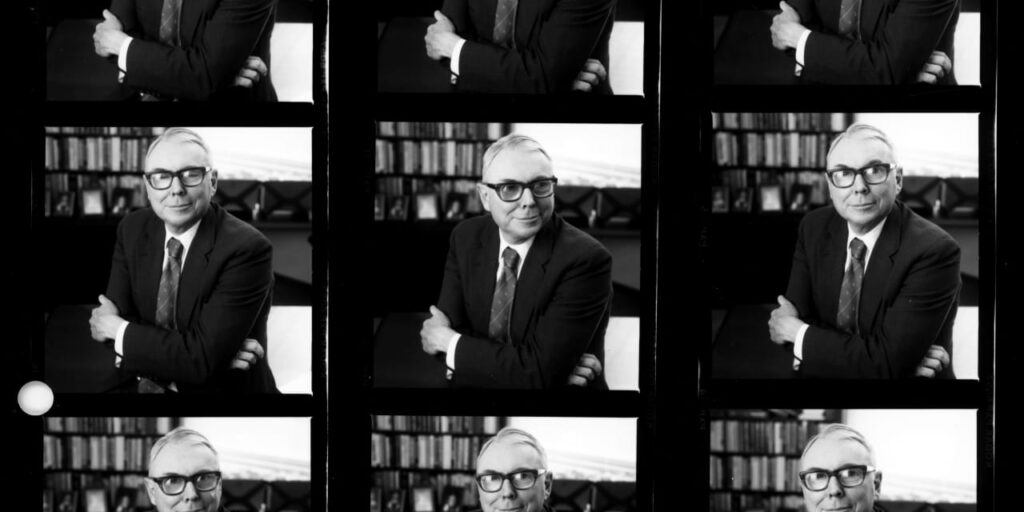

I spent quite a few hours with Charlie over the years, interviewing him mostly, but occasionally just chatting with him at Buffett’s brunch the Sunday after the Berkshire annual meeting in Omaha. Charlie didn’t really act like a billionaire—whatever that means. He usually had his assistant around and someone to help with the wheelchair. That’s about it. Not that he didn’t enjoy the good life. It’s just that he valued mental stimulation most of all.

He could be brusque, but also warm, and he enjoyed a good chuckle—though you’d have to have a pretty good line to make him laugh. Warren could do that, that’s for sure, and I saw that often up on the dais at the Berkshire annual meeting, both of them munching on See’s peanut brittle (which is, in fact, super-addictive).

Charlie’s thinking was the very definition of iconoclastic. He was a journalist’s dream in that he never, ever held back, always speaking his mind without a filter and without a care for the consequences. Consultants, bankers, and crypto proponents (among others) drew his particular ire. His ideas could be quirky, but more often they simply cut to the quick, often as a perfect counterpoint to his partner Warren Buffett, theirs being of course the greatest buddy act in the history of American business.

Among investors, Charlie’s one-line retort delivered with pitch-perfect timing right after a protracted Buffett ramble on an investment idea became like a trope, or a line you know is coming from a long-running play.

Buffett: “Blah, blah blah…we have made mistakes, we will unfortunately probably continue to do so, etc, blah blah blah…”

[Finishing, Buffett turns to Munger] “Charlie?”

Munger: [Pauses] “I have nothing to add.” [Eats another piece of candy.]

[17,560 in the Omaha CHI Health Center Arena crack up. Every time.]

Buffett and Munger were of course remarkably simpatico, but they were also quite different. Charlie loved living in California, could be frank to the point of rude, was basically a libertarian Republican and was obsessed with Singapore. Warren will never leave Omaha, is polite to a fault and is mostly a liberal Democrat. And I’ve never heard Warren even mention Singapore. Charlie would do his own thing too, had his own thing. Like investing in BYD, the Chinese EV maker. And he loved architecture and tried to design university dorms, without much success.

When interviewing Charlie, I loved just going down rabbit holes with him. Where they would lead, I could never predict, but boy, was it a wild ride. Here’s me asking him about the pandemic in 2022:

SERWER: What is your take, then, on the pandemic, though, Charlie? Does it look like it’s winding down to you? And what does that mean for our economy and society?

MUNGER: Well, to some extent, it’s terra incognita. The 1919 flu, which killed half of 1% of all the people in America, bang, and we didn’t stop the economy at all. We just let them die and buried them.

And we had to do that because it was still in the middle of a war and our troops were in Europe and so forth. This one was totally different. And nobody had any experience with anything on this scale before.

And nobody alive can remember what happened in 1919. So we’ve been doing the best we can with it. I have been appalled by the fear of vaccination in a big chunk of the nation. Speaking for myself, I couldn’t wait to be vaccinated. And I think the risks of being vaccinated are way less than the risk of not being vaccinated.

So it’s really massively stupid not to welcome vaccination. And we probably have 30% of the people in the country that think vaccination is evil and coming after them like the hobgoblins. And it isn’t good that there’s that much ignorance left.

SERWER: Should we have mandatory vaccines then, Charlie?

MUNGER: Well, if I were running the world, of course it would be mandatory. When I was in World War II’s army, they didn’t ask me if I wanted a vaccination. They vaccinated me, and it didn’t hurt me or anybody else in that world. We all just submitted to whatever the government told us to submit to.

And it was no big deal. And so I don’t like big chunks of the country going crazy. And I would argue that the anti-vaxxers are somewhat crazy. It isn’t zero risk in vaccination, it’s just that it’s so much safer to be vaccinated than not vaccinated, and it’s so much more considerate to your fellow citizens.

So it’s a massive kind of ignorance that 30% of the people have. And of course, it isn’t good.

I had many other such exchanges with him. I’m going to go back and reread them now. You can find a great deal on Charlie and his wisdom too because as with Buffett, there’s all manner of books on him. A new edition of “Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger” (384 pages) is set to come out Dec. 5. The opening features a foreword from Buffett and then a rebuttal from Munger. (Can you imagine?) It’s a book worth reading.

Young people liked Munger. So, too, the Chinese. So, too, millions of others. Wildly successful, wizened, wise, and candid beyond belief to the very end.

It was a great run and even a greater life, Charlie. RIP.

Write to Andy Serwer at andy.serwer@barrons.com

Read the full article here