(Bloomberg) — A pause in the war in Gaza and hopes for diplomatic progress have helped Israel’s stocks and currency hand investors the world’s best dollar-based returns in November.

Most Read from Bloomberg

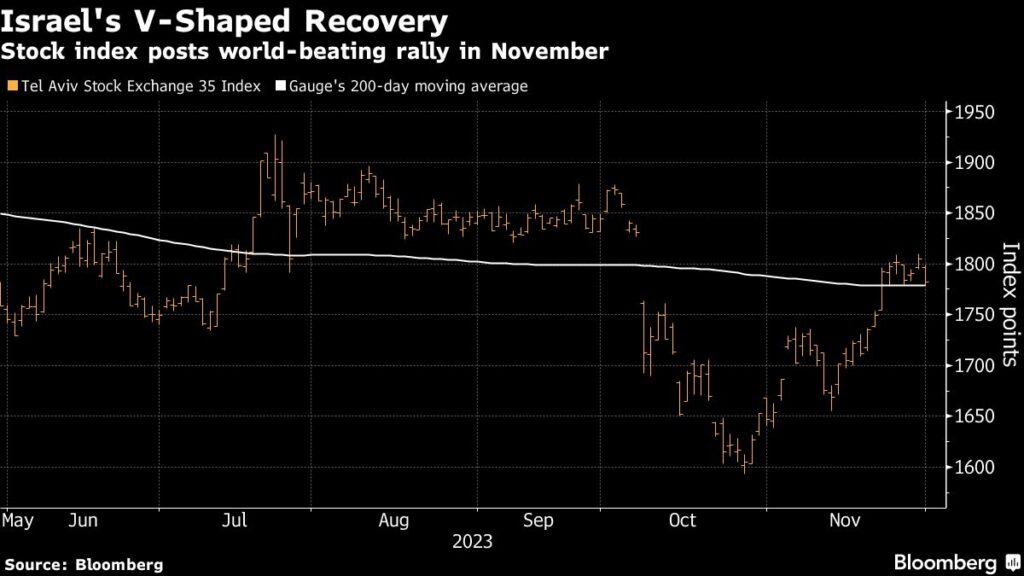

The Tel Aviv Stock Exchange 35 Index has jumped almost 20% in dollar terms this month, with roughly half the gains coming from equity prices and half from currency moves. That’s more than any other national benchmark excluding Argentina, whose capital controls restrict foreign access to local markets. Meanwhile, the shekel is poised for 9.5% rally against the greenback, the best among about 150 currencies tracked by Bloomberg.

A weeklong truce has allowed for the release of hostages as well as the flow of more aid into Gaza. The US said the diplomatic process is producing results and can continue. That, and expectations that the conflict has weakened Israeli Prime Minister Benjamin Netanyahu’s ability to push through controversial domestic plans, is helping Israeli assets rally, according to Hasnain Malik, a strategist at Tellimer in Dubai.

“The war has not spread across the region, the ceasefires give some hope for a cessation,” Malik said.

The rally in Israeli assets comes amid a global surge in risk sentiment that has sent a gauge of world stocks toward the biggest monthly advance in a year. Easing US inflation and dovish comments by Federal Reserve officials have encouraged traders to bet on not only the end of US interest-rate hikes but also a cut as early as May.

Market Intervention

The Bank of Israel on Nov. 27 calculated the “gross effect” of the conflict so far for Israel at $53 billion, with defense expenditures comprising more than half of the total. The bank pledged at the outset of the war to spend as much as $30 billion from its reserves and to provide as much as $15 billion more via swaps to protect the shekel. The interventions totaled $8.2 billion in October.

Israeli stocks have added $35 billion in market value this month, almost recouping the $36 billion lost in October after the nation retaliated against the Oct. 7 attacks by Hamas.

Technology companies and banks led the gains in Tel Aviv stocks, with Nice Ltd., Nova Ltd. and Bank Hapoalim BM contributing almost a third, according to data compiled by Bloomberg.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here